Marginal Tax Rate Calculation: Examples and Explanation

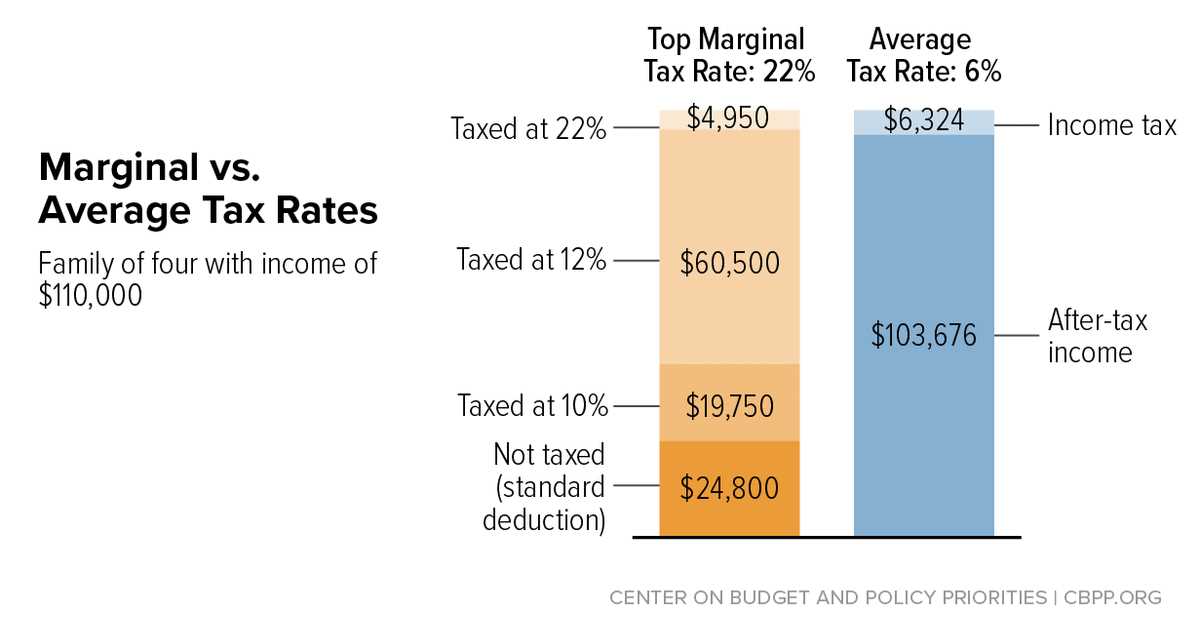

Your marginal tax rate is the percentage of tax that you pay on an additional dollar of income. It is important to note that your marginal tax rate is not the same as your overall tax rate, which is the average rate at which you pay taxes on all of your income.

To calculate your marginal tax rate, you need to know the tax brackets and rates that apply to your income. Tax brackets are ranges of income that are taxed at different rates. The tax rates increase as your income increases, resulting in a progressive tax system.

Let’s look at an example to illustrate how to calculate your marginal tax rate. Suppose you are a single individual and your income falls into the following tax brackets:

- 10% on the first $9,875 of income

- 12% on income between $9,876 and $40,125

- 22% on income between $40,126 and $85,525

- 24% on income between $85,526 and $163,300

If your income is $50,000, your marginal tax rate would be 22%. This means that for every additional dollar you earn above $40,125, you would pay 22 cents in taxes.

Calculating your marginal tax rate can help you make informed financial decisions. For example, if you are considering taking on additional work or a higher-paying job, knowing your marginal tax rate can help you determine how much of that extra income will go towards taxes.

What is a Marginal Tax Rate?

A marginal tax rate is the percentage of tax that is paid on an additional dollar of income. It is different from the average tax rate, which is the total tax paid divided by total income. Marginal tax rates are progressive, meaning that they increase as income increases.

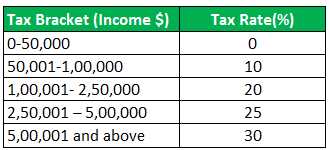

For example, let’s say there are three tax brackets: 10%, 20%, and 30%. If your income falls into the 10% tax bracket, you will pay 10% tax on the first portion of your income. As your income increases and falls into the 20% tax bracket, you will pay 20% tax on the additional income in that bracket. The same goes for the 30% tax bracket.

Calculating Marginal Tax Rates

To calculate your marginal tax rate, you need to know the tax brackets and their corresponding tax rates. You also need to know your taxable income, which is your total income minus any deductions or exemptions.

Here is a simplified example to illustrate how to calculate your marginal tax rate:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 10% | 10% | |

| 20% | 20% | |

| 30% | 30% | $20,001 and above |

Calculating Marginal Tax Rates: Examples

To calculate the marginal tax rate, you need to know the tax brackets and rates that apply to your income level. Tax brackets are specific ranges of income that are taxed at different rates. As your income increases, you may move into a higher tax bracket, resulting in a higher marginal tax rate.

Here are a few examples to illustrate how to calculate marginal tax rates:

Example 1:

Let’s say you have an annual income of $50,000 and the tax brackets for your income level are as follows:

- 10% on the first $9,875

- 12% on income between $9,876 and $40,125

- 22% on income between $40,126 and $85,525

- 24% on income between $85,526 and $163,300

Example 2:

Now let’s consider a scenario where your income increases to $100,000. The tax brackets for this income level are as follows:

- 10% on the first $9,875

- 12% on income between $9,876 and $40,125

- 22% on income between $40,126 and $85,525

- 24% on income between $85,526 and $163,300

- 32% on income between $163,301 and $207,350

Calculating marginal tax rates can be complex, especially when considering different income levels and tax brackets. It is important to consult with a tax professional or use online tax calculators to accurately determine your marginal tax rate.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.