Step-by-Step Guide: Using the Indirect Method to Prepare a Cash Flow Statement

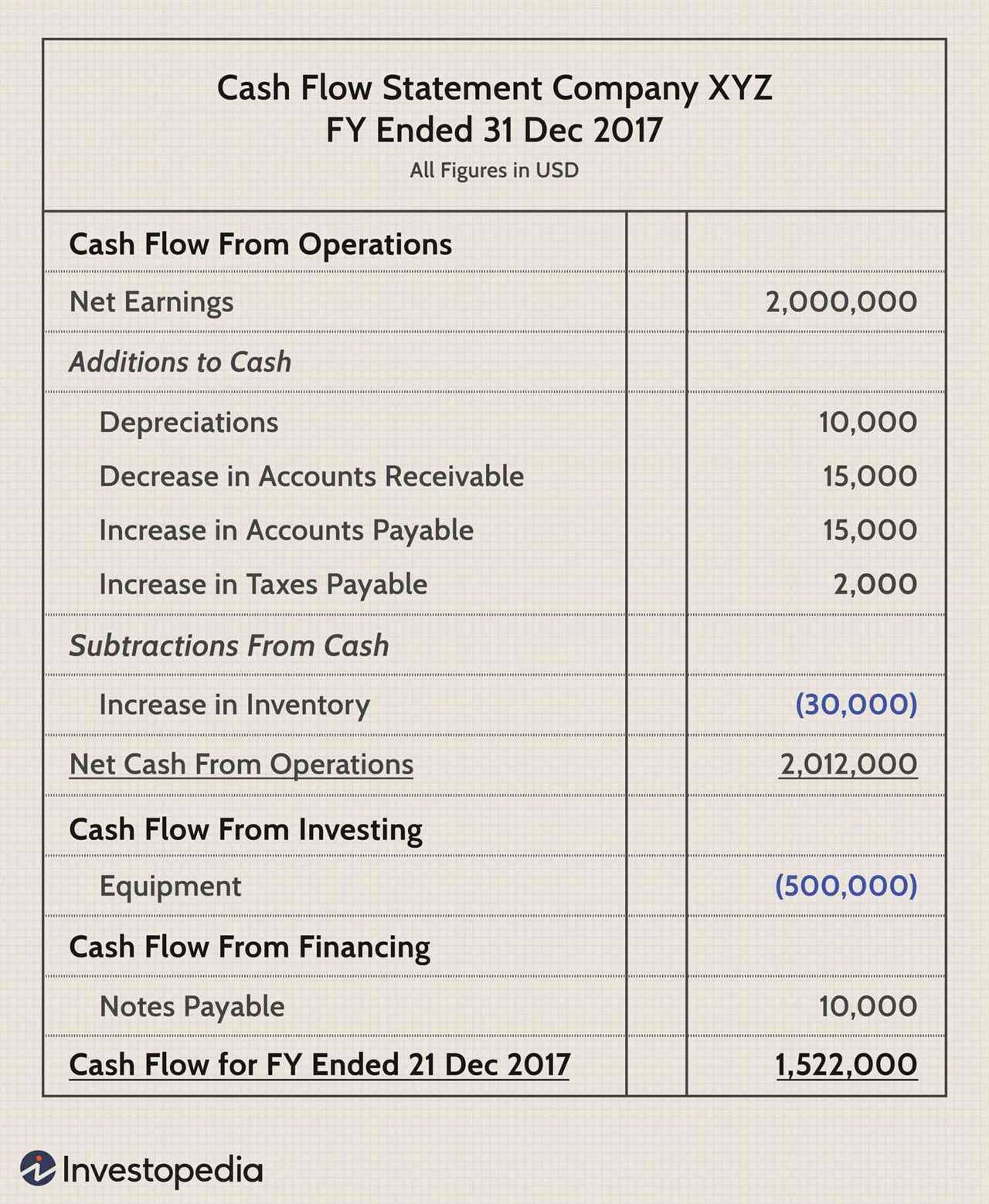

Step 1: Start with Net Income

The first step in preparing a cash flow statement using the indirect method is to start with the net income from the income statement. Net income represents the profit or loss generated by the business during a specific period. It is usually found at the bottom of the income statement.

Step 2: Adjust for Non-Cash Expenses

Next, you need to adjust the net income for non-cash expenses. Non-cash expenses are expenses that do not involve the outflow of cash, such as depreciation and amortization. These expenses are added back to the net income because they do not affect the actual movement of cash within the business.

Step 3: Adjust for Changes in Working Capital

After adjusting for non-cash expenses, you need to account for changes in working capital. Working capital includes current assets and current liabilities, such as accounts receivable, accounts payable, and inventory. Changes in working capital can have a significant impact on cash flow, so it is important to adjust for these changes.

Step 4: Adjust for Investing and Financing Activities

Once you have adjusted for non-cash expenses and changes in working capital, you need to account for investing and financing activities. Investing activities include the purchase or sale of long-term assets, while financing activities include the issuance or repayment of debt and equity. These activities can result in cash inflows or outflows and need to be included in the cash flow statement.

Step 5: Calculate the Net Cash Flow

Finally, you can calculate the net cash flow by summing up the adjusted net income, changes in working capital, and investing and financing activities. The net cash flow represents the overall movement of cash within the business during the period.

By following these step-by-step instructions, you can effectively prepare a cash flow statement using the indirect method. This statement will provide valuable insights into the cash flow dynamics of your business and help you make informed financial decisions.

The indirect method is one of the two methods used to prepare a cash flow statement, the other being the direct method. The cash flow statement is a financial statement that shows the inflows and outflows of cash during a specific period, and it is an important tool for analyzing a company’s liquidity and financial health.

The indirect method starts with the net income from the income statement and adjusts it for non-cash expenses and changes in working capital to arrive at the net cash provided by operating activities. This method is widely used because it is easier to prepare and provides more detailed information about the sources and uses of cash.

When using the indirect method, the net income is adjusted for non-cash expenses such as depreciation and amortization. These expenses are added back to the net income because they do not involve an actual outflow of cash. Additionally, changes in working capital, such as accounts receivable, accounts payable, and inventory, are also adjusted to reflect the cash impact of these changes.

The indirect method also includes the net cash provided or used by investing and financing activities. Investing activities include the purchase or sale of long-term assets, such as property, plant, and equipment, as well as investments in other companies. Financing activities include the issuance or repayment of debt and equity, such as loans, bonds, and stock.

By using the indirect method, companies can provide a more accurate representation of their cash flows, as it takes into account non-cash expenses and changes in working capital. This method is also preferred by many users of financial statements, such as investors and creditors, as it provides more detailed information about a company’s cash flow.

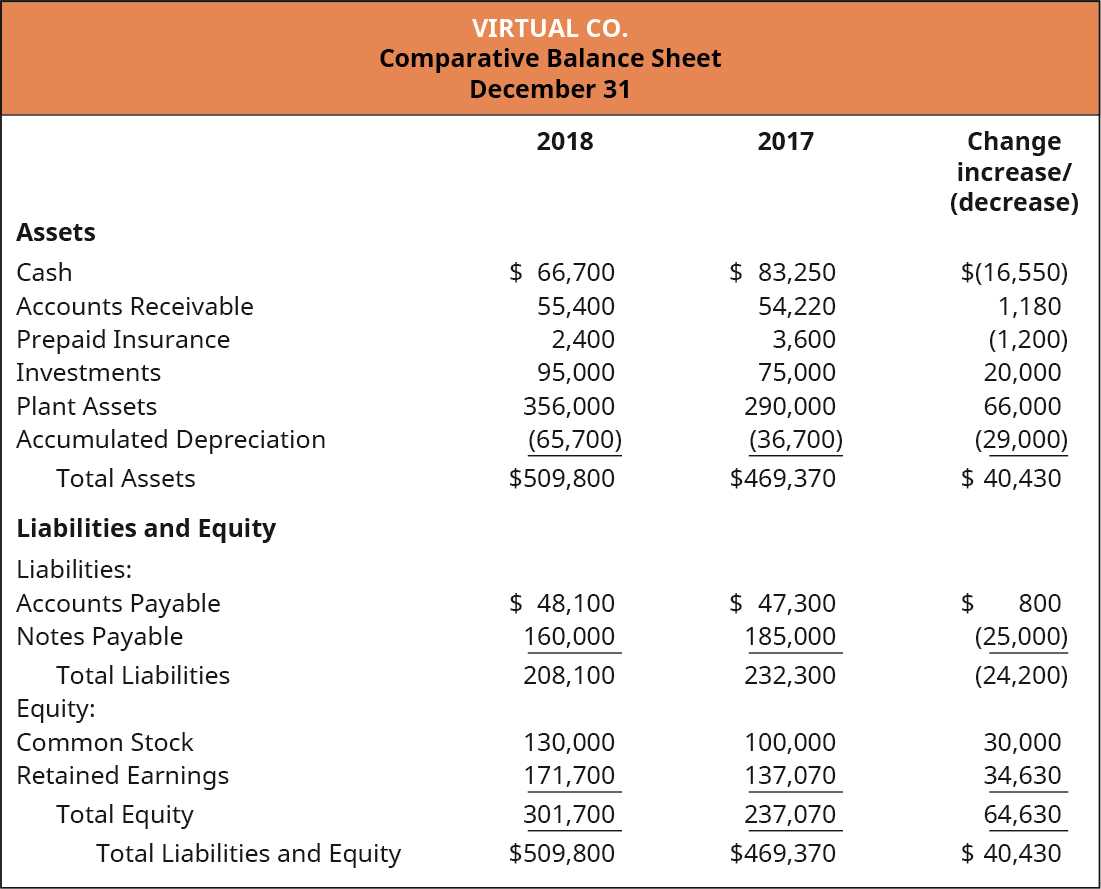

Step 4: Calculate the Changes in Current Assets and Current Liabilities

After adjusting for non-cash expenses, the next step in preparing a cash flow statement using the indirect method is to calculate the changes in current assets and current liabilities. This step is crucial in determining the cash flow from operating activities.

To calculate the changes in current assets, you need to compare the balances of current assets at the beginning and end of the accounting period. Current assets include items such as accounts receivable, inventory, and prepaid expenses. If the balance of a current asset has increased, it means that cash has been used to acquire more of that asset. Conversely, if the balance has decreased, it indicates that cash has been generated from the sale or reduction of that asset.

Similarly, to calculate the changes in current liabilities, you need to compare the balances of current liabilities at the beginning and end of the accounting period. Current liabilities include items such as accounts payable, accrued expenses, and short-term loans. If the balance of a current liability has increased, it means that cash has been generated from the increase in liabilities. On the other hand, if the balance has decreased, it indicates that cash has been used to repay or reduce those liabilities.

Once you have calculated the changes in current assets and current liabilities, you need to adjust the net income by adding or subtracting these changes. If there is an increase in current assets, you subtract the increase from net income. Conversely, if there is a decrease in current assets, you add the decrease to net income. Similarly, if there is an increase in current liabilities, you add the increase to net income, and if there is a decrease in current liabilities, you subtract the decrease from net income.

By calculating the changes in current assets and current liabilities and adjusting the net income accordingly, you can determine the cash flow from operating activities using the indirect method. This step provides valuable insights into how cash is being generated or used within the business, helping stakeholders make informed decisions about its financial health.

Step 2: Adjust for Non-Cash Expenses

After starting with net income, the next step in preparing a cash flow statement using the indirect method is to adjust for non-cash expenses. Non-cash expenses are expenses that do not involve an actual outflow of cash.

Some common examples of non-cash expenses include depreciation, amortization, and bad debt expenses. These expenses are recorded in the income statement but do not directly impact the cash flow of a business.

To adjust for non-cash expenses, you need to add them back to net income. This is because these expenses reduce net income but do not involve an actual cash outflow. By adding them back, you are effectively reversing their impact on net income and reflecting the cash flow impact.

For example, let’s say a company has a net income of $100,000 for the year and depreciation expense of $20,000. To adjust for this non-cash expense, you would add back the $20,000 to the net income:

Net Income: $100,000

+ Depreciation Expense: $20,000

= Adjusted Net Income: $120,000

By adjusting for non-cash expenses, you are able to reflect the true cash flow of the business. This is important because cash flow is a key indicator of a company’s financial health and ability to meet its obligations.

Why is adjusting for non-cash expenses necessary?

Adjusting for non-cash expenses is necessary because it allows you to separate the impact of these expenses on net income from their actual cash flow impact. By adding back non-cash expenses, you are able to show the true cash flow generated by the business.

Without adjusting for non-cash expenses, the cash flow statement would not accurately reflect the cash flow of the business. This could lead to misleading financial statements and an inaccurate assessment of the company’s financial health.

Overall, adjusting for non-cash expenses is a crucial step in preparing a cash flow statement using the indirect method. It ensures that the statement accurately reflects the cash flow generated by the business and provides valuable insights into its financial performance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.