The Significance of the NAHB/Wells Fargo Housing Market Index in Real Estate Investing

The NAHB/Wells Fargo Housing Market Index is a key indicator in the real estate investing industry. It provides valuable insights into the current state of the housing market, helping investors make informed decisions about buying, selling, or holding onto properties.

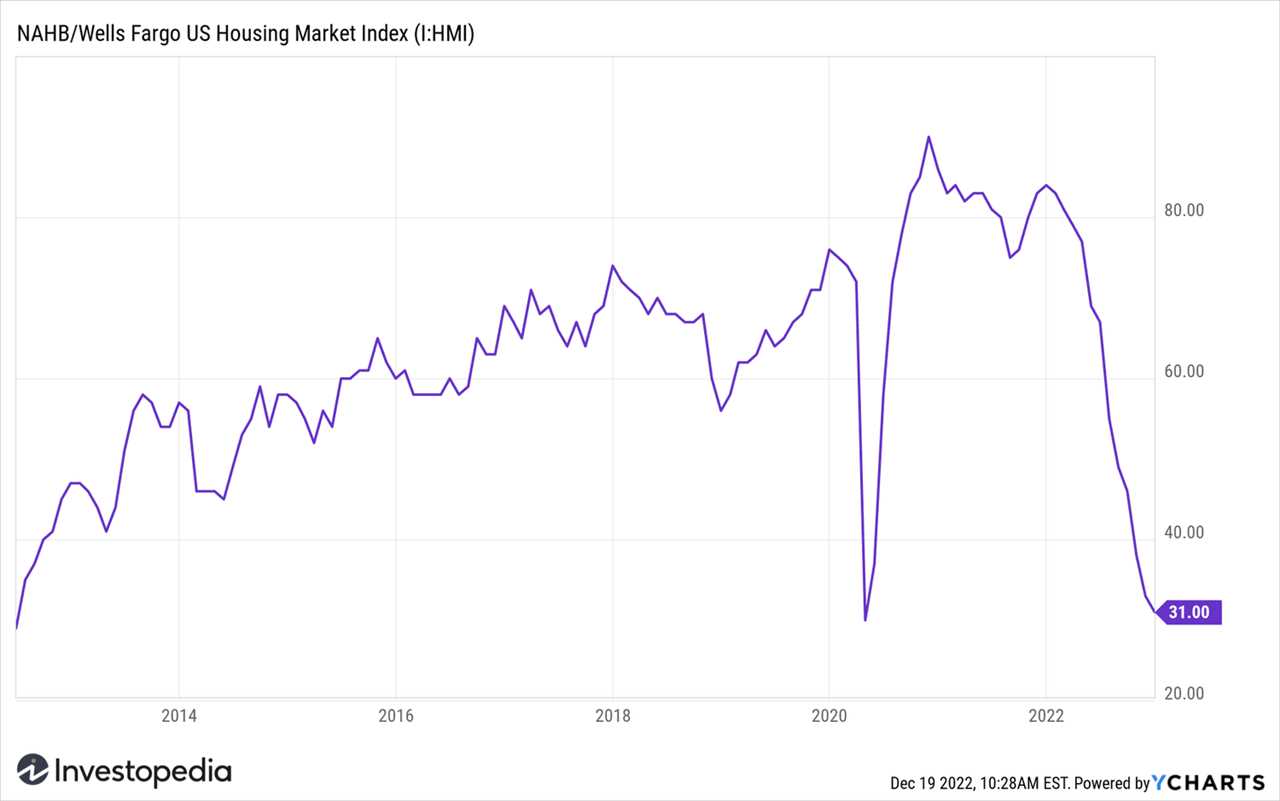

The NAHB/Wells Fargo Housing Market Index is a monthly survey conducted by the National Association of Home Builders (NAHB) and Wells Fargo. It measures builder perceptions of current single-family home sales and sales expectations for the next six months. The index is scored on a scale of 0 to 100, with a score above 50 indicating positive sentiment and a score below 50 indicating negative sentiment.

The index is based on a survey of NAHB members, who are asked to rate market conditions for the sale of new homes at the present time and in the next six months. The survey covers various aspects of the housing market, including buyer traffic, sales volume, and sales prices. The results are then compiled and released to the public, providing a snapshot of the overall sentiment in the housing market.

Significance for Real Estate Investors

The NAHB/Wells Fargo Housing Market Index is significant for real estate investors for several reasons:

| 1. Market Sentiment | The index reflects the sentiment of home builders, who are on the front lines of the housing market. It provides an indication of how confident builders are in the current and future market conditions. This sentiment can influence investor decisions, as positive sentiment may indicate a strong market with potential for growth, while negative sentiment may signal a slowdown or decline in the market. |

| 2. Market Trends | The index helps investors identify market trends and patterns. By tracking the index over time, investors can gain insights into the cyclical nature of the housing market and make more informed decisions about when to buy or sell properties. For example, if the index shows a consistent increase over several months, it may indicate a bullish market, while a decrease may suggest a bearish market. |

| 3. Investment Opportunities | The index can help investors identify potential investment opportunities. A high index score may indicate a strong demand for new homes, presenting opportunities for investors to purchase properties and sell them at a higher price. Conversely, a low index score may indicate a buyer’s market, allowing investors to negotiate better deals on properties. |

| 4. Risk Management | The index can also be used as a risk management tool. By monitoring the sentiment of home builders, investors can assess the level of risk associated with their investments. A positive sentiment may indicate lower risk, while a negative sentiment may signal higher risk. This information can help investors adjust their strategies and mitigate potential losses. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.