The Importance of Rebalancing in Portfolio Construction

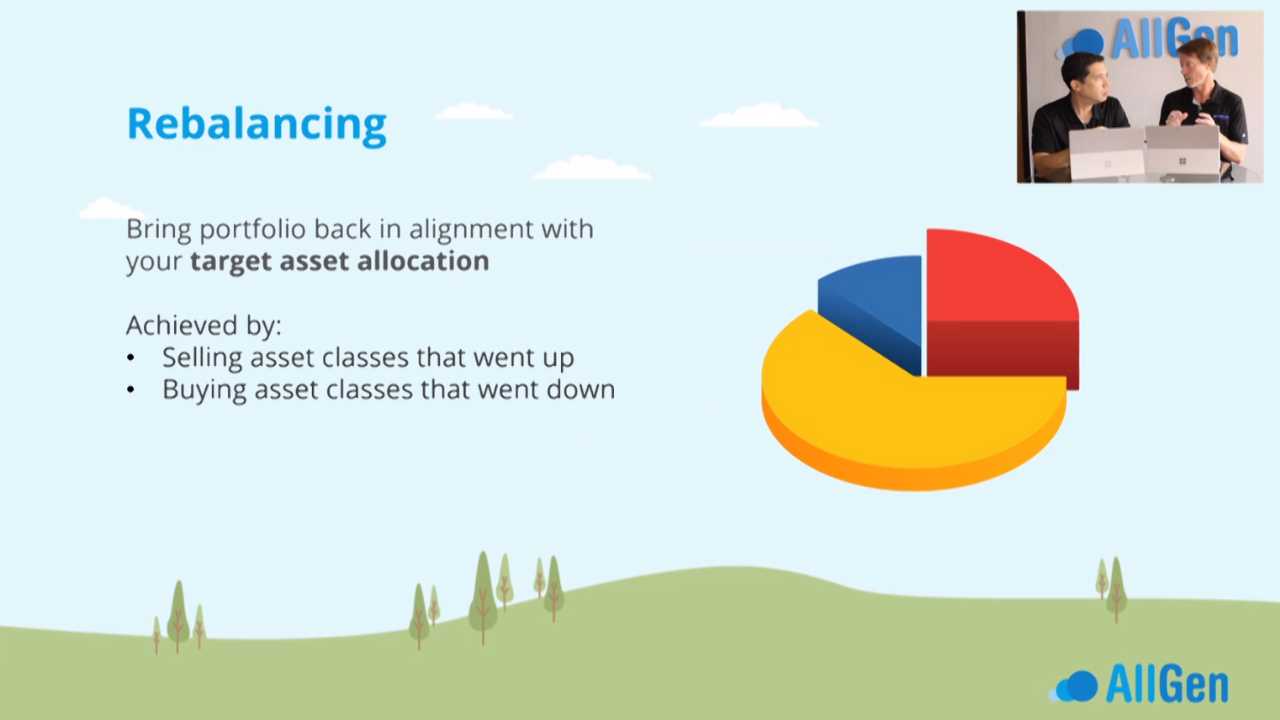

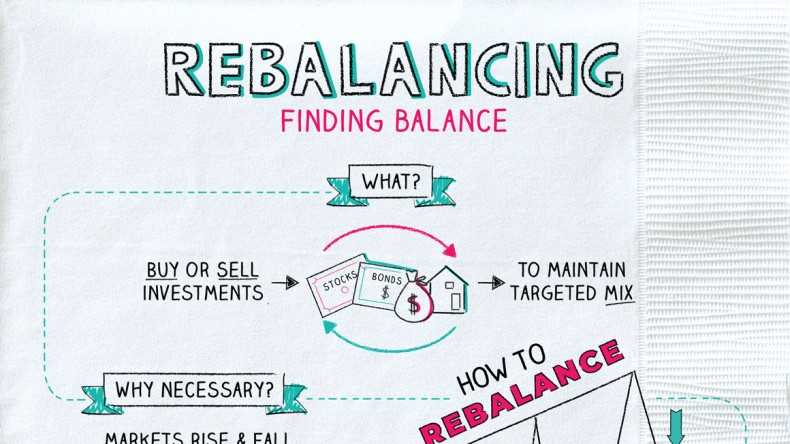

Rebalancing is a crucial aspect of portfolio construction that helps investors maintain their desired asset allocation and manage risk effectively. It involves periodically adjusting the weights of different assets in a portfolio to bring them back to their target levels.

There are several reasons why rebalancing is important in portfolio construction:

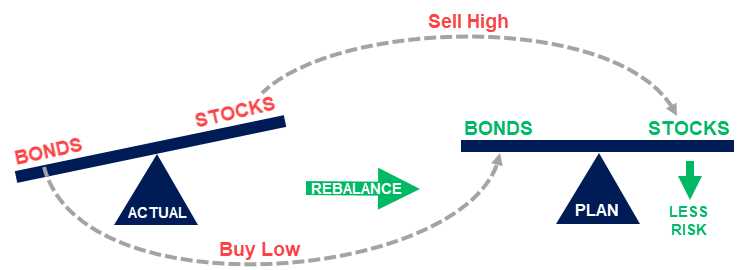

- Maintaining the desired asset allocation: Over time, the performance of different assets can vary, causing the portfolio’s allocation to deviate from the original target. Rebalancing allows investors to bring the portfolio back in line with their desired allocation, ensuring that it remains aligned with their investment objectives and risk tolerance.

- Controlling risk: Rebalancing helps to control risk by ensuring that the portfolio doesn’t become too heavily weighted towards certain assets that have performed well in the past. By periodically rebalancing, investors can reduce the concentration risk and avoid overexposure to any particular asset class or sector.

- Opportunities for buying low and selling high: Rebalancing provides investors with the opportunity to buy assets that have become relatively cheap and sell assets that have become relatively expensive. This disciplined approach allows investors to take advantage of market fluctuations and potentially enhance their returns over the long term.

- Discipline and long-term focus: Rebalancing requires discipline and a long-term perspective. It helps investors avoid making emotional investment decisions based on short-term market movements. By sticking to a rebalancing strategy, investors can stay focused on their long-term investment goals and avoid chasing performance or succumbing to market euphoria or panic.

- Adapting to changing market conditions: Rebalancing allows investors to adapt their portfolios to changing market conditions. By periodically reviewing and adjusting their asset allocation, investors can ensure that their portfolios are positioned to take advantage of new opportunities or mitigate potential risks that arise in the market.

Types and Examples of Rebalancing Strategies

Rebalancing is an essential aspect of portfolio construction that involves adjusting the weights of assets in a portfolio to maintain the desired asset allocation. There are various types of rebalancing strategies that investors can employ to ensure their portfolios stay aligned with their investment goals and risk tolerance. Here are some common types of rebalancing strategies:

1. Calendar-based Rebalancing

Calendar-based rebalancing involves setting specific time intervals, such as quarterly or annually, to rebalance the portfolio. This strategy ensures that the portfolio is regularly reviewed and adjusted, regardless of market conditions. For example, an investor may choose to rebalance their portfolio every six months to maintain their desired asset allocation.

2. Threshold-based Rebalancing

Threshold-based rebalancing involves setting specific thresholds or bands for each asset class in the portfolio. When the actual allocation deviates beyond the predetermined threshold, the portfolio is rebalanced. For instance, if an investor has set a threshold of 5% for a particular asset class and its allocation exceeds or falls below this threshold, they will rebalance the portfolio to bring it back in line.

3. Percentage-based Rebalancing

Percentage-based rebalancing involves rebalancing the portfolio based on the percentage deviation of each asset class from its target allocation. Investors determine a specific percentage deviation that triggers rebalancing. For example, if an investor has set a 10% deviation threshold, they will rebalance the portfolio when an asset class deviates by more than 10% from its target allocation.

4. Cash Flow-based Rebalancing

Cash flow-based rebalancing takes into account the cash flows into or out of the portfolio. This strategy involves rebalancing the portfolio when there are significant cash inflows or outflows that may disrupt the desired asset allocation. For instance, if an investor receives a large cash inflow, they may rebalance the portfolio to maintain the desired asset allocation.

It is important for investors to choose a rebalancing strategy that aligns with their investment objectives, risk tolerance, and market conditions. Regular rebalancing helps investors to control risk, maintain diversification, and ensure their portfolios are in line with their long-term goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.