Close Position Definition

In trading, the term “close position” refers to the action of exiting or liquidating a trade that an investor or trader has entered into. When a position is closed, it means that the investor is selling or buying back the financial instrument they previously bought or sold, effectively ending their exposure to that particular trade.

Closing a position is an essential part of trading as it allows traders to realize their profits or losses and manage their overall portfolio. It is a crucial decision-making process that requires careful analysis and consideration of various factors, including market conditions, risk tolerance, and investment goals.

When a trader opens a position, they are essentially taking a position in the market, either by buying (going long) or selling (going short) a financial instrument such as stocks, currencies, commodities, or derivatives. The trader’s objective is to profit from the price movement of the instrument.

However, market conditions can change rapidly, and the trader may decide to close their position to lock in their profits or limit their losses. Closing a position involves executing a reverse trade to the initial trade, effectively offsetting the position and exiting the market.

How Closing a Position Works in Trading

When a trader decides to close a position, they need to execute a trade in the opposite direction of their initial trade. For example, if they bought 100 shares of a stock, they would need to sell 100 shares to close the position.

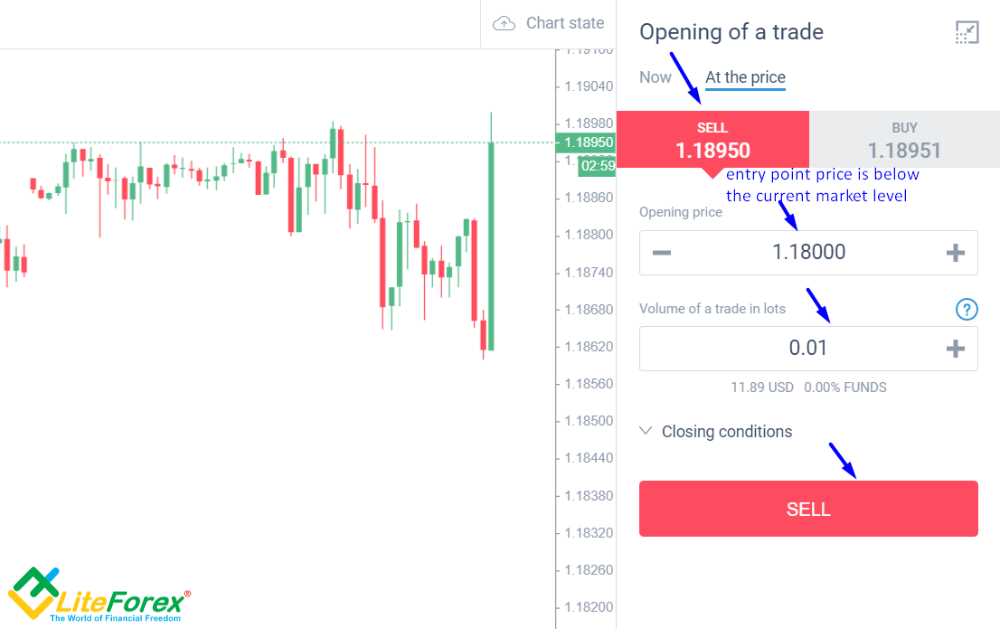

The process of closing a position can be done through various trading platforms and brokerage accounts. Traders can choose to close their positions manually by entering the trade details themselves or set up automated orders, such as stop-loss orders or take-profit orders, to automatically close the position when certain conditions are met.

It is important to note that closing a position does not necessarily mean that the trader is exiting the market entirely. They may choose to close a partial position, selling only a portion of their holdings while keeping the rest open to capture further potential gains.

Example of Closing a Position in Trading

Let’s say a trader buys 1,000 shares of XYZ Company at $50 per share, believing that the stock price will increase. After a few weeks, the stock price reaches $60 per share, and the trader decides to close their position to lock in their profits.

To close the position, the trader would sell 1,000 shares of XYZ Company at the current market price of $60 per share. By doing so, they would realize a profit of $10 per share, resulting in a total profit of $10,000 ($10 x 1,000 shares).

Importance of Closing Positions in Trading

Closing positions is a fundamental aspect of trading that allows traders to manage their risks and protect their capital. By closing positions, traders can lock in profits, limit losses, and free up capital to pursue other trading opportunities.

Additionally, closing positions helps traders maintain discipline and adhere to their trading strategies. It prevents them from holding onto losing positions for too long or becoming overly attached to winning positions, which can lead to emotional decision-making and irrational trading behavior.

When a trader opens a position, they are essentially entering into a contract to buy or sell a financial instrument at a specific price. This position remains open until the trader decides to close it. Closing a position can be done for various reasons, such as taking profits, cutting losses, or adjusting the trader’s overall portfolio.

One of the main reasons traders close their positions is to take profits. When a trader believes that the price of a financial instrument has reached a desirable level, they may choose to close their position and lock in their gains. This allows them to secure their profits and avoid any potential market reversals that could erode their gains.

On the other hand, closing a position can also be done to cut losses. If a trader realizes that their trade is not going as expected and is resulting in significant losses, they may decide to close the position to limit their losses. This is a risk management technique that helps traders protect their capital and avoid further financial damage.

Additionally, closing a position can be done to rebalance a trader’s overall portfolio. Traders often have multiple positions open simultaneously, and closing certain positions can help them adjust their exposure to different financial instruments or sectors. By closing positions strategically, traders can optimize their portfolio and align it with their trading strategy and market conditions.

It is important to note that closing a position does not necessarily mean the end of a trader’s involvement in a particular financial instrument. Traders can always open new positions in the future based on their analysis and market opportunities. Closing a position simply means exiting a specific trade at a given point in time.

How Closing a Position Works in Trading

In the world of trading, closing a position refers to the act of selling or buying back an existing position in a financial instrument. This action is taken by traders to realize their profits or cut their losses.

When a trader decides to close a position, they essentially reverse the initial transaction that opened the position. If the trader initially bought a financial instrument, they will sell it to close the position. Conversely, if the trader initially sold a financial instrument, they will buy it back to close the position.

The process of closing a position involves several steps. First, the trader must determine the appropriate time to close the position based on their trading strategy and market conditions. This decision can be influenced by factors such as profit targets, stop-loss orders, or technical indicators.

Once the trader decides to close the position, they will place an order with their broker or trading platform. The order specifies the quantity of the financial instrument to be bought or sold and the desired price. The order is then executed by the broker, and the position is closed.

Example of Closing a Position in Trading

Let’s consider an example to understand how closing a position works in trading:

Scenario:

John is a trader who bought 100 shares of XYZ Company at $50 per share. He believes that the stock price will increase in the near future, so he decides to hold onto his position.

After a few weeks, the stock price of XYZ Company rises to $60 per share. John decides to close his position and take his profits.

Closing the Position:

Therefore, John’s total profit from closing his position is $10 x 100 shares = $1000.

On the other hand, if the stock price had decreased to $40 per share, John might have decided to close his position to cut his losses.

Closing a position allows traders to lock in their profits or limit their losses. It is an essential aspect of trading that helps traders manage their risk and make informed decisions based on market conditions.

Importance of Closing Positions in Trading

Closing positions is a crucial aspect of trading that every trader should understand and prioritize. It refers to the act of selling or buying back an existing position in order to exit a trade and realize profits or limit losses. The importance of closing positions cannot be overstated, as it directly impacts a trader’s overall performance and success in the market.

One of the key reasons why closing positions is important is risk management. By closing a position, traders can effectively manage their risk exposure and protect their capital. This is especially important in volatile markets where prices can fluctuate rapidly. Closing a position allows traders to lock in profits or cut losses before the market turns against them.

Closing positions also enables traders to free up their capital for new opportunities. By closing a profitable position, traders can reinvest the proceeds into other potentially profitable trades. This helps to diversify their portfolio and maximize their potential returns. Additionally, closing losing positions allows traders to cut their losses and allocate their capital to more promising trades.

Another important aspect of closing positions is maintaining discipline and sticking to a trading plan. Successful traders understand the importance of having a predefined exit strategy for each trade. By closing positions according to their plan, traders can avoid emotional decision-making and stay focused on their long-term trading goals.

Furthermore, closing positions in a timely manner can help traders avoid overnight risks. Holding positions overnight exposes traders to various risks such as news events, economic data releases, and market gaps. By closing positions before the market closes, traders can minimize these risks and protect their capital.

Lastly, closing positions allows traders to evaluate their trading performance and make necessary adjustments. By reviewing closed trades, traders can analyze their strategies, identify strengths and weaknesses, and learn from their past mistakes. This self-reflection is crucial for continuous improvement and long-term success in trading.

| Key Takeaways: |

| 1. Closing positions is important for risk management and protecting capital. |

| 2. It allows traders to free up capital for new opportunities and diversify their portfolio. |

| 3. Closing positions helps maintain discipline and stick to a trading plan. |

| 4. It helps avoid overnight risks and minimize potential losses. |

| 5. Closing positions allows traders to evaluate their performance and make necessary adjustments. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.