Net International Investment Position (NIIP) in Macroeconomics

The Net International Investment Position (NIIP) is a key indicator used in macroeconomics to measure the difference between a country’s external financial assets and liabilities. It provides valuable insights into the country’s economic relationship with the rest of the world.

The NIIP is calculated by subtracting a country’s total external liabilities from its total external assets. External assets include foreign investments, foreign currency reserves, and other financial claims on foreign entities. External liabilities include foreign debts, loans, and other financial obligations owed to foreign entities.

A positive NIIP indicates that a country has more external assets than liabilities, meaning it is a net creditor to the rest of the world. This suggests that the country has invested more abroad than it owes to foreign entities. On the other hand, a negative NIIP indicates that a country has more external liabilities than assets, making it a net debtor to the rest of the world.

The NIIP is an important indicator of a country’s economic vulnerability and its ability to meet its external financial obligations. A negative NIIP can signal a high level of foreign debt and dependence on foreign capital, which may pose risks to the country’s financial stability. A positive NIIP, on the other hand, indicates a strong position in international finance and the ability to generate income from foreign investments.

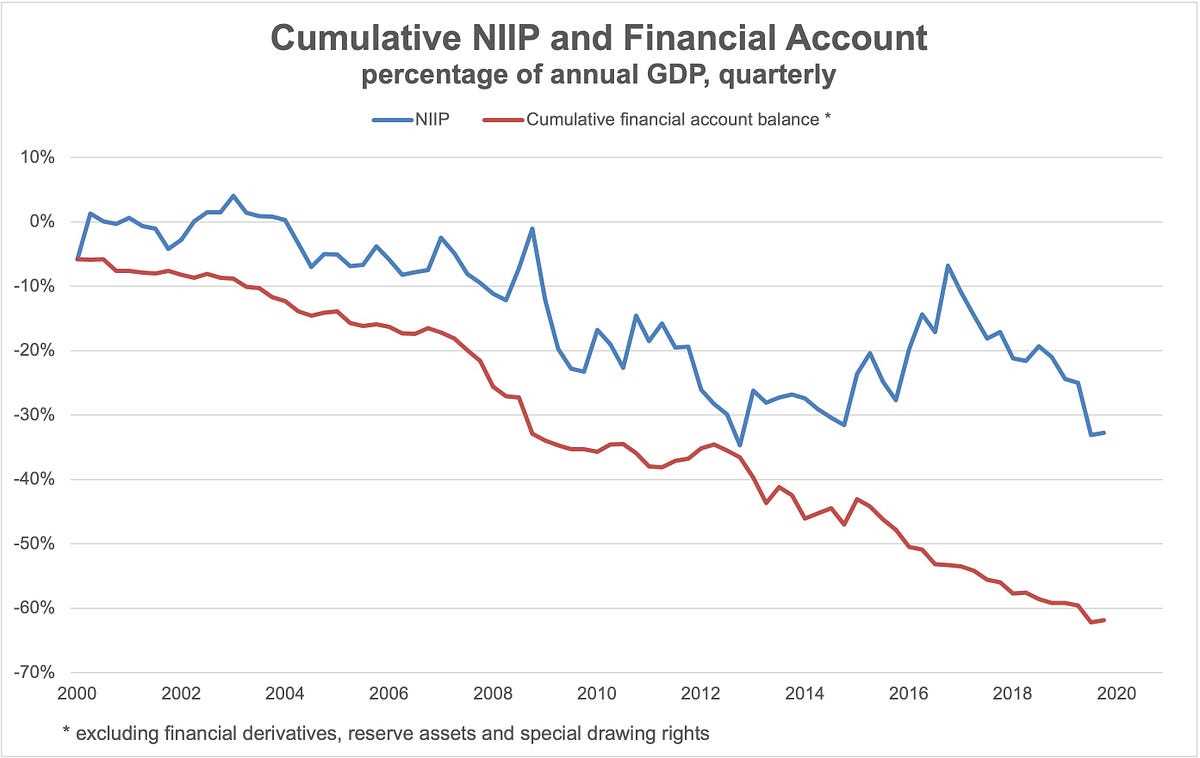

It is worth noting that the NIIP is subject to change over time due to various factors such as exchange rate fluctuations, changes in asset prices, and international trade imbalances. Therefore, it is important to regularly monitor and analyze the NIIP to assess a country’s economic health and its exposure to external risks.

Definition of Net International Investment Position (NIIP)

The Net International Investment Position (NIIP) is a concept used in macroeconomics to measure the difference between a country’s external financial assets and liabilities. It provides an overview of the country’s financial relationship with the rest of the world.

The NIIP takes into account various types of financial assets and liabilities, including direct investment, portfolio investment, financial derivatives, and other investment positions. It is calculated by subtracting the value of a country’s external liabilities from the value of its external assets.

The NIIP is an important indicator of a country’s financial vulnerability and its ability to meet its external obligations. A positive NIIP indicates that a country’s external assets exceed its external liabilities, suggesting that it is a net creditor to the rest of the world. On the other hand, a negative NIIP indicates that a country’s external liabilities exceed its external assets, making it a net debtor.

Importance of the Net International Investment Position

The NIIP provides valuable insights into a country’s economic health and its position in the global financial system. It helps policymakers and economists understand the country’s exposure to external shocks and its ability to attract foreign investment.

On the other hand, a negative NIIP can be a cause for concern, as it suggests that a country is heavily reliant on foreign financing. This can make the country vulnerable to changes in global financial conditions and can lead to difficulties in meeting its external obligations.

Factors Affecting the Net International Investment Position

Several factors can influence a country’s NIIP. These include trade imbalances, foreign direct investment, exchange rate movements, and changes in asset prices.

A country with a trade surplus, meaning it exports more than it imports, is likely to have a positive NIIP. This is because it is accumulating foreign currency through its trade activities, which can be used to acquire foreign assets.

Foreign direct investment (FDI) can also have a significant impact on a country’s NIIP. When foreign companies invest in a country, they bring in capital that increases the country’s external assets. Conversely, when domestic companies invest abroad, it increases the country’s external liabilities.

Exchange rate movements can affect the NIIP by changing the value of a country’s external assets and liabilities. A depreciation of the domestic currency can increase the value of external assets denominated in foreign currency, while a depreciation can increase the value of external liabilities.

Changes in asset prices, such as stock market fluctuations or changes in real estate values, can also impact the NIIP. If the value of a country’s external assets increases, it will have a positive effect on the NIIP, while a decrease in asset values will have a negative effect.

Example of Net International Investment Position (NIIP)

The Net International Investment Position (NIIP) is a measure that reflects the difference between a country’s external financial assets and liabilities. It provides valuable insights into a country’s economic relationships with the rest of the world.

For example, let’s consider Country A. Country A has a positive NIIP, which means that its external financial assets exceed its external financial liabilities. This indicates that Country A is a net creditor to the rest of the world.

Country A’s external financial assets may include foreign direct investments, portfolio investments, and reserve assets. These assets can be in the form of equity, debt securities, or cash. On the other hand, Country A’s external financial liabilities may include foreign debts, loans, and other financial obligations.

By analyzing the components of Country A’s NIIP, policymakers and economists can gain insights into the country’s financial stability, economic growth prospects, and vulnerability to external shocks. A positive NIIP suggests that Country A has a strong position in the global economy and is less dependent on external financing.

However, it is important to note that a positive NIIP does not necessarily indicate a favorable economic situation. It could also imply that Country A has accumulated a large external debt burden, which may pose risks to its financial stability in the long run.

In contrast, a negative NIIP implies that a country’s external financial liabilities exceed its external financial assets. This indicates that the country is a net debtor to the rest of the world. A negative NIIP suggests that the country relies heavily on external financing and may be more vulnerable to economic shocks and changes in global financial conditions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.