What is Negative Goodwill?

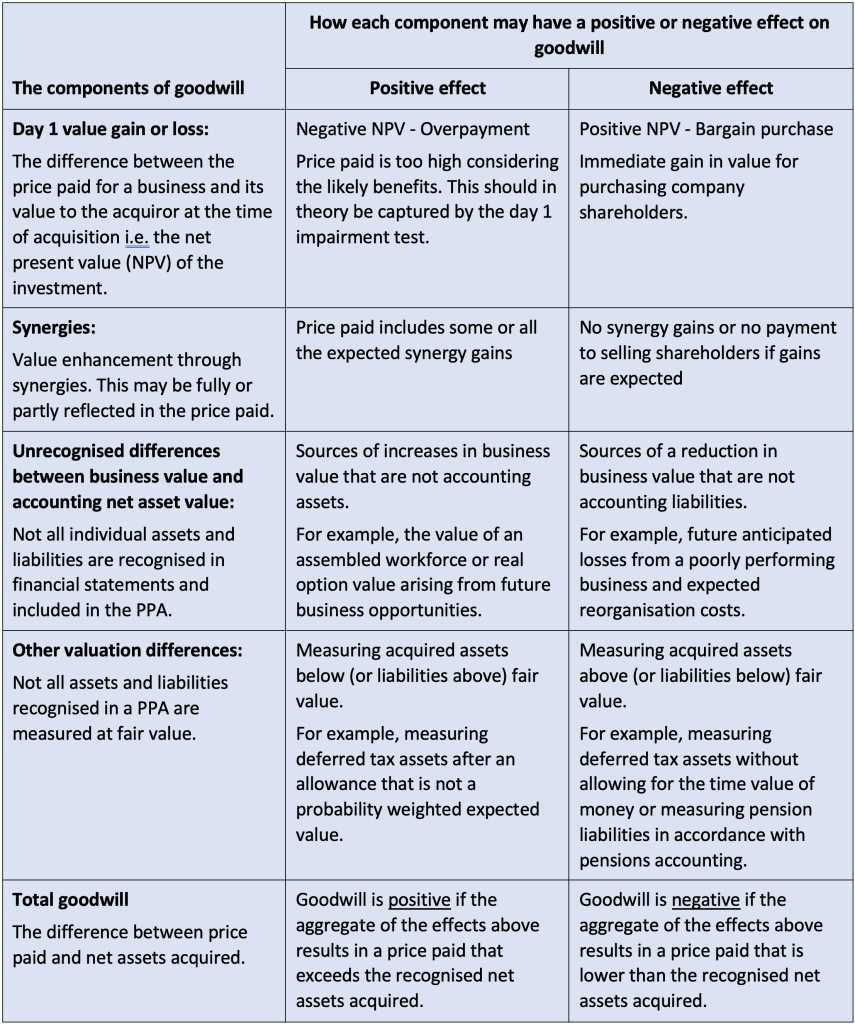

This situation can arise due to various factors, such as distressed sales, economic downturns, or a lack of competition in the market. Negative goodwill is often seen as a favorable outcome for the acquiring company, as it allows them to acquire assets at a discounted price.

However, negative goodwill can also indicate financial distress or poor performance of the target company. It may result from overvaluation of assets, excessive liabilities, or other unfavorable circumstances. As a result, negative goodwill is generally recognized as a gain in the financial statements of the acquiring company.

Definition of Negative Goodwill

Negative goodwill can occur for various reasons, such as distressed sales, fire sales, or when the acquired company has significant liabilities or poor financial performance. It can also occur when the acquirer has significant bargaining power and negotiates a lower purchase price.

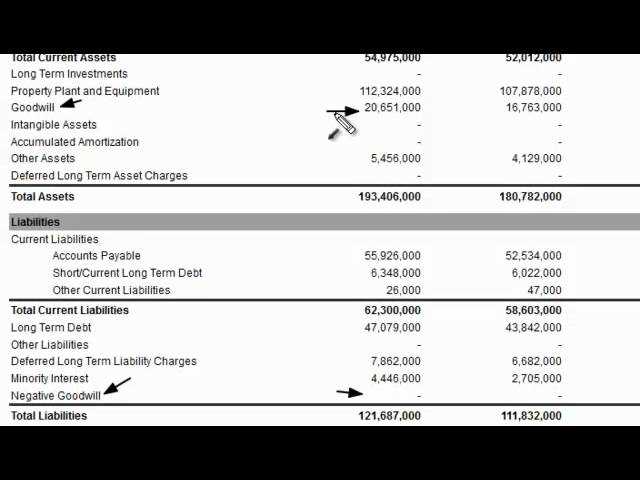

Accounting for negative goodwill requires the acquirer to recognize it as a gain in the income statement. It is recorded as a non-operating income and increases the acquirer’s net income. However, it is important to note that negative goodwill is a rare occurrence and is subject to strict accounting rules and regulations.

Examples of Negative Goodwill

1. Bargain Purchase

A common example of negative goodwill occurs when a company is acquired for a price that is significantly lower than its fair market value. This can happen when a target company is in financial distress or facing other challenges that reduce its value in the eyes of the acquirer. In such cases, the acquirer may be able to purchase the target company at a bargain price, resulting in negative goodwill.

2. Undervalued Assets

Another example of negative goodwill can arise when the fair market value of the target company’s assets is higher than the purchase price. This can happen if the target company’s assets are undervalued on its balance sheet or if the acquirer has a more optimistic view of the assets’ value. In such cases, the difference between the fair market value of the assets and the purchase price can result in negative goodwill.

3. Synergy Benefits

In some cases, negative goodwill can be the result of expected synergy benefits from the merger or acquisition. Synergy benefits occur when the combined value of the acquirer and target company is greater than the sum of their individual values. If the acquirer expects to achieve significant cost savings or revenue growth through the merger or acquisition, the resulting increase in value can lead to negative goodwill.

Overall, negative goodwill in M&A transactions can occur for various reasons, including bargain purchases, undervalued assets, and expected synergy benefits. It is important for companies to properly account for negative goodwill in their financial statements to ensure accurate reporting of their financial position.

Accounting for Negative Goodwill in M&A

Accounting for negative goodwill in M&A involves recognizing it as a gain on the acquiring company’s financial statements. This gain is typically recorded in the income statement and can have a significant impact on the company’s financial performance.

However, negative goodwill is not always a positive outcome for the acquiring company. It can indicate that the acquired company was undervalued or that there were significant issues with its assets. In some cases, negative goodwill may be the result of aggressive negotiation tactics or a distressed sale.

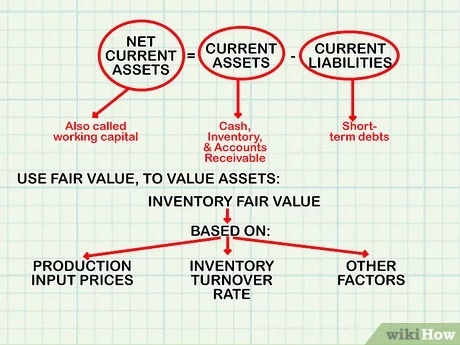

To account for negative goodwill, the acquiring company must first allocate the purchase price to the fair value of the acquired company’s identifiable assets and liabilities. Any excess of the fair value over the purchase price is considered negative goodwill. This amount is then recognized as a gain in the acquiring company’s financial statements.

It is important to note that negative goodwill is relatively rare in M&A transactions. Most acquisitions result in positive goodwill, where the purchase price is higher than the fair value of the acquired company’s net assets. Positive goodwill is typically recorded as an intangible asset on the acquiring company’s balance sheet and is subject to annual impairment testing.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.