Definition of Paper Money

Unlike commodity money, which has intrinsic value, paper money derives its value from the trust and confidence that people have in the government that issues it. This trust is based on the belief that the government will honor its promise to accept the paper money as a form of payment and that it can be exchanged for goods and services.

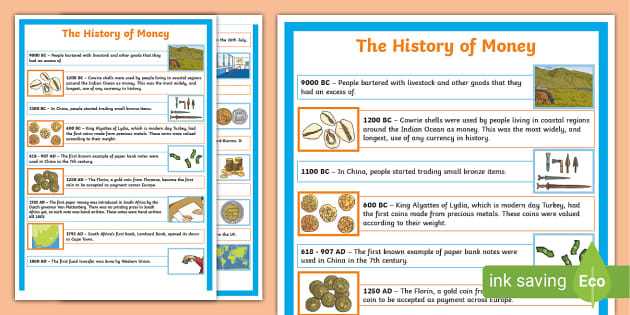

History of Paper Money

The use of paper money dates back to ancient China, where it was first introduced during the Tang Dynasty in the 7th century. The Chinese government issued paper money as a way to simplify trade and reduce the need to carry heavy coins.

Use of Paper Money

Paper money is used for various purposes, including everyday transactions, saving, and investment. It is accepted as a form of payment by businesses and individuals and can be used to buy goods and services.

One of the advantages of paper money is its convenience. It is lightweight and easy to carry compared to coins or other forms of currency. It is also easily divisible, allowing for smaller denominations to be used for smaller transactions.

Another use of paper money is as a store of value. People can save their money by keeping it in the form of paper currency. However, it is important to note that paper money can lose its value over time due to inflation or other economic factors.

Importance of Paper Money

Paper money plays a crucial role in the modern economy. It facilitates trade by providing a widely accepted medium of exchange. It allows for the efficient exchange of goods and services, making it easier for businesses and individuals to engage in economic transactions.

Furthermore, paper money allows governments to implement monetary policies to manage the economy. By controlling the supply of money, governments can influence interest rates, inflation, and economic growth. This ability to control the money supply is essential for maintaining price stability and promoting economic stability.

Additionally, paper money provides a sense of stability and security. It is backed by the government, which gives people confidence that their money is safe and can be used to meet their needs. This confidence in the currency is essential for maintaining trust in the financial system and promoting economic development.

Examples of Paper Money

There are numerous examples of paper money used around the world. Some of the most widely recognized examples include the United States dollar, the Euro, the British pound, the Japanese yen, and the Chinese yuan.

Each of these currencies has its own unique design and features, reflecting the culture and history of the country. They are widely accepted and used for both domestic and international transactions.

History of Paper Money

Origins of Paper Money

Over time, the use of paper money spread to other parts of the world. In the 13th century, Marco Polo encountered paper money during his travels in the Mongol Empire. The Mongols had adopted the use of paper money from the Chinese, and it quickly became a common form of currency in their vast empire.

Development of Modern Paper Money

One of the key advantages of paper money was its convenience and ease of use. Unlike coins, which could be heavy and cumbersome to carry, paper money was lightweight and could be easily transported. This made it ideal for large-scale commercial transactions and facilitated the growth of international trade.

Evolution of Paper Money

Since its inception, paper money has undergone significant changes and improvements. In the early days, paper money was often not fully backed by precious metals and was subject to frequent devaluations. However, as economies became more sophisticated, central banks were established to regulate the issuance and value of paper money.

Today, most modern economies operate on a system of fiat money, where the value of paper money is not directly linked to any physical commodity. Instead, the value of paper money is based on the trust and confidence of the people who use it. Central banks play a crucial role in maintaining the stability and integrity of paper money by controlling the money supply and implementing monetary policies.

Conclusion

Use of Paper Money

Convenience

One of the primary reasons for the widespread use of paper money is its convenience. Unlike coins, which can be heavy and cumbersome to carry around, paper money is lightweight and easy to transport. It can be folded and easily fit into wallets, pockets, or purses, making it more practical for everyday use. Additionally, paper money is available in different denominations, allowing for easy and precise transactions.

Acceptance

Another advantage of paper money is its universal acceptance. In most countries, paper money is recognized as legal tender and must be accepted as a form of payment for goods and services. This widespread acceptance makes it a trusted and reliable medium of exchange, ensuring that individuals can use it to buy the things they need without any issues.

Security Features

Modern paper money incorporates various security features to prevent counterfeiting and ensure its authenticity. These features can include holograms, watermarks, security threads, and special inks that are difficult to replicate. These security measures make it easier for individuals and businesses to verify the legitimacy of paper money, reducing the risk of fraud and counterfeit transactions.

Electronic Transactions

While the use of paper money is still prevalent, electronic transactions have become increasingly popular in recent years. With the advent of online banking, mobile payment apps, and digital wallets, individuals can now make purchases and transfer money electronically. However, paper money continues to play a crucial role in the economy, especially in areas where access to electronic payment methods may be limited or unreliable.

| Advantages | Disadvantages |

|---|---|

| Convenience | Prone to loss or theft |

| Universal acceptance | Subject to inflation |

| Security features | Potential for counterfeiting |

| Accessibility in areas with limited electronic payment options | Requires physical presence for transactions |

The Importance of Paper Money

Paper money plays a crucial role in modern economies and holds significant importance in various aspects of our daily lives. Here are some reasons why paper money is important:

1. Medium of Exchange

One of the primary functions of paper money is to serve as a medium of exchange. It allows individuals to buy goods and services without the need for bartering or exchanging goods directly. Paper money simplifies transactions and facilitates economic activities by providing a widely accepted form of payment.

2. Convenience

Paper money offers convenience compared to other forms of payment. It is lightweight, easily portable, and can be carried in wallets or pockets. Unlike carrying large amounts of coins or valuable commodities, paper money provides a practical and efficient means of carrying wealth.

3. Store of Value

Paper money serves as a store of value, allowing individuals to accumulate wealth and save for the future. It provides a stable and reliable medium for storing wealth, as it can be easily stored and accessed when needed. Unlike perishable goods or commodities, paper money retains its value over time.

4. Facilitates Economic Growth

Paper money plays a crucial role in facilitating economic growth. It allows governments to implement monetary policies, such as controlling inflation and interest rates, which are essential for maintaining a stable and healthy economy. Additionally, paper money enables individuals and businesses to invest, borrow, and engage in economic activities, contributing to overall economic development.

5. Global Acceptance

One of the key advantages of paper money is its global acceptance. Most countries accept major currencies as a form of payment, making it convenient for international trade and travel. Paper money promotes economic integration and facilitates cross-border transactions, contributing to globalization and interconnectedness.

6. Financial Stability

Paper money plays a vital role in maintaining financial stability. Central banks and monetary authorities regulate the supply and circulation of paper money to ensure stability in the economy. By controlling the money supply, they can manage inflation, stabilize prices, and promote economic stability.

Examples of Paper Money

Throughout history, various countries and civilizations have used paper money as a medium of exchange. Here are some examples of paper money from different parts of the world:

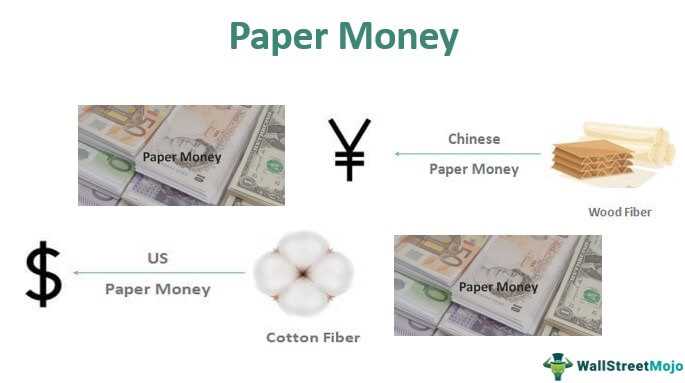

1. United States Dollar (USD): The USD is the official currency of the United States and is widely accepted as a global reserve currency. It has been in circulation since the late 18th century and is printed on cotton-based paper.

2. Euro (EUR): The Euro is the official currency of the Eurozone, which consists of 19 European Union member states. It was introduced in 1999 and is printed on pure cotton paper.

4. Japanese Yen (JPY): The Japanese Yen is the official currency of Japan. It has been in circulation since the late 19th century and is printed on a combination of cotton and pulp materials.

5. British Pound (GBP): The British Pound is the official currency of the United Kingdom. It has a long history dating back to the 8th century and is printed on a combination of cotton and polymer materials.

6. Indian Rupee (INR): The Indian Rupee is the official currency of India. It has been in circulation since the 16th century and is printed on a combination of cotton and polymer materials.

7. Australian Dollar (AUD): The Australian Dollar is the official currency of Australia. It has been in circulation since the early 20th century and is printed on a combination of cotton and polymer materials.

These are just a few examples of the many different types of paper money used around the world. Each currency has its own unique design and features, reflecting the history and culture of the country it represents.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.