Moral Suasion: Definition, Usage, and Example

Moral suasion is a term used in the field of monetary policy to refer to the use of persuasion and moral influence by central banks or regulatory authorities to encourage or discourage certain behaviors in financial institutions or market participants. It is a non-binding approach that relies on the power of communication and trust to achieve desired outcomes.

Definition

Moral suasion can be defined as a soft tool used by central banks or regulatory authorities to influence the behavior of financial institutions or market participants without resorting to formal regulations or laws. It involves the use of persuasive language, public statements, and informal meetings to convey expectations and recommendations.

Usage

Moral suasion is typically employed by central banks or regulatory authorities when they want to address specific issues or risks in the financial system. It can be used to encourage banks to increase or decrease their lending activities, promote responsible lending practices, or discourage excessive risk-taking. By using moral suasion, authorities can influence the behavior of financial institutions without imposing strict regulations or penalties.

Central banks may also use moral suasion to communicate their monetary policy stance to the public and market participants. Through public statements and speeches, they can provide guidance on interest rates, inflation targets, or other policy measures, which can help shape market expectations and influence economic behavior.

Example

An example of moral suasion in action is when a central bank expresses concerns about rising household debt levels and encourages banks to tighten their lending standards. The central bank may issue public statements highlighting the risks associated with excessive borrowing and emphasize the importance of responsible lending practices. By doing so, the central bank aims to influence the behavior of banks and discourage them from extending loans to borrowers with high levels of debt or limited repayment capacity.

What is Moral Suasion?

Moral suasion is a term used in the field of economics and finance to describe a non-binding, persuasive approach used by central banks or regulatory authorities to influence the behavior of financial institutions and market participants. It is a tool employed to encourage or discourage certain actions or behaviors without resorting to formal regulations or legal measures.

Moral suasion relies on the power of persuasion and the reputation and credibility of the central bank or regulatory authority to influence the decisions and actions of financial institutions and market participants. It involves the use of informal communication channels, such as speeches, public statements, or private meetings, to convey the desired message and encourage compliance with certain policies or guidelines.

The effectiveness of moral suasion depends on the perceived authority and credibility of the central bank or regulatory authority. If the institution is seen as trustworthy and capable, market participants are more likely to respond to moral suasion and adjust their behavior accordingly. However, if the institution lacks credibility or is seen as weak, moral suasion may have limited impact.

Moral suasion can be used in various contexts within the field of economics and finance. For example, central banks may use moral suasion to encourage commercial banks to increase or decrease lending rates, promote responsible lending practices, or discourage excessive risk-taking. Regulatory authorities may also employ moral suasion to influence the behavior of market participants in areas such as consumer protection, market stability, or compliance with ethical standards.

It is important to note that moral suasion is not a legally binding tool and does not carry the force of law. It relies on voluntary compliance and the willingness of financial institutions and market participants to heed the advice or guidance provided by the central bank or regulatory authority.

Usage of Moral Suasion in Monetary Policy

Moral suasion is a non-binding approach used by central banks to influence the behavior of financial institutions and market participants. It involves the use of persuasion, advice, and guidance to encourage banks to adopt certain policies or practices that align with the objectives of monetary policy.

Central banks use moral suasion as a tool to communicate their expectations and intentions to the financial sector. By engaging in dialogue and providing guidance, central banks aim to influence the behavior of banks and other financial institutions without resorting to formal regulations or legal measures.

How does moral suasion work?

Moral suasion works by leveraging the close relationship between central banks and financial institutions. Central banks have a unique position of authority and influence in the financial system, and their guidance is often heeded by banks due to the potential consequences of non-compliance.

When a central bank wants to implement a certain monetary policy objective, such as controlling inflation or stabilizing the currency, it may use moral suasion to encourage banks to take specific actions. For example, the central bank may request that banks increase their lending to stimulate economic growth or reduce their exposure to risky assets to maintain financial stability.

Through regular meetings, public statements, and private communications, central banks convey their expectations and concerns to the banking sector. They may provide guidance on interest rates, reserve requirements, or lending practices, among other things. The aim is to shape the behavior of financial institutions in a way that supports the overall objectives of monetary policy.

Advantages and limitations of moral suasion

Moral suasion offers several advantages as a policy tool. Firstly, it is a flexible and adaptable approach that can be tailored to specific circumstances and objectives. Central banks can adjust their communication strategies and messages based on the evolving economic and financial conditions.

Secondly, moral suasion can be a cost-effective tool compared to formal regulations or legal measures. It does not require the allocation of resources for enforcement or monitoring, as compliance is voluntary. However, the effectiveness of moral suasion relies on the credibility and reputation of the central bank. If banks perceive the central bank as lacking credibility or if the guidance provided is not seen as credible, moral suasion may be less effective.

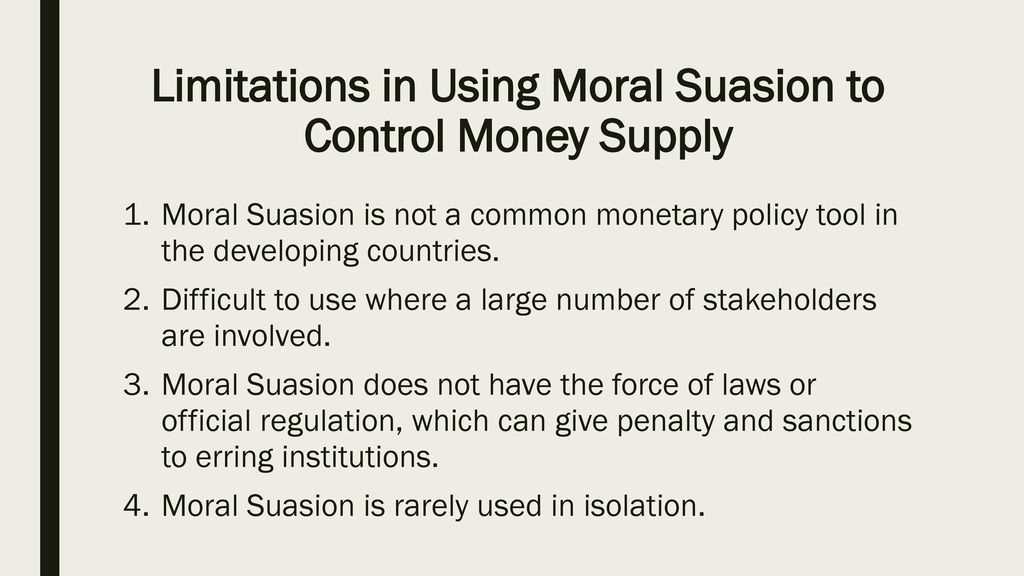

Furthermore, moral suasion has its limitations. It relies on the willingness of banks to cooperate and act in the best interest of the economy. If banks have conflicting objectives or face financial constraints, they may not fully comply with the guidance provided by the central bank. In such cases, the central bank may need to resort to other policy tools, such as regulatory measures or market operations.

Conclusion

Example of Moral Suasion in Action

Moral suasion is a tool used by central banks to influence the behavior of financial institutions and market participants without resorting to formal regulations or legal actions. It relies on the persuasive power and reputation of the central bank to encourage compliance with desired policies and practices.

During these interactions, the central bank may highlight the potential benefits of increased lending, such as job creation, business expansion, and increased consumer spending. They may also emphasize the potential risks of not complying with the request, such as negative impacts on economic stability or reputational damage for the banks themselves.

In response to moral suasion, commercial banks may choose to adjust their lending practices and increase the availability of credit to businesses and individuals. This can have a positive impact on economic activity, as increased lending can lead to higher investment, consumption, and overall economic growth.

However, it is important to note that moral suasion is not always effective. Financial institutions may have their own considerations and constraints that limit their ability or willingness to comply with the central bank’s requests. Additionally, moral suasion may be less effective during times of financial stress or when market conditions are unfavorable.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.