Married Filing Separately Explained: How It Works and Its Benefits

Married filing separately is a tax filing status that allows married couples to file their tax returns separately rather than jointly. While most couples choose to file jointly, there are certain situations where filing separately can be beneficial.

When you file separately, each spouse is responsible for reporting their own income, deductions, and credits on their individual tax return. This can be advantageous if one spouse has a significantly higher income or if one spouse has significant deductions or credits that could lower their tax liability.

One of the main benefits of filing separately is that it can protect each spouse from being held responsible for the other spouse’s tax liabilities. When you file jointly, both spouses are jointly and severally liable for any taxes owed. This means that if one spouse fails to pay their share of the taxes, the other spouse can be held responsible for the full amount. By filing separately, each spouse is only responsible for their own tax liability.

Another benefit of filing separately is that it can help preserve certain tax benefits or deductions. For example, if one spouse has high medical expenses that exceed the threshold for deductibility, filing separately can allow that spouse to claim the deduction without being limited by the joint income threshold. Similarly, if one spouse has significant unreimbursed business expenses, filing separately can allow that spouse to claim the deduction without being subject to the 2% of adjusted gross income limitation.

What is Married Filing Separately?

Married filing separately is a tax filing status that allows married couples to report their income, deductions, and credits separately on their individual tax returns. This means that each spouse is responsible for reporting their own income and claiming their own deductions and credits. Unlike filing jointly, where both spouses combine their income and deductions, filing separately keeps each spouse’s financial information separate.

Why Choose Married Filing Separately?

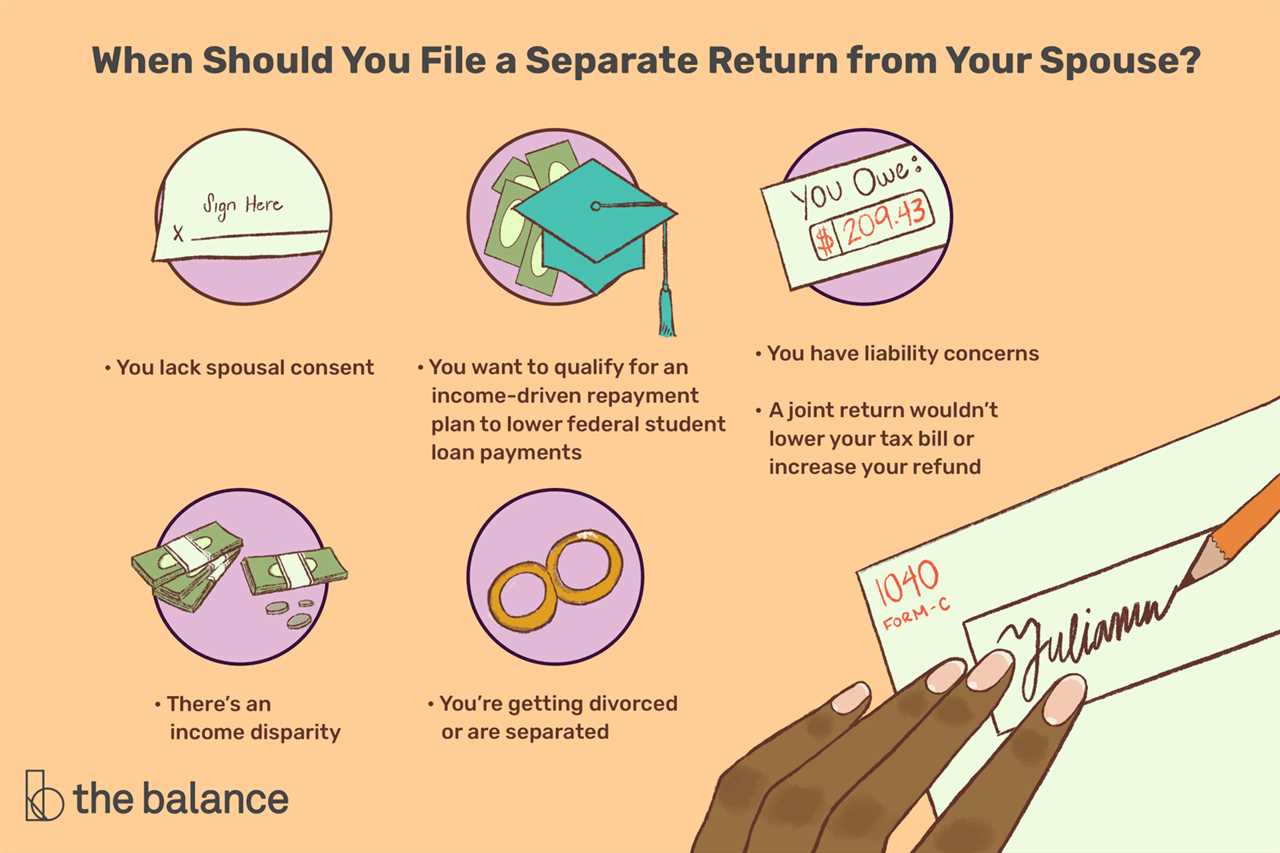

There are several reasons why a married couple may choose to file separately:

- Financial Independence: Filing separately allows each spouse to maintain financial independence. This can be beneficial if one spouse has significant debt or a high-risk profession.

- Protection from Liability: By filing separately, each spouse is only responsible for their own tax liability. This can be advantageous if one spouse has unpaid taxes or is involved in a business with potential legal issues.

- Itemized Deductions: If one spouse has significant itemized deductions, such as medical expenses or charitable contributions, filing separately may result in a higher deduction amount.

- Student Loan Repayment: Filing separately can be advantageous for couples with student loan debt. It allows each spouse to potentially qualify for income-driven repayment plans or loan forgiveness programs based on their individual income.

Considerations for Married Filing Separately

While there are benefits to filing separately, there are also some considerations to keep in mind:

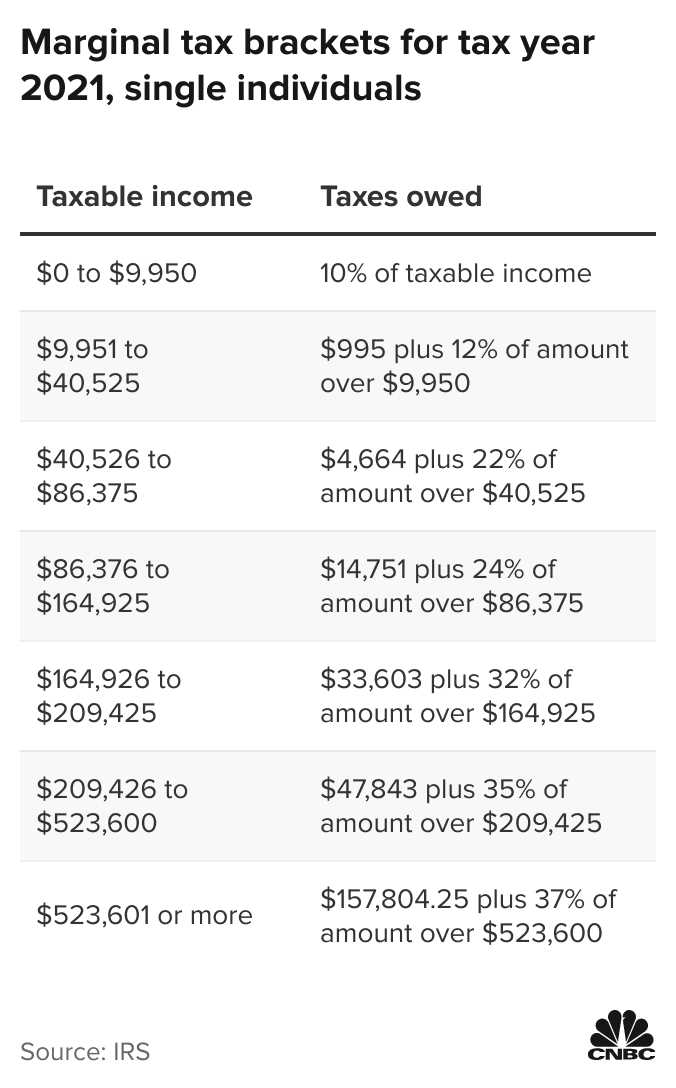

- Higher Tax Rates: The tax rates for married filing separately are often higher compared to filing jointly. This means that you may end up paying more in taxes by choosing this filing status.

- Coordination of Tax Planning: Filing separately requires coordination and communication between spouses to ensure that both are maximizing their tax benefits. It may also require additional time and effort to prepare separate tax returns.

Advantages of Married Filing Separately

1. Protection from each other’s tax liabilities:

One of the main advantages of filing separately is that it can protect each spouse from the other’s tax liabilities. When you file jointly, both spouses are jointly and severally liable for any taxes owed. This means that if one spouse has unpaid taxes or is audited, the other spouse is also responsible. By filing separately, each spouse is only responsible for their own tax liabilities.

2. Preserving individual deductions and credits:

Another advantage of filing separately is that it allows each spouse to preserve their individual deductions and credits. When you file jointly, you must combine your incomes, deductions, and credits, which can sometimes result in a higher tax liability. By filing separately, each spouse can claim their own deductions and credits, potentially reducing their overall tax burden.

3. Protection of personal financial information:

Filing separately can also provide protection for personal financial information. When you file jointly, both spouses have access to all the financial information on the tax return. This may not be an issue for most couples, but in situations where there is a lack of trust or concerns about privacy, filing separately can help keep personal financial information confidential.

4. Avoiding the marriage penalty:

The marriage penalty refers to the situation where a married couple pays more in taxes than they would if they were single. This can occur when both spouses have similar incomes, pushing them into a higher tax bracket. By filing separately, each spouse’s income is taxed at their individual tax rate, potentially avoiding the marriage penalty.

5. Flexibility in filing status:

Finally, filing separately provides couples with flexibility in their filing status. If one spouse has significant deductions or credits, filing separately may allow them to take full advantage of these benefits. Additionally, if one spouse has a high income and the other has a low income, filing separately can help reduce the overall tax liability.

Considerations for Married Couples

One of the main considerations is the potential loss of certain tax benefits. When couples file separately, they may not be eligible for certain deductions and credits that are available to those who file jointly. This includes deductions for education expenses, student loan interest, and the child and dependent care credit. Additionally, couples who file separately may have a higher tax rate, resulting in a larger tax liability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.