What is an Unbundled Life Insurance Policy?

With an unbundled policy, policyholders have the flexibility to choose from a range of coverage options, such as term life insurance, whole life insurance, or universal life insurance. They can also select additional riders or add-ons, such as critical illness coverage or disability insurance, to enhance their policy.

One of the key advantages of an unbundled policy is that it allows policyholders to tailor their coverage to their changing needs over time. For example, if a policyholder’s financial situation or family circumstances change, they can easily adjust their coverage options or add riders to ensure they have the right level of protection.

Another benefit of an unbundled policy is that it can be more cost-effective than a traditional life insurance policy. Since policyholders only pay for the specific coverage options they choose, they can avoid paying for unnecessary benefits or coverage they don’t need.

Unbundled life insurance policies are typically offered by insurance companies that specialize in flexible coverage options. These companies often provide online tools and resources to help policyholders understand their options and make informed decisions about their coverage.

Benefits of an Unbundled Policy

An unbundled life insurance policy offers several benefits compared to a bundled policy. Here are some key advantages:

Customization

One of the main benefits of an unbundled policy is the ability to customize your coverage. With a bundled policy, you typically have limited options and must choose from pre-packaged coverage options. However, with an unbundled policy, you have the flexibility to select the specific coverage amounts and types that best suit your needs. This allows you to tailor your policy to your individual circumstances and financial goals.

Cost Savings

Another advantage of an unbundled policy is the potential for cost savings. Bundled policies often include various additional features and benefits that may not be necessary for everyone. By opting for an unbundled policy, you can avoid paying for these extra features that you don’t need, potentially reducing your premium costs. Additionally, you have the freedom to shop around and compare prices from different insurers, ensuring you get the best possible rate for your desired coverage.

Transparency

Flexibility

Flexibility is another significant advantage of an unbundled policy. With a bundled policy, you may be locked into a specific coverage structure for the duration of the policy. However, with an unbundled policy, you have the flexibility to adjust your coverage as your needs change over time. This means you can increase or decrease your coverage amounts, add or remove policy riders, and make other modifications to your policy to adapt to your evolving financial situation.

Types of Unbundled Policies

Unbundled life insurance policies come in various types, each offering different features and benefits. Here are some common types of unbundled policies:

1. Term Life Insurance: This type of policy provides coverage for a specific term, usually ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured individual passes away during the term. Term life insurance is typically more affordable compared to other types of life insurance.

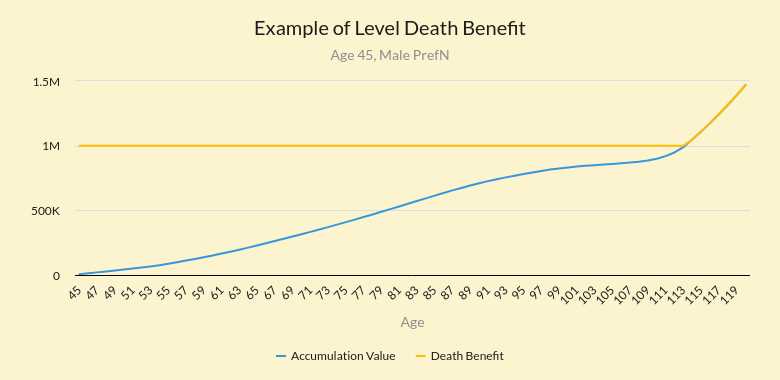

2. Whole Life Insurance: Unlike term life insurance, whole life insurance provides coverage for the entire lifetime of the insured individual. It also includes a cash value component that grows over time. Whole life insurance offers a death benefit to the beneficiaries and can also serve as an investment vehicle.

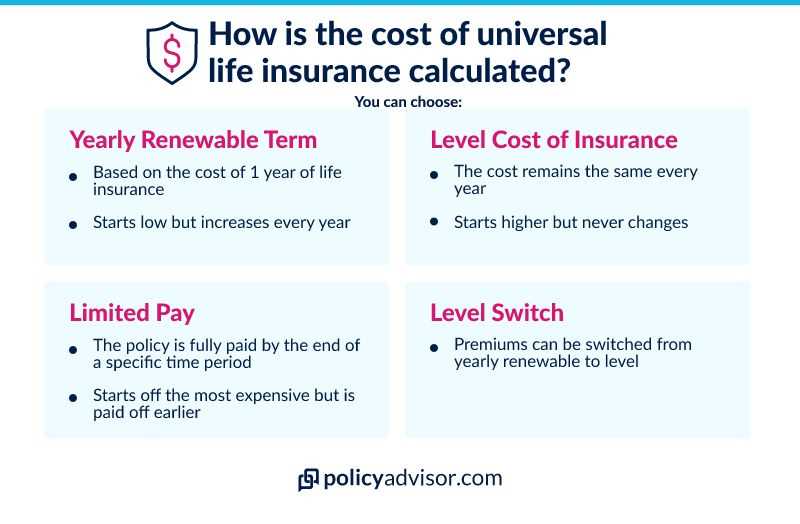

3. Universal Life Insurance: Universal life insurance is a flexible type of policy that allows policyholders to adjust their premium payments and death benefit amounts. It also includes a cash value component that earns interest. Universal life insurance offers more flexibility compared to whole life insurance.

4. Variable Life Insurance: Variable life insurance allows policyholders to invest their premium payments in various investment options, such as stocks and bonds. The cash value component of the policy fluctuates based on the performance of the investments. Variable life insurance offers the potential for higher returns but also carries more risk.

5. Indexed Universal Life Insurance: Indexed universal life insurance combines the features of universal life insurance with the potential for growth linked to a stock market index. The cash value component of the policy earns interest based on the performance of the chosen index. Indexed universal life insurance offers the opportunity for higher returns while still providing flexibility.

Choosing the Right Policy for You

| 1. Coverage Amount: | Consider how much coverage you need to protect your loved ones financially. This will depend on factors such as your income, debts, and future expenses. |

| 2. Policy Duration: | Determine how long you need the coverage for. If you have dependents who will rely on your income for many years, a longer policy duration may be necessary. |

| 3. Premiums: | Compare the premiums of different policies and choose one that fits within your budget. Keep in mind that lower premiums may mean less coverage or shorter policy duration. |

| 4. Additional Riders: | Consider if you need any additional riders or add-ons to your policy. These can provide extra benefits such as critical illness coverage or disability protection. |

| 5. Company Reputation: | Research the reputation and financial stability of the insurance company offering the policy. You want to make sure they will be able to fulfill their obligations in the future. |

| 6. Policy Terms and Conditions: | Read and understand the terms and conditions of the policy before making a decision. Pay attention to details such as exclusions, limitations, and the claims process. |

By considering these factors and conducting thorough research, you can choose the right unbundled life insurance policy that meets your needs and provides financial protection for your loved ones.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.