What is PVIFA and How Does it Work?

PVIFA, or Present Value Interest Factor of Annuity, is a financial concept used to calculate the present value of a series of future cash flows. It is a factor that represents the value of an annuity, which is a stream of equal payments made at regular intervals over a specified period of time.

The PVIFA formula takes into account the interest rate and the number of periods to calculate the present value of an annuity. The formula is as follows:

Where:

- PVIFA is the Present Value Interest Factor of Annuity

- r is the interest rate per period

- n is the number of periods

Using the PVIFA formula, you can calculate the present value of an annuity and make informed financial decisions. For example, if you are considering an investment that offers a series of future cash flows, you can use the PVIFA formula to determine the present value of those cash flows and assess the profitability of the investment.

It is important to note that the PVIFA formula assumes a constant interest rate and equal cash flows over the specified period. If the interest rate or cash flows vary, the PVIFA formula may not provide an accurate estimate of the present value.

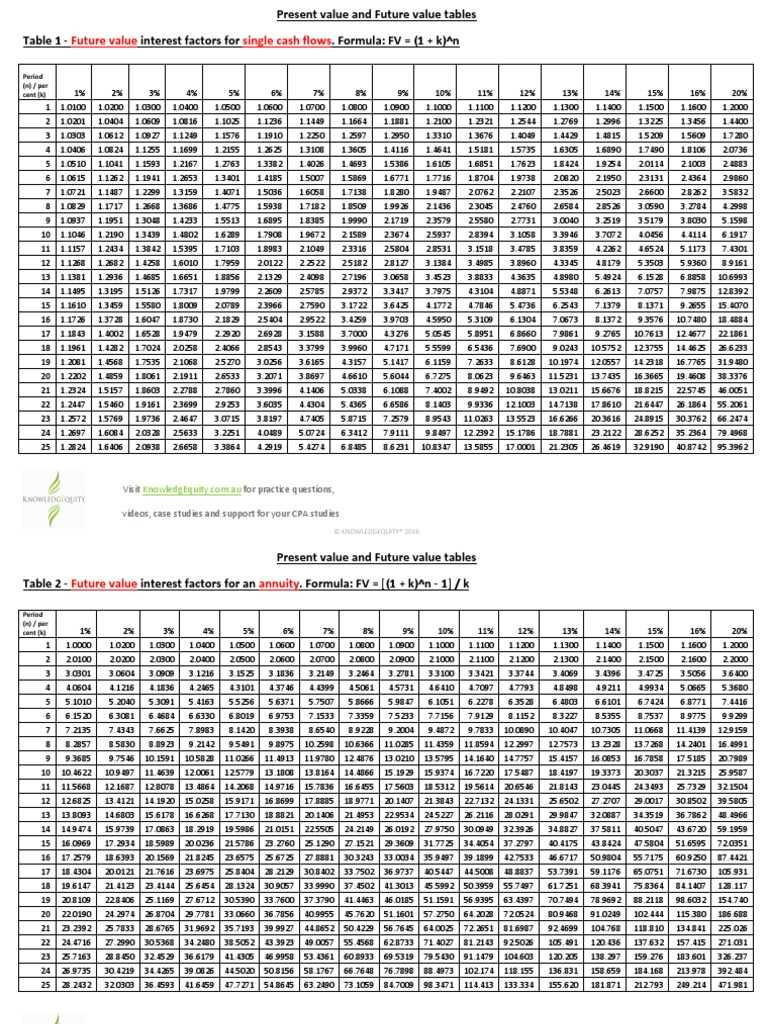

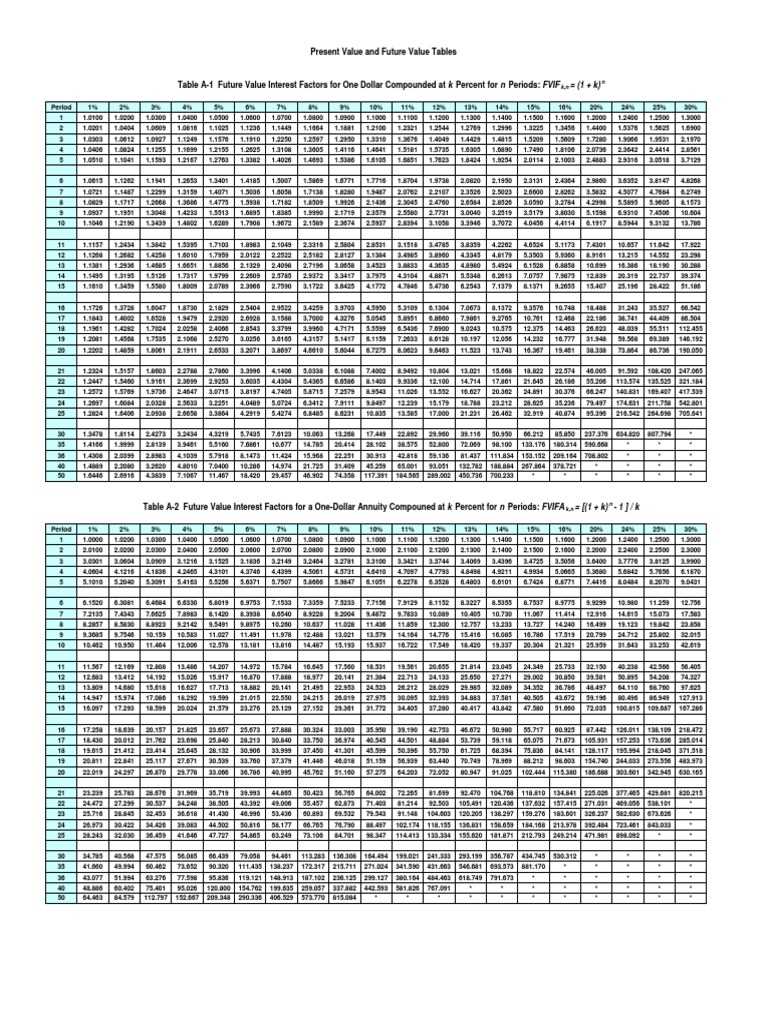

To simplify the calculation of PVIFA, financial tables are often used. These tables provide pre-calculated values of PVIFA for different combinations of interest rates and periods. By referencing these tables, you can quickly determine the PVIFA without having to perform the calculation manually.

Using PVIFA Tables for Quick Calculations

PVIFA tables provide a convenient way to find the PVIFA value for a given interest rate and number of periods. These tables are widely available and can be found in finance textbooks or online resources.

How to Use PVIFA Tables

Using PVIFA tables is relatively straightforward. Here are the steps:

- Identify the interest rate and number of periods for your annuity.

- Locate the corresponding interest rate in the leftmost column of the PVIFA table.

- Move horizontally across the row until you find the column that matches the number of periods for your annuity.

- Read the value in the intersection of the interest rate row and the number of periods column. This value represents the PVIFA.

For example, let’s say you have an annuity with an interest rate of 5% and a duration of 10 periods. By using a PVIFA table, you can quickly find the PVIFA value of 7.7217.

Advantages of Using PVIFA Tables

There are several advantages to using PVIFA tables for quick calculations:

- Time-saving: PVIFA tables allow you to find the PVIFA value without having to perform complex calculations.

- Accuracy: PVIFA tables provide accurate values that have been calculated and verified.

- Easy to use: The step-by-step process of using PVIFA tables makes it easy for anyone to calculate the PVIFA value.

- Widely available: PVIFA tables can be found in various finance resources, making them accessible to anyone who needs to calculate the present value of an annuity.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.