Return on Total Assets: Overview

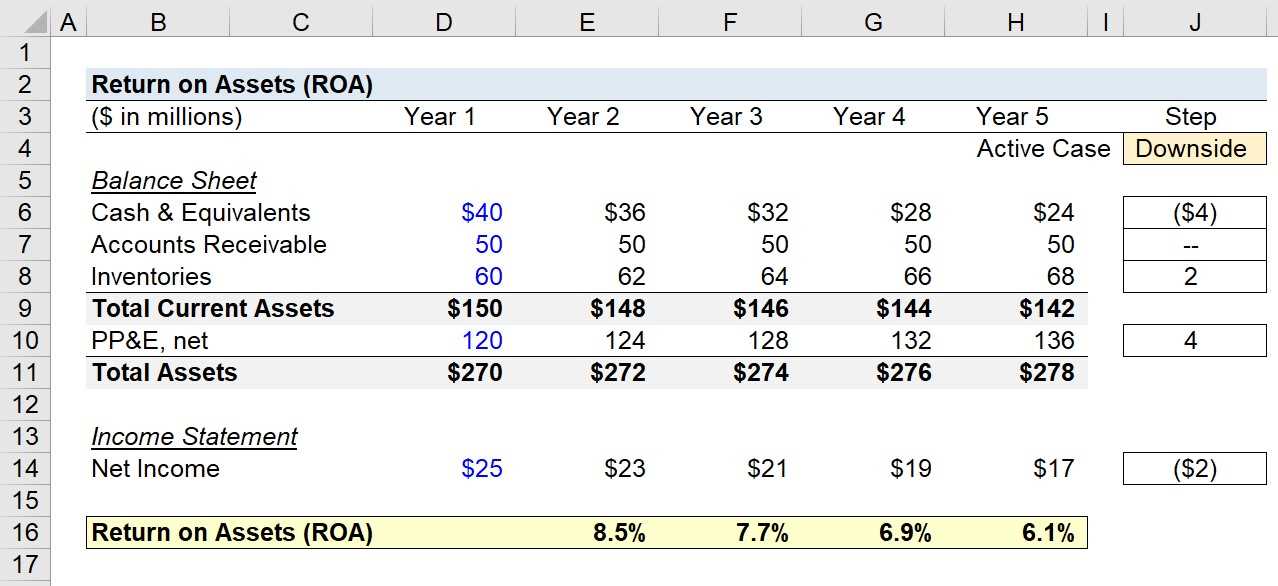

Return on Total Assets (ROTA) is a financial ratio that measures a company’s profitability by comparing its net income to its total assets. It is a key indicator of a company’s efficiency in generating profits from its investments in assets.

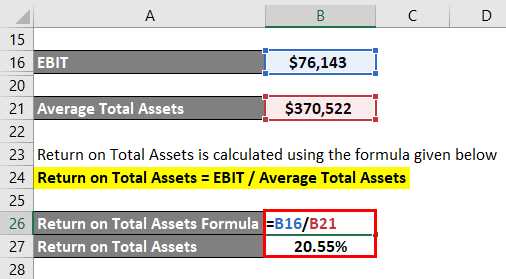

ROTA is calculated by dividing the net income of a company by its total assets and multiplying the result by 100 to express it as a percentage. The formula for ROTA is:

ROTA = (Net Income / Total Assets) * 100

ROTA provides insights into how effectively a company is utilizing its assets to generate profits. A higher ROTA indicates that a company is generating more profits from its assets, while a lower ROTA suggests inefficiency in asset utilization.

ROTA is commonly used by investors, analysts, and financial institutions to evaluate a company’s financial performance and compare it to its competitors. It helps in assessing the overall profitability and efficiency of a company’s operations.

It is important to note that ROTA should be interpreted in the context of the industry in which a company operates. Different industries have different asset structures and profitability expectations, so comparing ROTA across industries may not provide meaningful insights.

Overall, Return on Total Assets is a valuable financial ratio that provides a comprehensive view of a company’s profitability and efficiency in utilizing its assets. It helps investors and analysts make informed decisions and assess the financial health of a company.

What is Return on Total Assets?

Return on Total Assets (ROTA) is a financial ratio that measures a company’s profitability by comparing its net income to its total assets. It is an important metric for investors and analysts to assess a company’s efficiency in generating profits from its investments in assets.

ROTA is calculated by dividing a company’s net income by its total assets and multiplying the result by 100 to express it as a percentage. The formula for ROTA is:

ROTA = (Net Income / Total Assets) * 100

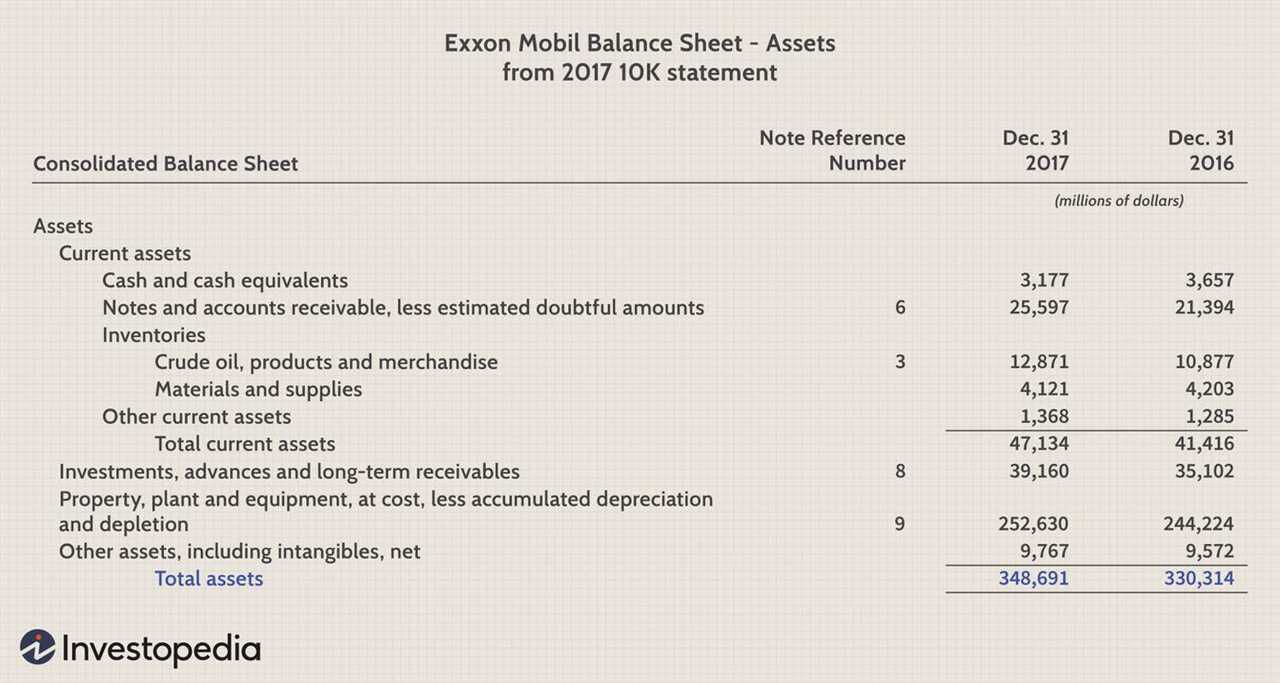

Net income represents the company’s total revenue minus all expenses, including taxes and interest. Total assets include all the assets that a company owns, such as cash, inventory, property, and equipment.

ROTA provides insight into how effectively a company is utilizing its assets to generate profits. A higher ROTA indicates that a company is generating more profits for each unit of assets it owns, while a lower ROTA suggests that the company is less efficient in utilizing its assets.

Importance of Return on Total Assets

ROTA is an important metric for investors and analysts as it helps them evaluate a company’s profitability and efficiency. It provides a measure of how well a company is utilizing its assets to generate profits, which is crucial for assessing its financial health and potential for growth.

By comparing a company’s ROTA to industry benchmarks or its own historical performance, investors can determine whether the company is performing well or underperforming. A consistently high ROTA indicates that the company is efficiently utilizing its assets to generate profits, while a declining ROTA may indicate potential issues with the company’s operations or financial management.

ROTA is also useful for comparing companies within the same industry. Investors can use ROTA to identify companies that are more efficient in generating profits from their assets and make informed investment decisions based on these comparisons.

In summary, Return on Total Assets is a key financial ratio that measures a company’s profitability and efficiency in utilizing its assets. It is an important tool for investors and analysts to evaluate a company’s financial health and make informed investment decisions.

Importance of Return on Total Assets

The return on total assets (ROTA) is a crucial financial metric that provides insights into a company’s efficiency in generating profits from its assets. It is a key indicator of a company’s ability to utilize its resources effectively and maximize its profitability.

ROTA is important for several reasons:

1. Performance Evaluation: ROTA allows investors, analysts, and stakeholders to assess a company’s financial performance and compare it with its competitors. It provides a standardized measure to evaluate how efficiently a company is utilizing its assets to generate profits.

2. Efficiency Measurement: ROTA helps in measuring a company’s efficiency in utilizing its assets. A higher ROTA indicates that the company is generating more profits from its assets, which suggests effective asset management and resource allocation.

3. Investment Decision-making: ROTA is a crucial factor for investors when making investment decisions. It helps investors determine whether a company is generating sufficient returns on its assets to justify investment. A higher ROTA indicates better investment potential.

4. Identifying Operational Issues: A declining ROTA can indicate operational issues within a company. It could suggest inefficient asset utilization, poor management, or declining profitability. By monitoring ROTA, companies can identify areas of improvement and take corrective actions.

5. Benchmarking: ROTA serves as a benchmark for companies to compare their performance against industry standards. It allows companies to identify their strengths and weaknesses and make necessary adjustments to improve their profitability.

6. Creditworthiness: Lenders and creditors often consider ROTA when assessing a company’s creditworthiness. A higher ROTA indicates a company’s ability to generate profits and repay its debts, making it more attractive to lenders.

Return on Total Assets: Examples

Return on Total Assets (ROTA) is a financial ratio that measures a company’s profitability by calculating the return generated from its total assets. It is an important metric for investors and analysts to assess a company’s efficiency in utilizing its assets to generate profits.

Example 1: Company A

Let’s consider Company A, a manufacturing company, to understand how Return on Total Assets can be calculated and interpreted.

Company A has total assets of $1,000,000 at the beginning of the year and generates a net income of $200,000 during the year. To calculate the Return on Total Assets, we divide the net income by the average total assets.

Net Income = $200,000

Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2

Average Total Assets = ($1,000,000 + $1,200,000) / 2 = $1,100,000

Return on Total Assets = Net Income / Average Total Assets

Return on Total Assets = $200,000 / $1,100,000 = 0.1818 (or 18.18%)

Investors and analysts often use Return on Total Assets as a key metric to evaluate a company’s financial health and performance. It helps them assess the company’s ability to generate profits from its assets and make informed investment decisions.

| Company | Net Income | Average Total Assets | Return on Total Assets |

|---|---|---|---|

| Company A | $200,000 | $1,100,000 | 18.18% |

| Company B | $150,000 | $900,000 | 16.67% |

| Company C | $300,000 | $1,500,000 | 20.00% |

Overall, Return on Total Assets is a useful ratio for investors and analysts to assess a company’s financial performance and efficiency in utilizing its assets. It provides insights into the company’s profitability and helps in making informed investment decisions.

Example 1: Company A

Let’s take a closer look at an example to understand how Return on Total Assets (ROTA) is calculated and its significance for a company. We will consider Company A as our case study.

Background

Company A is a manufacturing company that produces electronic devices. They have been in operation for the past five years and have shown consistent growth in their financial performance.

Financial Data

Here are the financial data for Company A:

- Total Assets: $10,000,000

- Net Income: $1,500,000

Calculating Return on Total Assets

To calculate the Return on Total Assets (ROTA) for Company A, we use the following formula:

ROTA = (Net Income / Total Assets) * 100

Plugging in the values from the financial data, we get:

ROTA = ($1,500,000 / $10,000,000) * 100 = 15%

Interpretation

A Return on Total Assets (ROTA) of 15% indicates that for every dollar of assets invested, Company A generates a return of 15 cents. This means that the company is utilizing its assets efficiently to generate profits.

Furthermore, a higher ROTA indicates better financial performance and efficiency in asset utilization. It shows that the company is generating higher profits relative to its total assets, which is a positive sign for investors and stakeholders.

Comparison and Benchmarking

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.