Market Timing: The Risks of Trying to Predict the Market

Market timing refers to the practice of trying to predict the future movements of the stock market in order to make investment decisions. It involves attempting to buy stocks or other securities when prices are low and sell them when prices are high. While it may seem like a strategy that can lead to significant profits, market timing is fraught with risks and challenges.

The Difficulty of Predicting the Market

One of the main reasons why market timing is difficult is because it requires accurately predicting the future movements of the market. The stock market is influenced by a wide range of factors, including economic indicators, geopolitical events, and investor sentiment. Trying to predict how all these factors will play out and impact stock prices is a challenging task.

Even professional investors and analysts with access to extensive research and data find it difficult to consistently predict market movements. The market is inherently unpredictable, and trying to time it can often lead to poor investment decisions.

The Risks of Market Timing

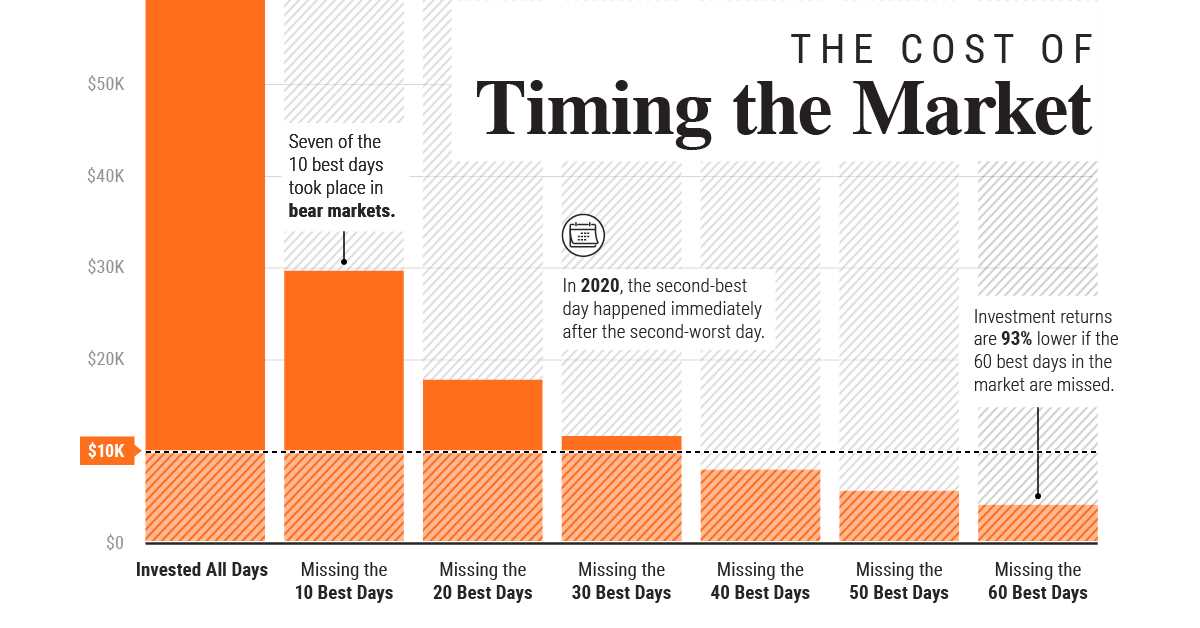

Market timing carries several risks that investors should be aware of. One of the main risks is the potential for missed opportunities. If an investor tries to time the market and waits for prices to drop before buying, they may miss out on potential gains if the market continues to rise. Similarly, if an investor tries to time the market and sells their investments when prices are high, they may miss out on further gains if the market continues to climb.

Another risk of market timing is the potential for increased transaction costs. Buying and selling securities frequently can result in higher brokerage fees and taxes, which can eat into investment returns. Additionally, frequent trading can lead to increased stress and emotional decision-making, which can negatively impact investment performance.

Furthermore, market timing requires making accurate predictions not only about the direction of the market but also about the timing of market movements. Even if an investor correctly predicts that the market will go up or down, they may still lose money if their timing is off. The market can be highly volatile and subject to sudden fluctuations, making it challenging to time entry and exit points accurately.

Alternative Strategies for Investors

Instead of trying to time the market, many financial experts recommend a long-term, buy-and-hold approach. This strategy involves investing in a diversified portfolio of stocks or mutual funds and holding onto them for the long term, regardless of short-term market fluctuations.

By taking a long-term approach, investors can benefit from the overall growth of the market over time and avoid the risks and challenges associated with market timing. This strategy also allows investors to take advantage of compounding returns, where their investment gains generate additional gains over time.

Another alternative strategy is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can help mitigate the risks of market timing by spreading out investments over time and potentially buying more shares when prices are low.

Market timing is a strategy used by investors to try and predict the future movements of the stock market or individual securities. It involves making buying and selling decisions based on anticipated changes in the market, with the goal of maximizing profits or minimizing losses.

The concept of market timing is based on the belief that it is possible to predict when the market will rise or fall, and to take advantage of these anticipated movements. Proponents of market timing argue that by carefully analyzing market trends, economic indicators, and other factors, investors can make informed decisions about when to buy or sell.

However, market timing is a highly debated and controversial strategy. Critics argue that it is extremely difficult, if not impossible, to consistently predict market movements. They point out that even professional investors and financial experts often fail to accurately time the market.

One of the main challenges of market timing is that it requires making accurate predictions not only about the direction of the market, but also about the timing of these movements. Even if an investor correctly predicts that the market will rise or fall, they may still lose money if they buy or sell too early or too late.

Another risk of market timing is that it can lead to emotional decision-making. Investors may become overly confident during periods of market growth and take on excessive risk, or they may panic during market downturns and sell their investments at a loss. These emotional reactions can result in poor investment performance.

Furthermore, market timing can be costly. Buying and selling securities frequently can result in transaction costs, such as brokerage fees and taxes, which can eat into investment returns. Additionally, market timing requires active management and constant monitoring of the market, which can be time-consuming and may not be suitable for all investors.

Despite these challenges and risks, some investors continue to practice market timing. They believe that by carefully studying market trends and using sophisticated analytical tools, they can gain an edge in the market. However, it is important for investors to be aware of the potential pitfalls and to consider alternative strategies, such as long-term investing or diversification, which can help mitigate the risks associated with market timing.

| Pros | Cons |

|---|---|

| – Potential for higher returns | – Difficult to consistently predict market movements |

| – Can take advantage of short-term market fluctuations | – Emotional decision-making |

| – May provide opportunities for active investors | – Transaction costs |

Why Market Timing is Difficult

Market timing refers to the practice of trying to predict the future movements of the stock market in order to make investment decisions. It involves buying or selling stocks based on the belief that the market is about to go up or down.

However, market timing is a notoriously difficult task. There are several reasons why it is challenging to accurately predict the market:

1. Unpredictable Factors:

The stock market is influenced by a wide range of factors, including economic indicators, geopolitical events, and investor sentiment. These factors are often unpredictable and can change rapidly, making it difficult to anticipate their impact on the market.

2. Information Asymmetry:

Market participants have access to different levels of information, and some may have access to information that is not publicly available. This information asymmetry can make it difficult for individual investors to accurately assess market trends and make informed decisions.

3. Emotional Bias:

Investors are often influenced by emotions such as fear and greed, which can cloud their judgment and lead to irrational investment decisions. Market timing requires a rational and disciplined approach, but emotions can interfere with this process.

4. Timing the Peaks and Valleys:

Timing the market not only requires accurately predicting when the market will go up or down, but also knowing when to buy and sell to maximize returns. This is a challenging task, as it requires both accurate market predictions and precise timing of trades.

5. Transaction Costs:

Market timing involves frequent buying and selling of stocks, which can result in high transaction costs. These costs can eat into investment returns and make it more difficult to achieve consistent profits through market timing.

Given these challenges, many financial experts recommend a long-term, buy-and-hold investment strategy rather than trying to time the market. This approach focuses on investing in a diversified portfolio and staying invested for the long term, allowing investors to benefit from the overall growth of the market over time.

The Potential Risks of Market Timing

Market timing, or the practice of trying to predict the future movements of the stock market, is a strategy that many investors attempt to use in order to maximize their returns. However, this approach comes with a number of potential risks that investors should be aware of.

One of the main risks of market timing is that it is extremely difficult to accurately predict the future movements of the market. Even experienced investors and financial professionals struggle to consistently time the market correctly. The stock market is influenced by a wide range of factors, including economic indicators, political events, and investor sentiment, making it highly unpredictable.

Another risk of market timing is that it can lead to missed opportunities. If an investor tries to time the market and sells their investments in anticipation of a market downturn, they may miss out on potential gains if the market continues to rise. Similarly, if an investor tries to time the market and holds onto their investments during a downturn, they may experience significant losses if the market continues to decline.

Market timing also requires investors to make frequent trades, which can result in higher transaction costs. Buying and selling stocks frequently can lead to increased brokerage fees and taxes, which can eat into an investor’s overall returns. Additionally, the constant monitoring and decision-making involved in market timing can be time-consuming and stressful for investors.

Furthermore, market timing can be influenced by emotions and biases, which can cloud an investor’s judgment. Investors may be tempted to make impulsive decisions based on fear or greed, rather than relying on sound investment principles. This can lead to poor investment choices and ultimately result in financial losses.

Instead of trying to time the market, investors may be better off adopting a long-term, buy-and-hold strategy. This approach involves investing in a diversified portfolio of assets and holding onto them for an extended period of time, regardless of short-term market fluctuations. By focusing on long-term goals and maintaining a disciplined investment strategy, investors can potentially achieve more consistent and sustainable returns.

Alternative Strategies for Investors

While market timing may seem like an attractive strategy for investors looking to maximize their returns, it is important to recognize the potential risks and difficulties associated with trying to predict the market. Instead of relying on market timing, investors can consider alternative strategies that can help them achieve their financial goals.

Diversification

One alternative strategy is diversification. By spreading investments across different asset classes, sectors, and geographic regions, investors can reduce their exposure to any single investment or market. Diversification can help to mitigate the impact of market fluctuations and reduce the risk of significant losses.

Long-Term Investing

Another alternative strategy is long-term investing. Instead of trying to time the market, investors can focus on the long-term growth potential of their investments. By adopting a buy-and-hold approach, investors can ride out short-term market volatility and potentially benefit from the compounding effect of long-term growth.

Long-term investing also allows investors to take advantage of dollar-cost averaging. This strategy involves investing a fixed amount of money at regular intervals, regardless of market conditions. By consistently investing over time, investors can potentially buy more shares when prices are low and fewer shares when prices are high, reducing the impact of market timing on their overall returns.

Asset Allocation

Asset allocation is another alternative strategy that can help investors manage risk and optimize their returns. By allocating investments across different asset classes, such as stocks, bonds, and cash, investors can create a diversified portfolio that aligns with their risk tolerance and financial goals.

Asset allocation involves periodically rebalancing the portfolio to maintain the desired allocation. This strategy ensures that investors are not overly exposed to any single asset class and can take advantage of potential opportunities in different market conditions.

Overall, while market timing may be tempting, it is important for investors to consider alternative strategies that can help them achieve their financial goals without relying on predicting the market. Diversification, long-term investing, and asset allocation are just a few examples of alternative strategies that can provide investors with a more stable and potentially rewarding investment approach.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.