The Power of Compound Interest

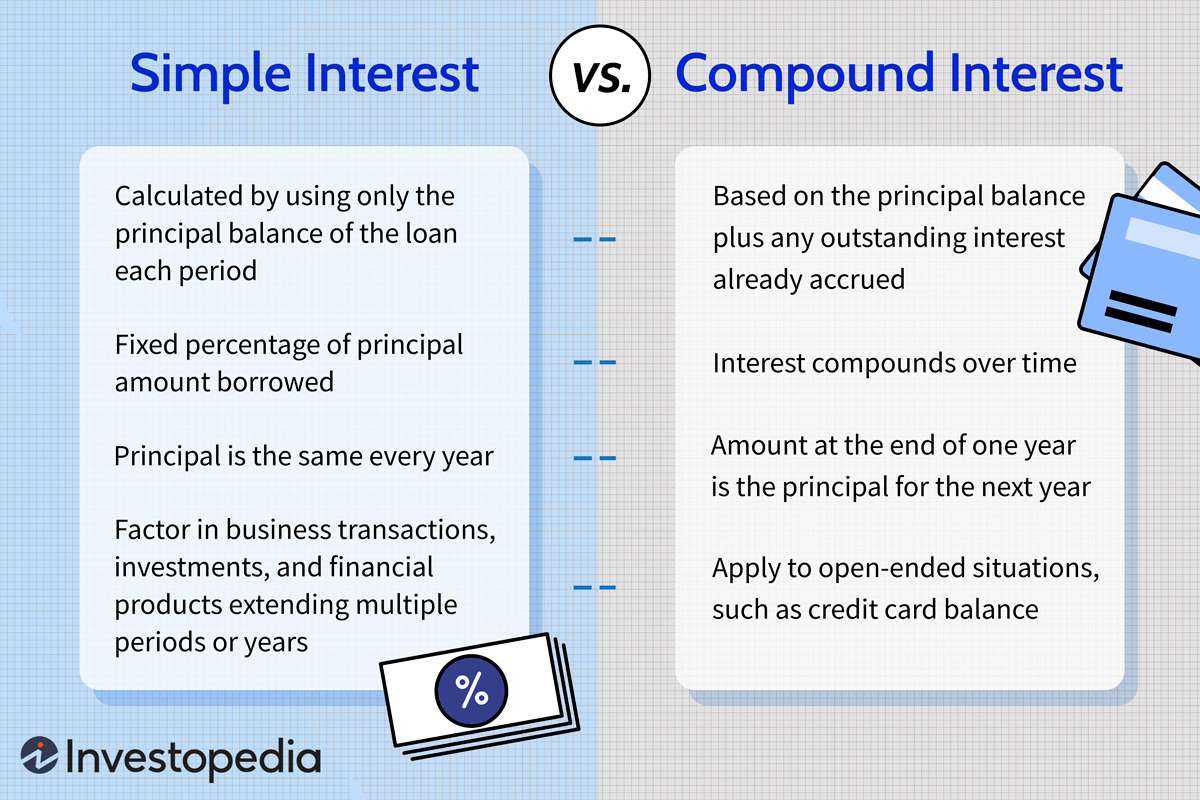

Compound interest is a powerful concept that can have a significant impact on your finances. It is the interest that is calculated not only on the initial amount of money you invest or save, but also on the accumulated interest from previous periods. This means that over time, compound interest can help your money grow at an accelerated rate.

One of the key advantages of compound interest is that it allows you to earn interest on interest. As your initial investment or savings account balance grows, the interest earned in each period also increases. This creates a compounding effect, where your money can grow exponentially over time.

To illustrate the power of compound interest, let’s consider an example. Suppose you invest $1,000 in a savings account with an annual interest rate of 5%. At the end of the first year, you would earn $50 in interest, bringing your total balance to $1,050. In the second year, you would earn interest not only on the initial $1,000, but also on the additional $50 of interest earned in the first year. This compounding effect continues to grow your balance each year.

Over a longer period of time, compound interest can have a significant impact on your wealth. The more time your money has to compound, the greater the growth potential. This is why it is important to start saving and investing as early as possible.

Calculations and Examples

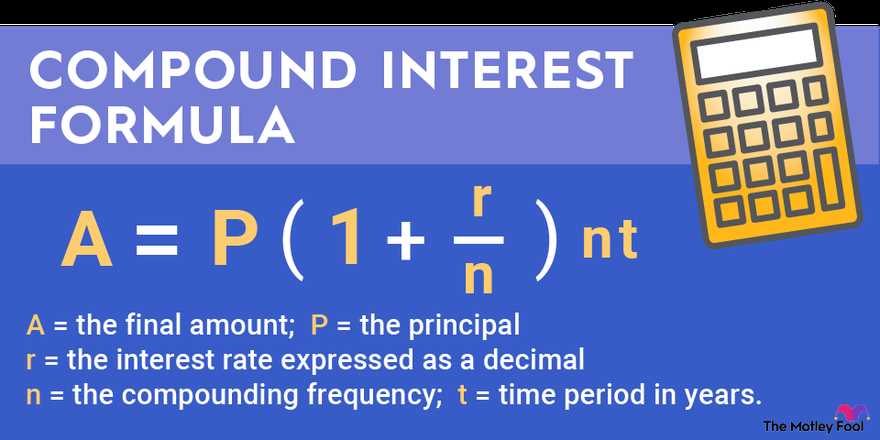

Compound interest can be calculated using the formula:

A = P(1 + r/n)^(nt)

Where:

- A is the final amount of money after interest has been compounded

- P is the principal amount (the initial investment)

- r is the annual interest rate (expressed as a decimal)

- n is the number of times that interest is compounded per year

- t is the number of years

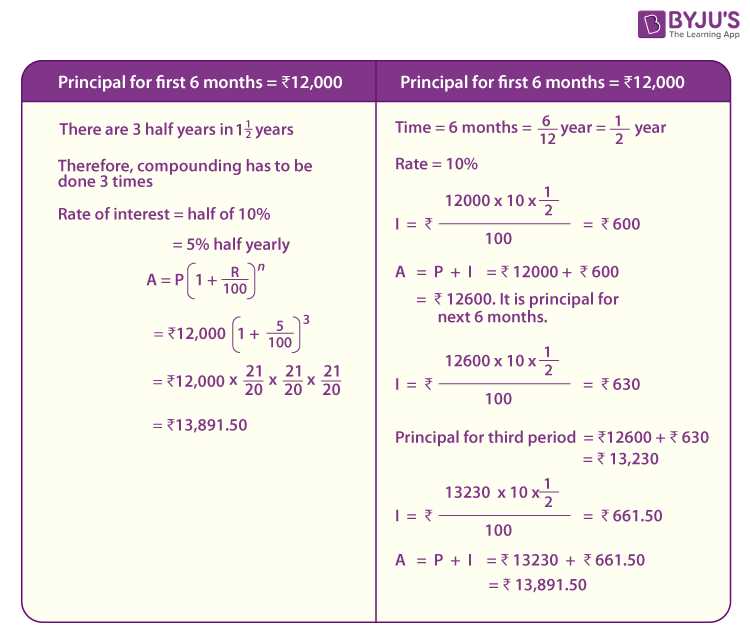

Let’s look at an example to illustrate the power of compound interest:

Suppose you invest $1,000 in a savings account that earns an annual interest rate of 5%. The interest is compounded annually. After 1 year, your investment will grow to:

| Year | Principal | Interest | Total |

|---|---|---|---|

| 1 | $1,000 | $50 | $1,050 |

After 2 years, your investment will grow to:

| Year | Principal | Interest | Total |

|---|---|---|---|

| 1 | $1,000 | $50 | $1,050 |

| 2 | $1,050 | $52.50 | $1,102.50 |

As you can see, the interest earned in the first year ($50) is added to the principal amount for the second year, resulting in a higher interest payment ($52.50) and a higher total amount ($1,102.50).

This compounding effect continues to grow over time. After 10 years, your investment will grow to:

| Year | Principal | Interest | Total |

|---|---|---|---|

| 1 | $1,000 | $50 | $1,050 |

| 2 | $1,050 | $52.50 | $1,102.50 |

| 3 | $1,102.50 | $55.13 | $1,157.63 |

| 4 | $1,157.63 | $57.88 | $1,215.51 |

| 5 | $1,215.51 | $60.78 | $1,276.29 |

| 6 | $1,276.29 | $63.81 | $1,340.10 |

| 7 | $1,340.10 | $67.00 | $1,407.10 |

| 8 | $1,407.10 | $70.36 | $1,477.46 |

| 9 | $1,477.46 | $73.87 | $1,551.33 |

| 10 | $1,551.33 | $77.57 | $1,628.90 |

After 10 years, your initial investment of $1,000 has grown to $1,628.90, thanks to the power of compound interest.

The Power of Compound Interest in the Banking Category

Compound interest is the interest that is calculated on both the initial principal and the accumulated interest from previous periods. This means that as time goes on, the interest earned on an investment grows exponentially. The longer the investment is held, the greater the impact of compound interest.

Let’s look at an example to illustrate the power of compound interest. Suppose you invest $1,000 in a savings account with an annual interest rate of 5%. If the interest is compounded annually, after one year, you would have $1,050. However, if the interest is compounded quarterly, after one year, you would have $1,051.16. The more frequently the interest is compounded, the greater the final amount.

Compound interest can also be a powerful tool for individuals. By investing regularly and allowing the interest to compound over time, individuals can build wealth and achieve their financial goals. It is important to start investing early and be consistent in order to maximize the benefits of compound interest.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.