What is a Personal Financial Statement?

A personal financial statement is a document that provides an overview of an individual’s financial situation. It includes information about their assets, liabilities, income, and expenses. This statement is typically used by individuals to assess their financial health and make informed decisions about their personal finances.

Personal financial statements are important tools for individuals who want to manage their finances effectively. By creating a personal financial statement, individuals can track their income and expenses, identify areas where they can save money, and set financial goals.

The purpose of a personal financial statement is to provide a snapshot of an individual’s financial position at a specific point in time. It helps individuals understand their net worth, which is calculated by subtracting their liabilities from their assets. This information can be used to evaluate their financial health and make informed decisions about their financial future.

Personal financial statements are used for various purposes, such as applying for loans, mortgages, or credit cards. Lenders often require borrowers to submit a personal financial statement to assess their creditworthiness and determine their ability to repay the loan. Additionally, personal financial statements can be used for tax planning, estate planning, and retirement planning.

Here is an example of a personal financial statement:

Assets:

- Checking Account: $5,000

- Savings Account: $10,000

- Investment Portfolio: $50,000

- Real Estate: $200,000

Liabilities:

- Mortgage: $150,000

- Car Loan: $20,000

- Credit Card Debt: $5,000

Net Worth: $90,000

Definition and Purpose

A personal financial statement is a document that provides a snapshot of an individual’s financial situation at a specific point in time. It includes information about their assets, liabilities, income, and expenses. The purpose of a personal financial statement is to assess an individual’s financial health and to help them make informed decisions about their personal finances.

Furthermore, a personal financial statement can be useful for setting financial goals and creating a budget. By knowing their current financial situation, individuals can set realistic goals for saving, investing, or paying off debt. They can also use the statement to track their progress towards these goals and make adjustments as needed.

In addition to personal use, a personal financial statement may be required by lenders or financial institutions when applying for a loan or credit. Lenders use the statement to assess an individual’s creditworthiness and determine their ability to repay the loan. The statement provides a comprehensive view of the individual’s financial situation, allowing lenders to make informed decisions about lending money.

Importance of Personal Financial Statements

A personal financial statement is a crucial tool for individuals to assess their financial health and make informed decisions about their personal finances. It provides a comprehensive snapshot of an individual’s financial situation, including their assets, liabilities, income, and expenses.

Assessing Financial Health

One of the primary reasons why personal financial statements are important is that they allow individuals to assess their financial health. By analyzing their assets and liabilities, individuals can determine their net worth, which is an essential indicator of their financial well-being. A positive net worth indicates that an individual’s assets exceed their liabilities, while a negative net worth suggests the opposite.

Financial Planning and Decision Making

Personal financial statements are also crucial for financial planning and decision making. By analyzing their income and expenses, individuals can create a budget that aligns with their financial goals and priorities. A budget helps individuals allocate their income effectively, ensuring that they have enough money to cover their expenses, save for the future, and invest in their financial well-being.

Financial Goal Setting

Personal financial statements also play a crucial role in setting and achieving financial goals. By analyzing their assets and liabilities, individuals can identify areas where they can increase their net worth and improve their financial situation. This analysis helps individuals set realistic and achievable financial goals, such as paying off debt, saving for retirement, or buying a home.

Regularly updating personal financial statements allows individuals to track their progress towards their financial goals. It provides them with a tangible measure of their success and motivates them to continue making positive financial decisions.

Uses of Personal Financial Statements

1. Assessing Net Worth

One of the primary uses of personal financial statements is to assess an individual’s net worth. Net worth is calculated by subtracting an individual’s liabilities (such as loans, credit card debt, and mortgages) from their assets (such as cash, investments, and real estate). By regularly updating and reviewing their personal financial statement, individuals can track changes in their net worth over time and evaluate their financial progress.

2. Budgeting and Financial Planning

Personal financial statements can also be used for budgeting and financial planning purposes. By analyzing their income and expenses, individuals can identify areas where they can cut back on spending and allocate more funds towards savings or investments. This can help individuals set realistic financial goals and create a plan to achieve them.

3. Applying for Loans or Credit

When applying for loans or credit, financial institutions often require individuals to submit personal financial statements. These statements provide lenders with a comprehensive overview of an individual’s financial health and help them assess the individual’s creditworthiness. By maintaining an up-to-date personal financial statement, individuals can easily provide the necessary information when applying for loans or credit.

4. Estate Planning

Personal financial statements are also useful for estate planning purposes. By documenting their assets and liabilities, individuals can ensure that their financial affairs are in order and make it easier for their loved ones to manage their estate in the event of their passing. Personal financial statements can provide valuable information to estate planners and attorneys, helping to streamline the estate planning process.

5. Tax Planning

Personal financial statements can be instrumental in tax planning. By accurately documenting their income, expenses, and assets, individuals can identify potential tax deductions and credits, as well as ensure compliance with tax laws. Personal financial statements can serve as a reference when preparing tax returns and can help individuals maximize their tax savings.

6. Financial Decision Making

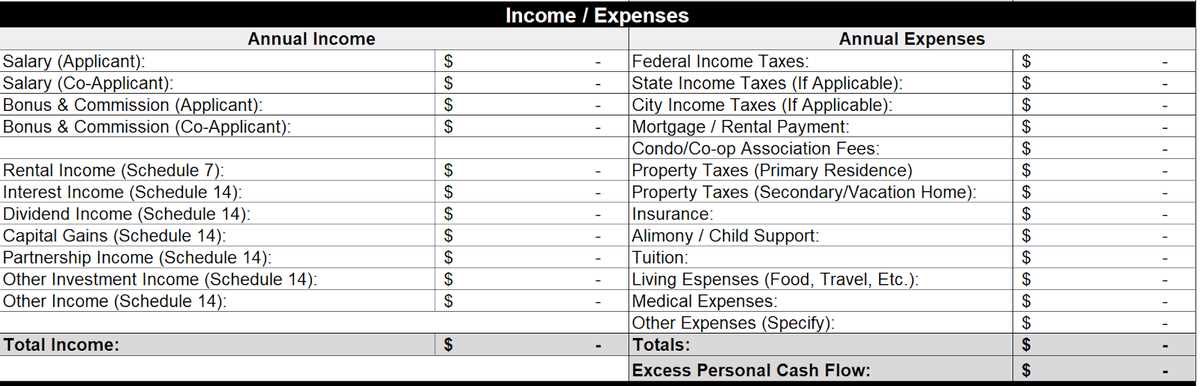

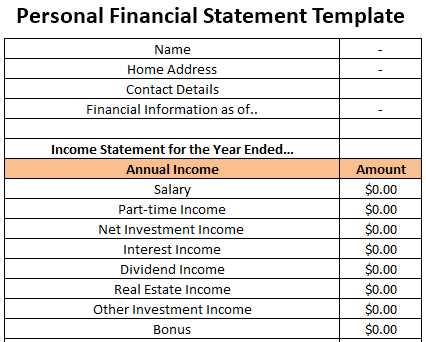

Example of a Personal Financial Statement

A personal financial statement is a document that provides an overview of an individual’s financial situation. It includes information about their assets, liabilities, income, and expenses. Here is an example of what a personal financial statement might look like:

Personal Information:

Name: John Smith

Date of Birth: January 1, 1980

Address: 123 Main Street, Anytown, USA

Email: johnsmith@email.com

Phone Number: 555-123-4567

Assets:

Cash: $10,000

Savings Account: $20,000

Checking Account: $5,000

Investment Portfolio: $50,000

Retirement Account: $100,000

Real Estate: $200,000

Vehicle: $15,000

Liabilities:

Credit Card Debt: $5,000

Student Loans: $20,000

Mortgage: $150,000

Car Loan: $10,000

Income:

Salary: $60,000 per year

Investment Income: $5,000 per year

Rental Income: $10,000 per year

Expenses:

Rent/Mortgage: $1,500 per month

Utilities: $200 per month

Food: $500 per month

Transportation: $300 per month

Insurance: $100 per month

Entertainment: $200 per month

Net Worth:

This is just a simple example, and personal financial statements can vary greatly depending on an individual’s financial situation. However, it provides a snapshot of an individual’s financial health and can be used for various purposes, such as applying for loans, tracking progress towards financial goals, or preparing for retirement.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.