What is the Future Value of an Annuity?

The future value of an annuity is a financial concept that calculates the value of a series of equal payments or cash flows at a specific point in the future. It is an important tool for individuals and businesses to understand the potential growth or accumulation of funds over time.

There are two types of annuities: ordinary annuities and annuities due. In an ordinary annuity, the payments are made at the end of each period, while in an annuity due, the payments are made at the beginning of each period.

Calculating the Future Value of an Annuity

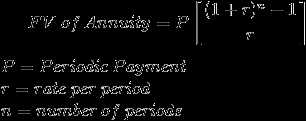

The future value of an annuity can be calculated using a formula that takes into account the interest rate, the number of periods, and the amount of each payment. The formula is as follows:

Where:

- FV is the future value of the annuity

- P is the payment amount

- r is the interest rate per period

- n is the number of periods

By plugging in the appropriate values into the formula, you can calculate the future value of an annuity. This calculation can help you determine the potential growth of your investments or savings over time.

It is important to note that the future value of an annuity assumes that the payments are made at regular intervals and that the interest rate remains constant throughout the entire period. In reality, interest rates may fluctuate, and the actual future value of an annuity may be different from the calculated value.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.