What is Merger Arbitrage?

Merger arbitrage is an investment strategy that involves profiting from the price discrepancies that occur during a merger or acquisition (M&A) process. It is a type of event-driven investing that aims to capture the spread between the current market price of a target company and the price that the acquiring company has agreed to pay.

When a merger or acquisition is announced, the stock price of the target company often does not immediately reach the agreed-upon acquisition price. This creates an opportunity for merger arbitrageurs to buy the target company’s stock at a lower price and profit from the price increase that occurs when the deal is completed.

How Does Merger Arbitrage Work?

Merger arbitrage involves several steps:

- Identifying Potential Merger Opportunities: Merger arbitrageurs actively search for companies that are involved in merger or acquisition deals. They analyze the terms of the deal, including the offer price, the expected completion date, and any regulatory or shareholder approval requirements.

- Evaluating the Deal: Once a potential merger opportunity is identified, merger arbitrageurs evaluate the likelihood of the deal being completed. They consider factors such as regulatory approvals, antitrust concerns, and potential competing bids. This evaluation helps them assess the risk and potential return of the investment.

- Managing the Investment: Throughout the merger process, merger arbitrageurs closely monitor the progress of the deal. They stay updated on any regulatory or legal developments that could impact the completion of the merger. If there are any changes or risks that arise, they may adjust their position or exit the investment.

- Profiting from the Spread: Once the merger is completed, the acquiring company typically pays the agreed-upon price for the target company’s shares. If the merger arbitrageur bought the shares at a lower price, they can sell them at the higher acquisition price, capturing the spread as profit.

Merger arbitrage can be a complex strategy that requires careful analysis and monitoring of multiple factors. It is typically employed by hedge funds and other sophisticated investors who have expertise in M&A transactions and the ability to assess and manage the associated risks.

Benefits of Merger Arbitrage

Merger arbitrage is a popular investment strategy that offers several benefits to investors. Here are some of the key advantages of engaging in merger arbitrage:

1. Potential for Profit

One of the primary benefits of merger arbitrage is the potential for profit. By investing in companies that are involved in merger and acquisition (M&A) deals, investors can take advantage of price discrepancies between the target company’s stock price and the offer price. If the deal goes through as expected, investors can earn a profit by buying the target company’s stock at a lower price and selling it at the higher offer price.

2. Lower Risk

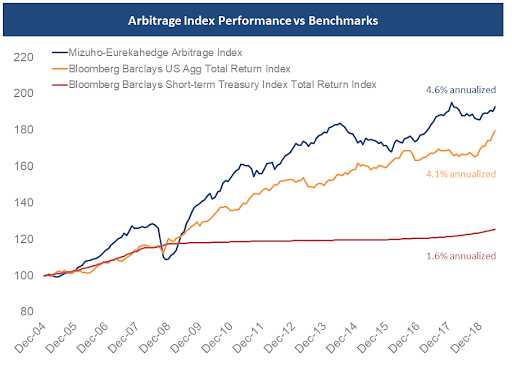

Merger arbitrage is often considered a lower-risk investment strategy compared to other forms of trading. This is because it focuses on exploiting price discrepancies rather than relying on market trends or stock performance. The strategy aims to generate returns regardless of the overall market conditions, making it a potentially attractive option for risk-averse investors.

3. Diversification

Engaging in merger arbitrage allows investors to diversify their portfolios. By investing in multiple M&A deals across different industries, investors can spread their risk and reduce the impact of any single deal falling through. This diversification can help protect against significant losses and provide a more stable investment strategy.

4. Defined Timeframe

5. Hedging Opportunities

Merger arbitrage can also provide hedging opportunities for investors. By taking positions in both the target company’s stock and the acquiring company’s stock, investors can offset potential losses. If the deal falls through, the decline in the target company’s stock price may be offset by an increase in the acquiring company’s stock price, reducing the overall impact on the investor’s portfolio.

How Merger Arbitrage Works

Merger arbitrage is an investment strategy that involves taking advantage of price discrepancies between the stock prices of companies involved in a merger or acquisition. The goal of merger arbitrage is to profit from the successful completion of the merger or acquisition, regardless of the overall movement of the stock market.

When a merger or acquisition is announced, the stock price of the target company often increases, while the stock price of the acquiring company may decrease. This creates an opportunity for merger arbitrageurs to buy the stock of the target company at a lower price and sell it at a higher price once the merger is completed.

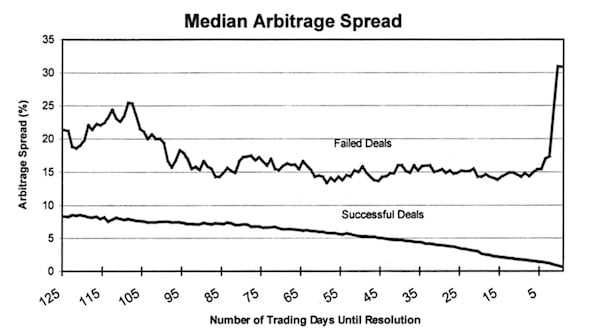

Merger arbitrageurs aim to capture the spread between the current stock price and the expected merger price. They carefully analyze the terms of the merger, including the exchange ratio, cash component, and any other conditions or contingencies. They also assess the likelihood of the merger being completed, taking into account regulatory approvals, shareholder votes, and other factors.

Once a merger is announced, merger arbitrageurs will typically buy the stock of the target company and short sell the stock of the acquiring company. This allows them to hedge their positions and minimize the impact of market movements on their overall returns.

However, merger arbitrage is not without risks. There is always a possibility that the merger will not be completed or will be delayed, which could result in losses for the arbitrageur. Additionally, market conditions and investor sentiment can impact the spread between the stock prices, affecting the potential profitability of the strategy.

Overall, merger arbitrage is a complex investment strategy that requires careful analysis, risk management, and monitoring of market conditions. It can be an effective way to generate returns in a relatively short period of time, but it is not suitable for all investors and should be approached with caution.

Managing Risk with Merger Arbitrage

Merger arbitrage is a strategy that involves profiting from the price discrepancies that occur during a merger or acquisition. While this strategy can be lucrative, it is not without risks. However, by carefully managing these risks, investors can increase their chances of success.

1. Thorough Due Diligence

2. Diversification

Another important risk management technique in merger arbitrage is diversification. By spreading investments across multiple merger deals, investors can reduce the impact of any single deal falling through. Diversification can be achieved by investing in a portfolio of merger arbitrage opportunities across different industries and sectors.

3. Hedging Strategies

Hedging strategies can also be employed to manage risk in merger arbitrage. This involves taking offsetting positions in related securities to protect against potential losses. For example, an investor may short sell the shares of the acquiring company while simultaneously buying shares of the target company. This can help mitigate the risk of the deal not going through or the stock prices moving unfavorably.

4. Monitoring and Adjusting Positions

Monitoring the progress of the merger and making necessary adjustments to positions is crucial in managing risk. Investors should stay updated on any developments or changes in the merger deal and adjust their positions accordingly. This may involve exiting a position if the deal is no longer favorable or increasing the position if new information suggests a higher probability of success.

5. Risk-Reward Analysis

Conducting a risk-reward analysis is essential in merger arbitrage. Investors should carefully assess the potential gains and losses of a merger arbitrage opportunity and compare them to the level of risk involved. This analysis can help investors make informed decisions and avoid taking on excessive risk.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.