Lost Decade in Japan: A Look at the History and Causes

The Lost Decade in Japan refers to a period of economic stagnation that lasted from the early 1990s to the early 2000s. During this time, Japan experienced a prolonged period of low economic growth, deflation, and financial instability. This article will provide an overview of the history and causes of the Lost Decade in Japan.

The Lost Decade in Japan can be traced back to the bursting of the Japanese asset price bubble in the late 1980s. During the 1980s, Japan experienced a period of rapid economic growth, fueled by a speculative bubble in real estate and stock prices. However, when the bubble burst in the early 1990s, it led to a sharp decline in asset prices and a collapse in consumer and business confidence.

Additionally, the Lost Decade in Japan was also characterized by a decline in consumer spending. As asset prices fell and unemployment rose, households became more cautious with their spending, leading to a decrease in domestic demand. This further exacerbated the economic downturn and prolonged the period of stagnation.

Overview of the Lost Decade in Japan

The Lost Decade in Japan refers to a period of economic stagnation and slow growth that occurred in the country from the late 1980s to the early 2000s. It was a time of significant economic and financial challenges, and its effects are still felt in Japan today.

Background

However, in the late 1980s, Japan’s economic bubble burst, leading to a severe economic downturn. The bursting of the bubble was primarily caused by excessive speculation and overinvestment in real estate and stocks. The prices of these assets had been artificially inflated, and when the bubble burst, their values plummeted, leading to significant financial losses for banks and investors.

Causes of the Lost Decade

Several factors contributed to the prolonged economic stagnation during the Lost Decade in Japan:

- Banking Crisis: The bursting of the economic bubble led to a banking crisis, as many banks faced insolvency due to their exposure to bad loans. The government had to intervene and provide financial support to prevent a collapse of the banking system.

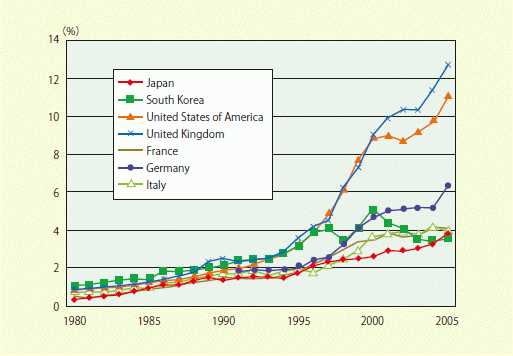

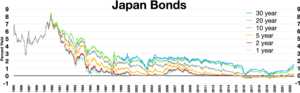

- Deflation: Japan experienced a prolonged period of deflation during the Lost Decade, where prices of goods and services continued to decline. Deflationary pressures made it difficult for businesses to increase their profits and for consumers to increase their spending, leading to a cycle of economic stagnation.

- Structural Issues: Japan faced several structural issues that hindered its economic recovery. These included an aging population, a rigid labor market, and a lack of innovation and entrepreneurship. These factors made it challenging for Japan to adapt and respond to changing global economic conditions.

- Government Policies: The Japanese government implemented various policies during the Lost Decade to stimulate the economy, such as low-interest rates and fiscal stimulus. However, these measures were not always effective in reviving economic growth and addressing the underlying structural issues.

Overall, the Lost Decade in Japan was a challenging period for the country’s economy. It highlighted the vulnerabilities and weaknesses in Japan’s economic system and led to significant changes in economic policies and reforms in the following years. While Japan has made progress in recovering from the Lost Decade, its effects continue to shape the country’s economic landscape.

Causes of the Lost Decade in Japan

The Lost Decade in Japan refers to a period of economic stagnation that lasted from the early 1990s to the early 2000s. During this time, Japan experienced a prolonged period of low economic growth, deflation, and financial instability. There were several key factors that contributed to the causes of the Lost Decade in Japan.

1. Asset Price Bubble

2. Banking Crisis

The bursting of the asset price bubble also triggered a banking crisis in Japan. Many banks had lent heavily to finance the speculative boom, and when asset prices collapsed, they were left with a large number of non-performing loans. The banking sector became burdened with bad debt, leading to a credit crunch and a decrease in lending. This further exacerbated the economic downturn and hindered the recovery process.

3. Structural Issues

4. Government Policy

The government’s response to the economic downturn also played a role in prolonging the Lost Decade. Initially, the government implemented expansionary fiscal and monetary policies to stimulate the economy. However, these measures were not effective in reversing the economic decline. Additionally, the government’s reluctance to address the banking crisis and implement necessary structural reforms further hindered the recovery process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.