What is a Quota Share Treaty?

A quota share treaty is a type of reinsurance agreement in the insurance industry. It is a proportional reinsurance arrangement where the insurer cedes a portion of its risks and premiums to a reinsurer. In simple terms, it is a sharing of both risks and rewards between the insurer and reinsurer.

In a quota share treaty, the insurer and reinsurer agree on a specific percentage or quota to share the risks and premiums. For example, if the insurer and reinsurer agree on a 50% quota share treaty, the insurer will cede 50% of its risks and premiums to the reinsurer.

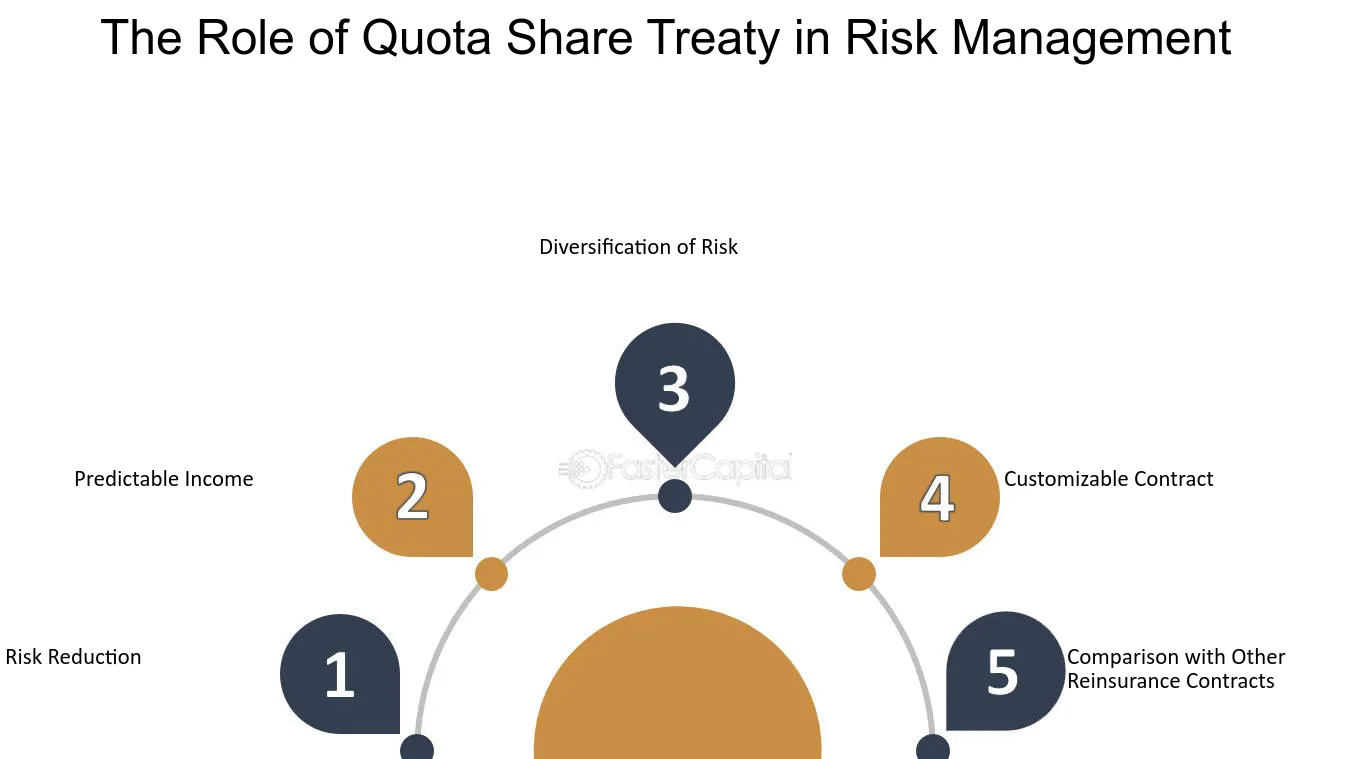

This type of reinsurance arrangement is commonly used when the insurer wants to reduce its exposure to risks and diversify its portfolio. By sharing the risks with a reinsurer, the insurer can limit its potential losses and improve its financial stability.

Mechanism of Quota Share Treaty

The mechanism of a quota share treaty involves the following steps:

- The insurer and reinsurer negotiate and agree on the percentage or quota to be shared.

- The insurer identifies the risks and premiums that will be ceded to the reinsurer.

- The insurer calculates the ceding commission based on the agreed percentage.

- The reinsurer accepts the ceded risks and premiums and provides the necessary reinsurance coverage.

- In case of claims, the reinsurer pays its share of the claims based on the agreed percentage.

Overall, the quota share treaty provides a way for insurers to manage their risks and improve their financial stability by sharing the risks with reinsurers.

| Advantages | Disadvantages |

|---|---|

| Reduces insurer’s exposure to risks | Lower potential for higher profits |

| Diversifies insurer’s portfolio | Dependence on reinsurer’s financial stability |

| Improves insurer’s financial stability | Loss of control over ceded risks |

Under a quota share treaty, the ceding company and the reinsurer agree on the terms and conditions of the reinsurance arrangement. This includes the percentage of each policy that will be ceded, the premium that will be paid to the reinsurer, and the maximum amount of liability that the reinsurer will assume.

One of the key benefits of a quota share treaty is that it provides a predictable and stable source of reinsurance capacity for the ceding company. Unlike other types of reinsurance agreements, such as excess of loss treaties, quota share treaties provide coverage for a fixed percentage of each policy, regardless of the size of the loss.

For example, if an insurance company enters into a quota share treaty with a reinsurer for a 50% quota share, the reinsurer would assume 50% of the risk for each policy. This means that if the ceding company pays a claim of $100,000, the reinsurer would be responsible for reimbursing $50,000.

Quota share treaties are commonly used in property and casualty insurance, where the risks are more predictable and can be spread across multiple insurers. They are less commonly used in life insurance, where the risks are more individualized and difficult to quantify.

Mechanism of Quota Share Treaty

A quota share treaty is a type of reinsurance agreement where the insurer cedes a portion of its risk and premiums to a reinsurer. This mechanism allows the insurer to reduce its exposure to potential losses and stabilize its financial position.

Here is a step-by-step explanation of how the mechanism of a quota share treaty works:

1. Agreement:

The insurer and the reinsurer enter into a quota share treaty agreement, which outlines the terms and conditions of the reinsurance arrangement. This includes the percentage of risk and premiums that will be ceded to the reinsurer.

2. Risk Sharing:

Under the quota share treaty, the insurer transfers a predetermined percentage of each policy it underwrites to the reinsurer. This means that the reinsurer will assume a proportional share of the risks associated with those policies.

3. Premium Sharing:

Similarly, the insurer also cedes a percentage of the premiums it collects from policyholders to the reinsurer. This allows the reinsurer to share in the financial benefits of the policies underwritten by the insurer.

4. Claims Settlement:

In the event of a claim, the insurer is responsible for handling the claims process and paying the policyholder. However, the reinsurer will reimburse the insurer for its share of the claim amount based on the agreed percentage.

5. Profit and Loss Sharing:

At the end of each accounting period, the insurer and the reinsurer will assess the overall profitability or loss of the quota share treaty. The reinsurer will receive a proportional share of the profits or bear a share of the losses based on the agreed percentage.

6. Long-Term Partnership:

A quota share treaty is typically a long-term agreement between the insurer and the reinsurer. This allows both parties to establish a stable and mutually beneficial partnership, ensuring continuity in risk sharing and premium sharing.

Overall, the mechanism of a quota share treaty provides insurers with a means to manage their risk exposure and improve their financial stability. It also allows reinsurers to diversify their risk portfolio and generate additional revenue from the premiums ceded by the insurer.

Illustrations of Quota Share Treaty in Insurance

Quota Share Treaty is a common reinsurance arrangement in the insurance industry. It involves the ceding of a portion of the insurance risk to a reinsurer in exchange for a proportional share of the premium. This arrangement helps insurance companies manage their risk exposure and ensure financial stability.

Example 1: Property Insurance

Let’s consider a property insurance company that wants to limit its exposure to a catastrophic event, such as a hurricane. The company enters into a quota share treaty with a reinsurer, agreeing to cede 50% of the risk and premium to the reinsurer.

Under this arrangement, if the property insurance company receives a premium of $1 million for a policy, it will cede $500,000 (50%) to the reinsurer. In return, the reinsurer will assume 50% of the risk associated with the policy.

If a hurricane causes $2 million in damages to the insured properties, the property insurance company will be responsible for covering $1 million, while the reinsurer will cover the remaining $1 million. This helps the insurance company limit its losses and maintain its financial stability.

Example 2: Life Insurance

Another example of a quota share treaty can be seen in the life insurance industry. A life insurance company may enter into a quota share treaty with a reinsurer to manage its mortality risk.

Suppose the life insurance company sells a policy with a death benefit of $1 million. It enters into a quota share treaty with a reinsurer, agreeing to cede 30% of the risk and premium to the reinsurer.

If the policyholder passes away, and the life insurance company needs to pay the death benefit, it will be responsible for $700,000 (70% of $1 million), while the reinsurer will cover the remaining $300,000 (30% of $1 million).

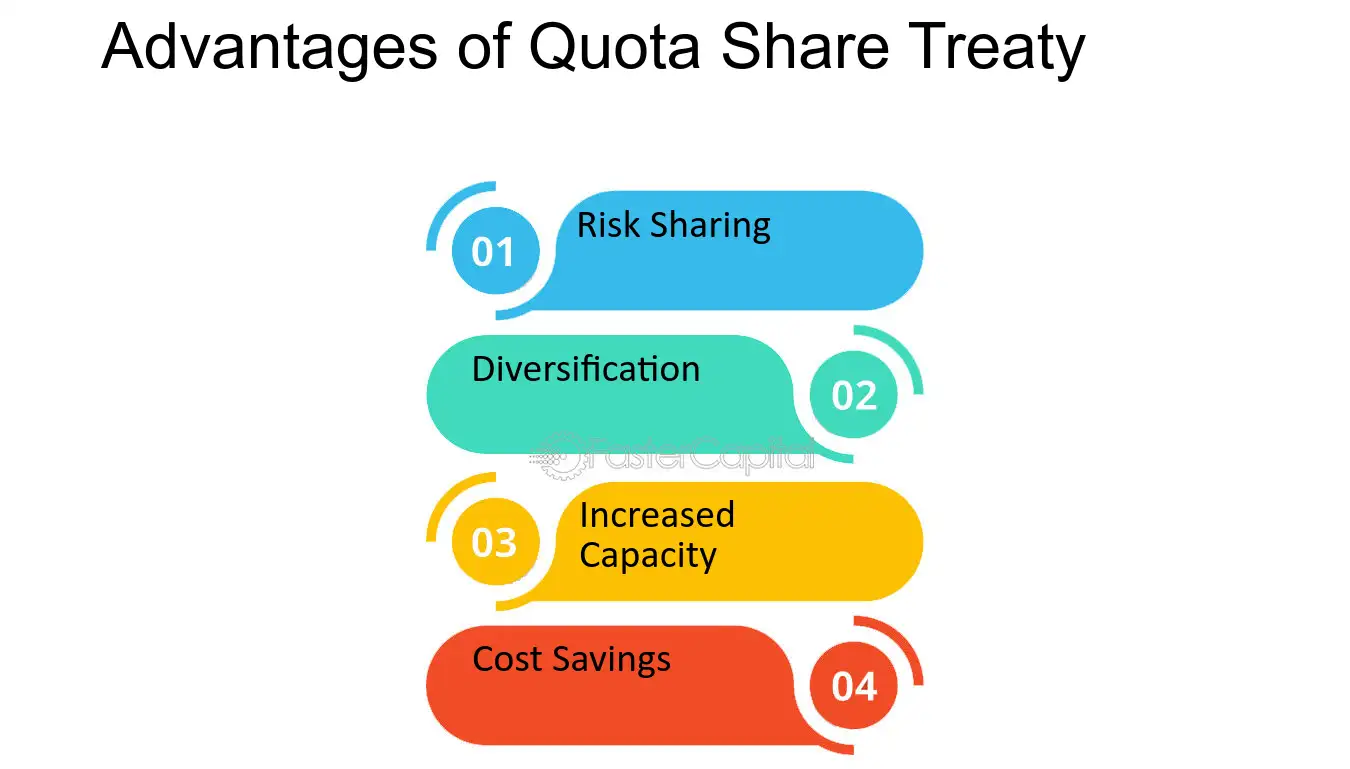

Benefits of Quota Share Treaty

Quota Share Treaty offers several benefits to insurance companies:

- Risk Management: By ceding a portion of the risk to a reinsurer, insurance companies can reduce their exposure to large losses and manage their overall risk portfolio.

- Financial Stability: Quota Share Treaty helps insurance companies maintain financial stability by sharing the risk and losses with a reinsurer.

- Capacity Enhancement: Insurance companies can underwrite larger policies and take on more business by leveraging the capacity of the reinsurer.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.