What is Loan Lock?

Loan lock is a term commonly used in the mortgage industry to refer to the process of securing a specific interest rate for a mortgage loan. It is a way for borrowers to protect themselves from potential interest rate fluctuations that could occur between the time they apply for a loan and the time it closes.

When a borrower locks in a loan, the lender guarantees the interest rate for a specific period of time, typically until the loan closes. This means that even if interest rates rise during that time, the borrower’s rate will remain the same. Conversely, if interest rates decrease, the borrower will not benefit from the lower rates.

Why is Loan Lock Important?

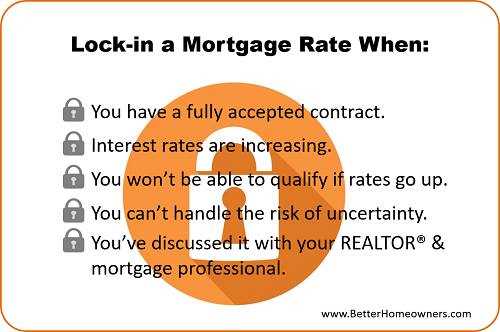

Loan lock is important because it provides borrowers with certainty and peace of mind. By locking in a specific interest rate, borrowers can accurately budget for their mortgage payments and avoid any surprises that may arise from fluctuating interest rates.

Additionally, loan lock can be particularly beneficial in a rising interest rate environment. If interest rates are expected to increase in the near future, borrowers can lock in a lower rate to secure more favorable terms for their loan.

How Does Loan Lock Work?

The loan lock process typically begins when a borrower submits a loan application to a lender. At that point, the borrower can choose to lock in the current interest rate or float the rate, allowing it to fluctuate until a later date.

If the borrower decides to lock in the rate, the lender will provide a written confirmation specifying the locked rate, the duration of the lock, and any associated fees. The borrower must then sign and return the confirmation to the lender to finalize the lock.

Benefits of Loan Lock

The primary benefit of loan lock is that it provides borrowers with peace of mind and financial stability. By locking in a specific interest rate, borrowers can accurately predict their monthly mortgage payments, allowing for better budgeting and planning. This is especially important in a volatile interest rate market.

Additionally, loan lock protects borrowers from potential rate increases. If interest rates rise after the lock is in place, the borrower will still benefit from the lower locked-in rate. This can result in significant savings over the life of the loan.

Process of Loan Lock

The process of loan lock typically involves the following steps:

- Initial Rate Quote: The borrower receives an initial interest rate quote from the lender.

- Rate Lock Agreement: Once the borrower decides to proceed with the loan, they enter into a rate lock agreement with the lender. This agreement specifies the locked-in interest rate, the duration of the lock, and any associated fees.

- Lock Confirmation: The lender provides a written confirmation of the rate lock, detailing the terms and conditions.

- Loan Processing: The loan application is processed, and all necessary documentation is collected.

- Loan Approval: The lender reviews the application and approves the loan, subject to underwriting conditions.

- Loan Closing: The loan closing takes place, and the borrower becomes the owner of the property.

Types of Loan Lock

There are two main types of loan lock:

- Traditional Rate Lock: This type of lock guarantees the interest rate for the entire lock period, regardless of any changes in market rates.

- Float Down: A float down lock allows the borrower to take advantage of a lower interest rate if market rates decrease during the lock period. This provides borrowers with flexibility and potential savings.

Factors to Consider

Before entering into a loan lock agreement, borrowers should consider the following factors:

- Lock Duration: The length of the lock period should align with the expected timeline for loan processing and closing.

- Lock Expiration: If the loan does not close within the lock period, the lock may expire, and the borrower may need to renegotiate the terms.

- Lock Fees: Some lenders charge fees for rate locks, so borrowers should be aware of any associated costs.

- Market Conditions: Borrowers should monitor market conditions and interest rate trends to make an informed decision about when to lock their rate.

How Does Loan Lock Work?

When a borrower decides to lock their loan, they are essentially entering into an agreement with the lender. The lender guarantees the borrower a specific interest rate, points, and other terms for the duration of the lock period.

During the lock period, the borrower is protected from any increase in interest rates. This means that even if market rates rise, the borrower’s rate will remain the same. On the other hand, if rates decrease, the borrower is usually not able to take advantage of the lower rates unless they have a float down option.

It is important for borrowers to carefully consider the lock period when deciding to lock their loan. If the lock period is too short, there is a risk of not being able to close the loan before the lock expires, which could result in a higher interest rate. On the other hand, if the lock period is too long, the borrower may miss out on lower rates if they decrease during that time.

Benefits of Loan Lock

Loan lock provides several benefits to borrowers:

- Rate Protection: By locking their loan, borrowers can protect themselves from potential increases in interest rates.

- Budgeting: Knowing the exact interest rate allows borrowers to accurately budget for their mortgage payments.

- Peace of Mind: Locking the loan provides peace of mind, as borrowers do not have to worry about rate fluctuations.

Considerations

While loan lock offers many advantages, borrowers should also consider the following factors:

- Float Down Option: Some lenders offer a float down option, which allows borrowers to take advantage of lower rates if they decrease during the lock period.

- Lock Extension: If the lock period expires and the loan has not closed, the borrower may have the option to extend the lock, but this could come with additional fees.

Exploring the Process and Benefits of Loan Lock

The process of obtaining a loan lock involves the borrower and lender agreeing on the terms of the lock, including the duration and the interest rate. Once the lock is in place, the borrower is protected from any fluctuations in interest rates during the lock period.

There are several benefits to securing a loan lock. First and foremost, it provides borrowers with peace of mind. By knowing exactly what their interest rate will be, borrowers can accurately budget and plan for their mortgage payments. This can be particularly important for those on a fixed income or with tight financial constraints.

Another benefit of a loan lock is protection against rising interest rates. If rates increase during the lock period, the borrower is not affected and will still pay the lower locked-in rate. This can result in significant savings over the life of the loan.

Additionally, a loan lock can provide borrowers with a sense of security during the loan application process. Knowing that their interest rate is locked in allows borrowers to focus on other aspects of the mortgage process, such as gathering necessary documentation and completing required paperwork.

However, it is important to note that there may be some drawbacks to obtaining a loan lock. For example, if interest rates decrease during the lock period, the borrower is still obligated to pay the higher locked-in rate. This means they may miss out on potential savings.

Furthermore, some lenders may charge a fee for locking in an interest rate. This fee can vary depending on the lender and the terms of the lock. Borrowers should carefully consider whether the potential benefits outweigh the cost of the lock.

Types of Loan Lock

- Standard Rate Lock: This is the most common type of loan lock. With a standard rate lock, the borrower locks in the interest rate and points at the time of application. This means that even if interest rates increase before closing, the borrower’s rate will remain the same.

- Float Down: A float down option allows the borrower to take advantage of a lower interest rate if rates decrease after the loan is locked. This option typically comes with a fee, but it can provide peace of mind to borrowers who are concerned about rates dropping.

- Extended Lock: An extended lock allows the borrower to lock in their rate for a longer period of time, usually beyond the standard 30-60 days. This can be beneficial for borrowers who anticipate a longer closing process or who want to secure a rate in a volatile market.

- Lock and Shop: With a lock and shop option, the borrower can lock in their rate while they shop for a home. This provides certainty in the interest rate while giving the borrower time to find the perfect property.

- Rate Lock Expiration: This type of loan lock has a specific expiration date. If the loan does not close before the expiration date, the borrower may need to pay an extension fee or risk losing the locked-in rate.

Comparing Rate Lock and Float Down

Rate Lock

A rate lock is an agreement between the borrower and the lender that guarantees a specific interest rate for a certain period of time. This means that even if interest rates rise during the lock period, the borrower’s rate will remain the same. Rate locks are typically available for 30, 45, 60, or 90 days, although longer lock periods may be available.

One of the main advantages of a rate lock is that it provides stability and peace of mind for borrowers. They can budget their monthly mortgage payments knowing that their interest rate will not change. However, if interest rates decrease during the lock period, borrowers will not be able to take advantage of the lower rates.

Float Down

A float down, on the other hand, allows borrowers to take advantage of lower interest rates if they become available before the loan closes. With a float down, borrowers have the option to lock in a lower rate if rates decrease during the lock period. This provides borrowers with flexibility and the opportunity to save money on their mortgage.

However, it is important to note that float downs often come with additional fees or costs. Lenders may charge a fee for the float down option, and borrowers may also need to pay for an updated appraisal or other documentation. These costs should be considered when deciding whether to choose a float down option.

Factors to Consider

When comparing rate lock and float down options, borrowers should consider several factors:

Market conditions: If interest rates are expected to rise, a rate lock may be a better option. However, if rates are expected to decrease, a float down may be more beneficial.

Costs: Borrowers should consider the additional fees and costs associated with a float down option. These costs can vary depending on the lender and the specific terms of the loan.

Timeline: Borrowers should also consider the timeline for their loan. If the loan is expected to close quickly, a rate lock may be the best choice to ensure a stable interest rate. However, if there is more time before the loan closes, a float down option may provide more flexibility.

Ultimately, the decision between a rate lock and a float down will depend on the borrower’s individual circumstances and preferences. It is important to carefully consider the options and consult with a mortgage professional to make the best decision for your specific situation.

Factors to Consider

1. Interest Rates

One of the most important factors to consider is the current interest rates. Borrowers should keep an eye on the market and analyze whether rates are expected to rise or fall in the near future. This will help determine whether it’s a good time to lock in a rate or wait for a potential decrease.

2. Loan Term

The term of the loan is another crucial factor to consider. Locking in a rate for a longer-term loan may provide more stability and protection against future rate increases. On the other hand, if the borrower plans to pay off the loan quickly, it may be more beneficial to opt for a shorter-term loan without a rate lock.

3. Flexibility

4. Lender Policies

Each lender may have different policies and fees associated with loan locks. It’s essential to understand these policies and fees before committing to a rate lock. Some lenders may offer a one-time float down option, which allows borrowers to lower their rate if rates decrease before closing. Others may charge additional fees for rate locks or have specific requirements for locking in a rate.

5. Financial Situation

Lastly, borrowers should evaluate their own financial situation and goals. Consider factors such as job stability, income, and future plans. If there is uncertainty about the ability to make mortgage payments in the future, a rate lock can provide peace of mind and stability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.