What is PIPE?

PIPE, which stands for Private Investment in Public Equity, is a financing method used by companies to raise capital. It involves the sale of publicly traded securities, such as stocks or bonds, to private investors, usually institutional investors or accredited individuals.

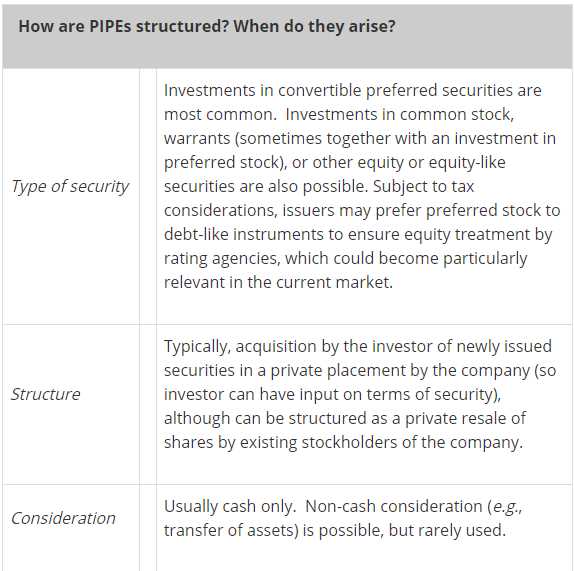

PIPE transactions are typically structured as private placements, meaning that the securities are sold directly to the investors without being offered to the general public. This allows companies to raise capital quickly and efficiently, without the need for a lengthy and costly initial public offering (IPO).

How Does PIPE Work?

In a PIPE transaction, the company issues new securities, such as common stock or convertible bonds, to the private investors at a discounted price compared to the current market price. The investors provide the company with immediate capital, which can be used for various purposes, such as funding acquisitions, expanding operations, or paying off debt.

PIPE transactions are typically negotiated between the company and the investors, and the terms of the investment, including the price, the number of securities, and any additional rights or restrictions, are outlined in a subscription agreement. Once the agreement is finalized, the company issues the securities to the investors, and the investors provide the agreed-upon funds to the company.

Advantages and Disadvantages of PIPE

However, PIPE transactions also have some disadvantages. The discounted price at which the securities are sold can dilute the ownership stake of existing shareholders, which may lead to a decrease in the company’s stock price. Furthermore, PIPE transactions are typically structured as private placements, which means that the securities cannot be freely traded on the public market until a certain holding period has passed.

| Advantages of PIPE | Disadvantages of PIPE |

|---|---|

| Quick and efficient way to raise capital | Potential dilution of existing shareholders |

| Less expensive than an IPO | Securities cannot be freely traded until holding period expires |

Definition of Private Investment in Public Equity (PIPE)

Private Investment in Public Equity (PIPE) is a financing method used by publicly traded companies to raise capital by selling shares of their stock to private investors. This method allows companies to raise funds quickly and efficiently without going through the traditional public offering process.

PIPE transactions are typically conducted by issuing new shares of stock to private investors at a discounted price compared to the current market price. The discounted price serves as an incentive for investors to participate in the offering and provides the company with the capital it needs.

How PIPE Works

When a company decides to pursue a PIPE transaction, it will enter into agreements with one or more private investors. These investors may include institutional investors, such as hedge funds or private equity firms, or high-net-worth individuals.

The company will negotiate the terms of the offering, including the number of shares to be issued, the price at which the shares will be sold, and any additional rights or privileges the investors may receive. Once the terms are agreed upon, the company will issue the shares to the investors and receive the capital in return.

After the transaction is complete, the private investors become shareholders in the company. They may hold onto their shares for the long term or sell them on the open market, potentially realizing a profit if the stock price increases.

Advantages of PIPE

PIPE transactions offer several advantages for both companies and investors. For companies, PIPE can provide a quick and efficient way to raise capital without the time-consuming and costly process of a traditional public offering. It also allows companies to tap into the expertise and resources of private investors.

For investors, PIPE transactions can offer the opportunity to invest in promising companies at a discounted price. If the company is successful, investors may see a significant return on their investment. Additionally, PIPE transactions are typically conducted with minimal market impact, reducing the risk of price volatility.

Overall, PIPE transactions provide a flexible and efficient financing option for publicly traded companies, while offering investors the potential for attractive returns.

Example of PIPE in Corporate Finance

Let’s consider an example to understand how Private Investment in Public Equity (PIPE) works in corporate finance.

Company XYZ

Imagine there is a company called XYZ that is publicly traded on a stock exchange. The company is looking to raise capital to fund its expansion plans. However, XYZ’s stock price has been declining, making it difficult for the company to attract traditional investors.

PIPE Investment

The private investors agree to purchase a certain number of shares of XYZ’s stock at a discounted price compared to the current market price. This discounted price is typically determined based on the average market price over a specific period of time.

For example, let’s say XYZ’s stock is currently trading at $10 per share in the market. The private investors agree to buy 1 million shares at a discounted price of $8 per share, resulting in a total investment of $8 million.

Benefits for XYZ

By opting for a PIPE investment, XYZ can raise capital quickly and efficiently, without the need for a lengthy and costly public offering. The company also benefits from the expertise and resources that the private investors bring, which can help accelerate its growth plans.

Benefits for Private Investors

On the other hand, the private investors in the PIPE transaction have the opportunity to invest in a publicly traded company at a discounted price. If the company’s stock price increases in the future, they can potentially earn a significant return on their investment.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.