Savings and Loan Crisis: Causes and Consequences

The crisis had several causes, including:

- Deregulation: In the 1980s, the government relaxed regulations on the savings and loan industry, allowing S&Ls to engage in riskier investments and speculative activities. This led to a wave of fraud and mismanagement within the industry.

- Interest rate volatility: During this period, interest rates were highly volatile, which caused significant losses for S&Ls that held long-term, fixed-rate mortgages while their funding costs increased.

- Real estate speculation: Many S&Ls invested heavily in real estate, particularly in commercial properties and development projects. When the real estate market crashed in the late 1980s, these investments became worthless, leading to massive losses for the S&Ls.

- Insufficient regulation and oversight: The regulatory agencies responsible for overseeing the S&L industry failed to effectively monitor and enforce compliance with existing regulations. This allowed fraudulent activities to go undetected and unchecked.

The consequences of the Savings and Loan Crisis were far-reaching. The collapse of hundreds of S&Ls resulted in the loss of billions of dollars for depositors and taxpayers. The federal government was forced to step in and bail out the failing institutions, ultimately costing taxpayers over $100 billion.

The aftermath of the crisis also led to significant changes in the financial industry. The government implemented stricter regulations and oversight for S&Ls, and many of the surviving institutions converted to commercial banks. The crisis served as a wake-up call for the need for stronger regulation and oversight in the financial sector.

1. Deregulation and Expansion of S&Ls

2. Fraud and Mismanagement

Another factor that contributed to the crisis was widespread fraud and mismanagement within the S&L industry. Many executives and board members of S&Ls engaged in fraudulent activities, such as making loans to themselves or their associates, in order to enrich themselves at the expense of the institutions they were supposed to be managing.

In addition, many S&Ls were poorly managed, with inadequate risk management practices and lax oversight. This allowed for excessive risk-taking and the accumulation of bad loans, which eventually led to insolvency.

3. Economic Factors

The S&L crisis was also influenced by broader economic factors. In the 1980s, the United States experienced a recession, which resulted in a decline in real estate values. This, combined with high interest rates, made it difficult for S&Ls to generate profits and caused many of their loans to go into default.

Furthermore, the Federal Reserve’s monetary policy during this period, aimed at controlling inflation, resulted in high interest rates. This made it expensive for S&Ls to borrow funds and exacerbated their financial difficulties.

4. Government Response

The government’s response to the crisis also played a role in its origins. The Federal Home Loan Bank Board, the regulatory agency overseeing S&Ls, failed to effectively monitor and regulate the industry, allowing the problems to escalate. Additionally, the Federal Savings and Loan Insurance Corporation (FSLIC), which insured deposits at S&Ls, was ill-equipped to handle the magnitude of the crisis and ultimately became insolvent itself.

Overall, the origins of the Savings and Loan Crisis can be attributed to a combination of factors, including deregulation, fraud and mismanagement, economic conditions, and inadequate government oversight. These factors created a perfect storm that led to the collapse of many S&Ls and resulted in significant financial losses for depositors and taxpayers alike.

Impacts and Aftermath of the Savings and Loan Crisis

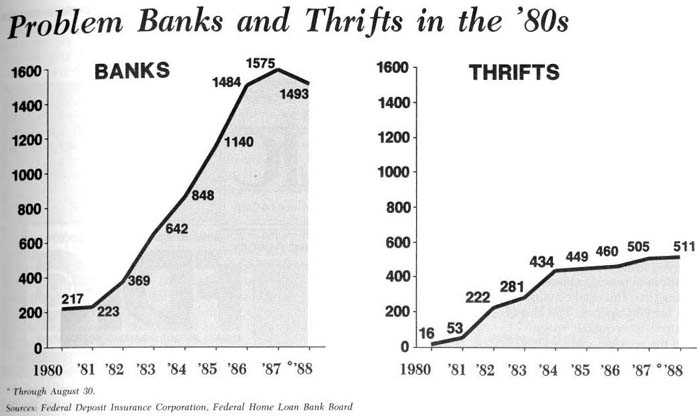

The Savings and Loan Crisis, which occurred in the United States during the 1980s and early 1990s, had far-reaching impacts on the economy and the financial industry. The crisis resulted in the closure of hundreds of savings and loan associations, leading to significant losses for depositors and taxpayers.

1. Economic Impact

The Savings and Loan Crisis had a profound impact on the economy. The collapse of numerous savings and loan institutions led to a sharp decline in lending activity, which in turn contributed to a slowdown in economic growth. The crisis also resulted in a loss of jobs, as many financial institutions were forced to lay off employees or shut down completely.

The government’s response to the crisis involved a massive bailout, with taxpayers ultimately footing the bill. The cost of the bailout amounted to hundreds of billions of dollars, leading to a significant increase in the national debt. This had long-term implications for the economy, as it put a strain on government finances and limited the ability to invest in other areas.

2. Regulatory Reforms

The Savings and Loan Crisis prompted significant regulatory reforms in the financial industry. The crisis exposed weaknesses in the regulatory framework and highlighted the need for stricter oversight of savings and loan associations. As a result, the government implemented new regulations to prevent similar crises in the future.

3. Public Confidence

The Savings and Loan Crisis eroded public confidence in the financial industry and the government’s ability to regulate it effectively. Many Americans lost their savings as a result of the crisis, which led to a widespread distrust of financial institutions. This distrust had a lasting impact on consumer behavior, with many individuals becoming more cautious and risk-averse in their financial decisions.

The crisis also highlighted the need for transparency and accountability in the financial industry. It served as a wake-up call for regulators and policymakers, who realized the importance of implementing measures to protect consumers and ensure the stability of the financial system.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.