What is a Market Order?

A market order is a type of order used in trading that instructs a broker to buy or sell a security at the current market price. It is the simplest and most common type of order used by investors.

When an investor places a market order, they are essentially saying, “I want to buy (or sell) this security right now, at whatever price it is currently trading at.” The order is executed immediately, and the investor will receive the best available price at the time the order is filled.

Market orders are typically used when an investor wants to enter or exit a position quickly and is less concerned with the specific price at which the trade is executed. They are often used for highly liquid securities, where there is a large volume of buyers and sellers, ensuring that the market order can be filled quickly.

Market orders are commonly used by individual investors, as well as institutional investors, such as mutual funds and pension funds. They are a quick and efficient way to enter or exit a position in the market.

In summary, a market order is a type of order used in trading that instructs a broker to buy or sell a security at the current market price. It is a simple and fast way to enter or exit a position, but the execution price may differ slightly from the quoted price due to market fluctuations.

Definition and Explanation

A market order is a type of order used in trading to buy or sell a security at the best available price in the market. When a market order is placed, it is executed immediately at the current market price, regardless of the price at which the security was trading when the order was placed. Market orders are commonly used when the speed of execution is more important than the price at which the trade is executed.

Market orders are executed based on the current bid and ask prices in the market. The bid price is the highest price at which buyers are willing to purchase the security, while the ask price is the lowest price at which sellers are willing to sell the security. When a market order to buy is placed, it is executed at the ask price, and when a market order to sell is placed, it is executed at the bid price.

Market orders are typically used when there is high liquidity in the market, meaning there are a large number of buyers and sellers actively trading the security. This ensures that the market order can be executed quickly and at a price close to the current market price. However, in situations where there is low liquidity or high volatility in the market, market orders may result in a higher execution price than expected.

It is important to note that market orders do not guarantee a specific execution price. The actual price at which the order is executed may vary from the current market price due to market fluctuations and the size of the order. Therefore, market orders are generally not recommended for large orders or in situations where price precision is important.

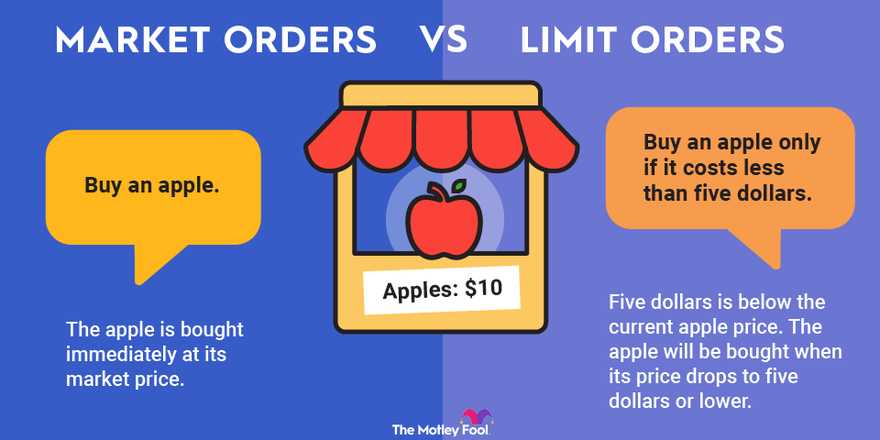

In contrast to market orders, limit orders allow traders to specify the maximum price they are willing to pay for a security when buying or the minimum price they are willing to accept when selling. Limit orders provide more control over the execution price but may not be executed immediately if the specified price is not available in the market.

In summary, a market order is a type of order used in trading to buy or sell a security at the best available price in the market. It is executed immediately at the current market price and is commonly used when speed of execution is more important than price precision. However, market orders do not guarantee a specific execution price and may result in a higher execution price than expected in certain market conditions.

Example of a Market Order

A market order is a type of order that is executed immediately at the current market price. It is used by traders who want to buy or sell a security as quickly as possible, without specifying a specific price. Market orders are commonly used when the speed of execution is more important than the price at which the trade is executed.

Let’s say you want to buy shares of a particular company, and the current market price is $50 per share. You decide to place a market order to buy 100 shares of the stock. Once you submit the market order, it will be executed immediately at the best available price in the market.

In summary, a market order is a type of order that is executed immediately at the current market price. It is used when speed of execution is more important than the price at which the trade is executed. Market orders are commonly used in highly liquid markets and are particularly useful when trading large quantities of securities.

How Market Orders Work in Practice

Market orders are commonly used by traders who want to enter or exit a position quickly and are less concerned about the specific price at which the trade is executed. These orders provide speed and certainty of execution, but they do not guarantee a specific price.

Advantages of Market Orders

One of the main advantages of market orders is their speed of execution. Since market orders are executed at the best available price, they are typically filled almost instantaneously. This can be beneficial in fast-moving markets where prices can change rapidly.

Another advantage of market orders is that they are more likely to be filled completely. Because market orders are executed at the current market price, there is usually enough liquidity in the market to fill the entire order. This is especially important for traders who need to enter or exit a position quickly.

Disadvantages of Market Orders

While market orders offer speed and certainty of execution, they also have some disadvantages. One of the main disadvantages is the lack of control over the execution price. Since market orders are executed at the best available price, there is a possibility of slippage, which is when the actual execution price differs from the expected price.

Another disadvantage of market orders is the potential for high transaction costs. In fast-moving markets with high volatility, the spread between the bid and ask prices can widen, resulting in higher transaction costs for market orders.

It is important for traders to consider these disadvantages and assess their risk tolerance before using market orders. For traders who require more control over the execution price, limit orders may be a better alternative.

Limit Order vs Market Order

A limit order is an order to buy or sell a security at a specific price or better. This means that the trader sets a specific price at which they are willing to buy or sell, and the order will only be executed if the market reaches that price or better. Limit orders provide traders with more control over the execution price, but there is no guarantee that the order will be filled.

On the other hand, a market order is an order to buy or sell a security at the current market price. This means that the trader is willing to buy or sell the security at whatever price it is currently trading at. Market orders are executed immediately and provide traders with certainty of execution, but the price at which the order is filled may not be the desired price.

There are advantages and disadvantages to both limit orders and market orders. Limit orders allow traders to specify the price at which they want to buy or sell, which can be useful in volatile markets where prices can change rapidly. However, there is a risk that the order may not be filled if the market does not reach the specified price.

Market orders, on the other hand, guarantee execution but do not guarantee a specific price. This can be advantageous in fast-moving markets where speed is more important than price. However, market orders can result in slippage, which is when the execution price is different from the expected price.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.