Tender in Finance: Definition and Examples

A tender in finance refers to the process of inviting bids from potential buyers or investors for the purchase of a particular financial instrument or asset. It is commonly used in various financial transactions, such as mergers and acquisitions, government bond issuances, and stock offerings.

Definition of Tender in Finance

In finance, a tender is a formal offer made by an individual or organization to buy a specific quantity of a financial instrument or asset at a specified price. The tender process typically involves the submission of bids by interested parties, and the highest bidder is usually awarded the opportunity to purchase the asset.

Tenders can be conducted through various methods, including public announcements, private invitations, or through intermediaries such as investment banks. The purpose of a tender is to ensure a fair and transparent process for the sale of financial assets, allowing interested parties to compete on equal terms.

Examples of Tenders in Finance

Another example is the issuance of government bonds. Governments often use tenders to sell their bonds to investors. Interested parties submit their bids, indicating the quantity of bonds they are willing to purchase and the price they are willing to pay. The government then selects the highest bidders and allocates the bonds accordingly.

Tenders are also commonly used in stock offerings, where companies invite investors to purchase newly issued shares. Interested investors submit their bids, and the company determines the price and quantity of shares to be allocated to each bidder based on the submitted offers.

What is a Tender in Finance?

A tender in finance refers to the process of inviting bids or offers from potential buyers or investors for the purchase of a company’s securities or assets. It is a formal and structured procedure that allows companies to sell their shares, bonds, or other financial instruments to interested parties.

During a tender, the company specifies the terms and conditions of the sale, including the price, quantity, and any other relevant details. Interested parties then submit their bids or offers, and the company evaluates them based on various factors such as price, financial stability, and strategic fit.

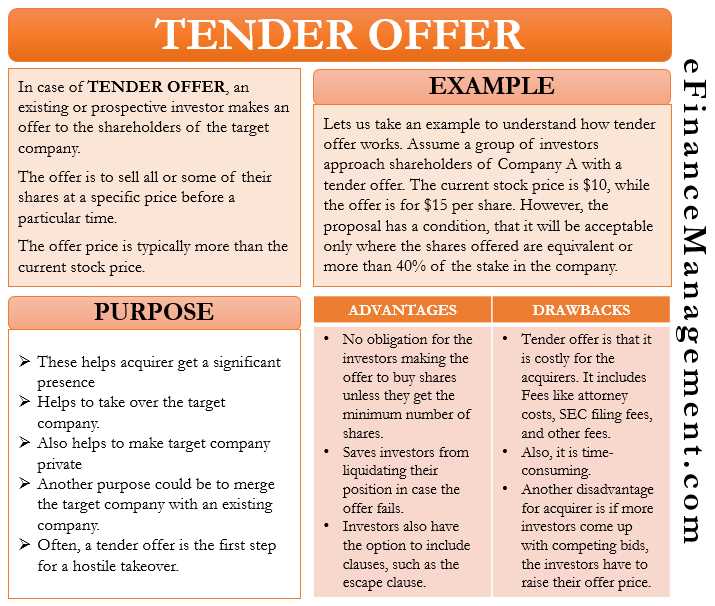

Tenders can be conducted for various purposes in finance, including mergers and acquisitions, privatizations, and divestitures. In the context of mergers and acquisitions, a tender offer is often made by one company to acquire the shares of another company. This offer is typically at a premium to the market price and is made directly to the shareholders of the target company.

One of the key advantages of using a tender in finance is that it allows companies to reach a wider pool of potential buyers or investors. By inviting bids from interested parties, companies can attract competitive offers and potentially achieve a higher price for their securities or assets.

Additionally, the tender process provides transparency and fairness, as all interested parties have an equal opportunity to participate and submit their bids. This helps to ensure that the sale is conducted in a fair and efficient manner, and that the best offer is selected.

Overall, a tender in finance is a crucial mechanism for companies to sell their securities or assets and attract potential buyers or investors. It provides a structured and transparent process that allows companies to achieve the best possible outcome for their shareholders.

Examples of Tenders in Finance

In the world of finance, tenders play a crucial role in various transactions. They are used to invite bids for the purchase or sale of financial securities, assets, or services. Here are some examples of tenders in finance:

| Tender Type | Description |

|---|---|

| Stock Tender | A company may issue a stock tender to repurchase its own shares from existing shareholders. This can be done to reduce the number of outstanding shares, increase the ownership percentage of certain shareholders, or return excess cash to shareholders. |

| Bond Tender | When a bond issuer wants to retire or redeem its bonds before their maturity date, they may conduct a bond tender. Bondholders are invited to submit their bonds for purchase at a specified price. This allows the issuer to manage its debt obligations and potentially reduce interest expenses. |

| Takeover Tender | In mergers and acquisitions, a takeover tender is often used by the acquiring company to acquire a controlling stake in the target company. The acquiring company offers to purchase the shares of the target company’s shareholders at a specified price. If enough shareholders accept the offer, the acquiring company gains control of the target company. |

| Service Tender | Government agencies or companies may issue service tenders to invite bids for the provision of financial services, such as auditing, consulting, or investment management. Interested parties submit their proposals, and the entity issuing the tender evaluates the bids based on various criteria before selecting a service provider. |

These are just a few examples of tenders in finance. The specific terms and conditions of each tender can vary depending on the transaction and the parties involved. Tenders are an important mechanism for facilitating transactions and ensuring fair competition in the financial markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.