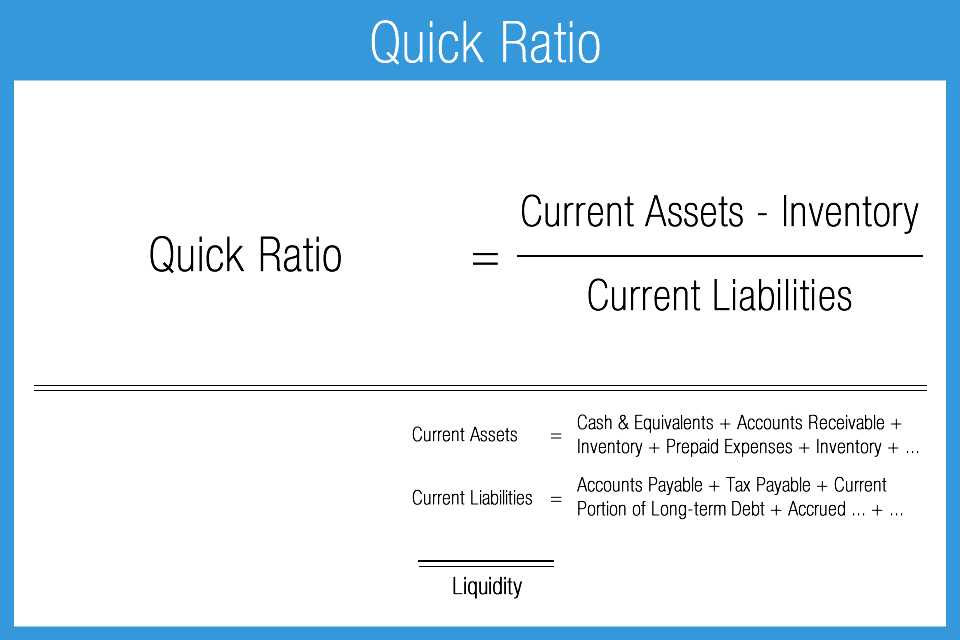

Quick Ratio Formula

The formula for Quick Ratio is:

| Quick Ratio Formula | = | / | Current Liabilities |

|---|

The Quick Ratio Formula provides a more conservative measure of a company’s liquidity compared to the Current Ratio. By excluding inventory, which may not be easily converted into cash, the Quick Ratio focuses on the most liquid assets that can be used to pay off short-term liabilities.

For example, if a company has $100,000 in current assets, $20,000 in inventory, and $50,000 in current liabilities, the Quick Ratio would be calculated as follows:

| Quick Ratio | = | / | $50,000 | |

|---|---|---|---|---|

| = | $80,000 | / | $50,000 | |

| = | 1.6 |

The Quick Ratio of 1.6 indicates that the company has $1.60 of liquid assets available to cover each dollar of its short-term liabilities.

Pros of using the Quick Ratio Formula include:

- It provides a more conservative measure of a company’s liquidity compared to the Current Ratio.

- It focuses on the most liquid assets that can be readily used to pay off short-term obligations.

- It helps assess a company’s ability to meet its short-term financial obligations.

Cons of using the Quick Ratio Formula include:

- It does not consider the quality or marketability of the inventory.

- It may not be suitable for companies with significant inventory holdings.

- It does not provide a complete picture of a company’s overall financial health.

What is the Quick Ratio?

The quick ratio is calculated by dividing a company’s quick assets by its current liabilities. Quick assets include cash, cash equivalents, and marketable securities. Current liabilities include short-term debt and accounts payable.

The quick ratio is a more conservative measure of liquidity compared to the current ratio, as it excludes inventory from the calculation. This is because inventory may not be easily converted into cash in the short term.

Why is the Quick Ratio Important?

The quick ratio is an important indicator of a company’s short-term financial health. It shows whether a company has enough liquid assets to cover its immediate obligations without relying on the sale of inventory.

A quick ratio of 1 or higher is generally considered good, as it indicates that a company has enough quick assets to cover its current liabilities. A quick ratio below 1 may indicate that a company may have difficulty meeting its short-term obligations.

Interpreting the Quick Ratio

However, a very high quick ratio may also indicate that a company is not effectively utilizing its assets and may have excess cash or marketable securities that could be invested elsewhere to generate higher returns.

On the other hand, a low quick ratio may indicate that a company is facing liquidity issues and may struggle to pay off its short-term debts. This could be a sign of poor financial health and may require further investigation.

Overall, the quick ratio is a valuable tool for investors, creditors, and analysts to assess a company’s ability to meet its short-term obligations and manage its liquidity effectively.

Examples of Quick Ratio Calculation

Calculating the quick ratio is an important step in assessing a company’s liquidity and financial health. Here are a few examples of how the quick ratio can be calculated:

These examples demonstrate how the quick ratio can be used to assess a company’s ability to meet its short-term obligations. A higher quick ratio indicates a stronger liquidity position, while a lower quick ratio may suggest potential liquidity issues.

Pros and Cons of Quick Ratio

Pros of Quick Ratio:

| Pros | Explanation |

|---|---|

| 1. Quick Assessment of Liquidity | The Quick Ratio provides a quick assessment of a company’s liquidity position by focusing on its most liquid assets, such as cash and cash equivalents, marketable securities, and accounts receivable. This helps investors and creditors evaluate the company’s ability to meet its short-term obligations. |

| 2. More Conservative Measure | |

| 3. Focus on High-Quality Assets | The Quick Ratio focuses on high-quality assets that can be easily converted into cash. This helps identify potential liquidity issues and ensures that a company has sufficient liquid assets to cover its short-term obligations. |

Cons of Quick Ratio:

| Cons | Explanation |

|---|---|

| 1. Limited View of Liquidity | |

| 2. Industry and Company-Specific Factors | The Quick Ratio may not be applicable or meaningful for all industries or companies. Different industries have different working capital requirements, and some companies may have unique business models that require higher or lower levels of liquidity. Therefore, it is important to consider industry and company-specific factors when interpreting the Quick Ratio. |

| 3. Potential Manipulation | Like any financial ratio, the Quick Ratio can be manipulated by management to present a more favorable liquidity position. For example, a company may delay paying its accounts payable to artificially increase its Quick Ratio. Therefore, it is important to analyze the components of the Quick Ratio and consider the integrity of the financial statements. |

Overall, the Quick Ratio is a useful tool for assessing a company’s short-term liquidity position. However, it should be used in conjunction with other financial ratios and analysis to get a comprehensive view of a company’s overall financial health.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.