Liquidity Crisis: Short Term Cash Flow Problems Explained

What is a liquidity crisis?

A liquidity crisis occurs when a company does not have enough cash on hand to meet its immediate financial obligations. This can be due to a variety of factors, such as a sudden decrease in sales, unexpected expenses, or a decline in credit availability.

Why is it important to understand liquidity crisis?

Causes of liquidity crisis

There are several common causes of liquidity crisis that businesses should be aware of:

- Decline in sales: A sudden decrease in sales can significantly impact a company’s cash flow, especially if it relies heavily on revenue from a few key customers or markets.

- Unexpected expenses: Unforeseen costs, such as repairs, legal fees, or regulatory fines, can quickly deplete a company’s cash reserves.

- Credit availability: If a company relies on credit to fund its operations, a reduction in credit availability can lead to a liquidity crisis.

How to address a liquidity crisis?

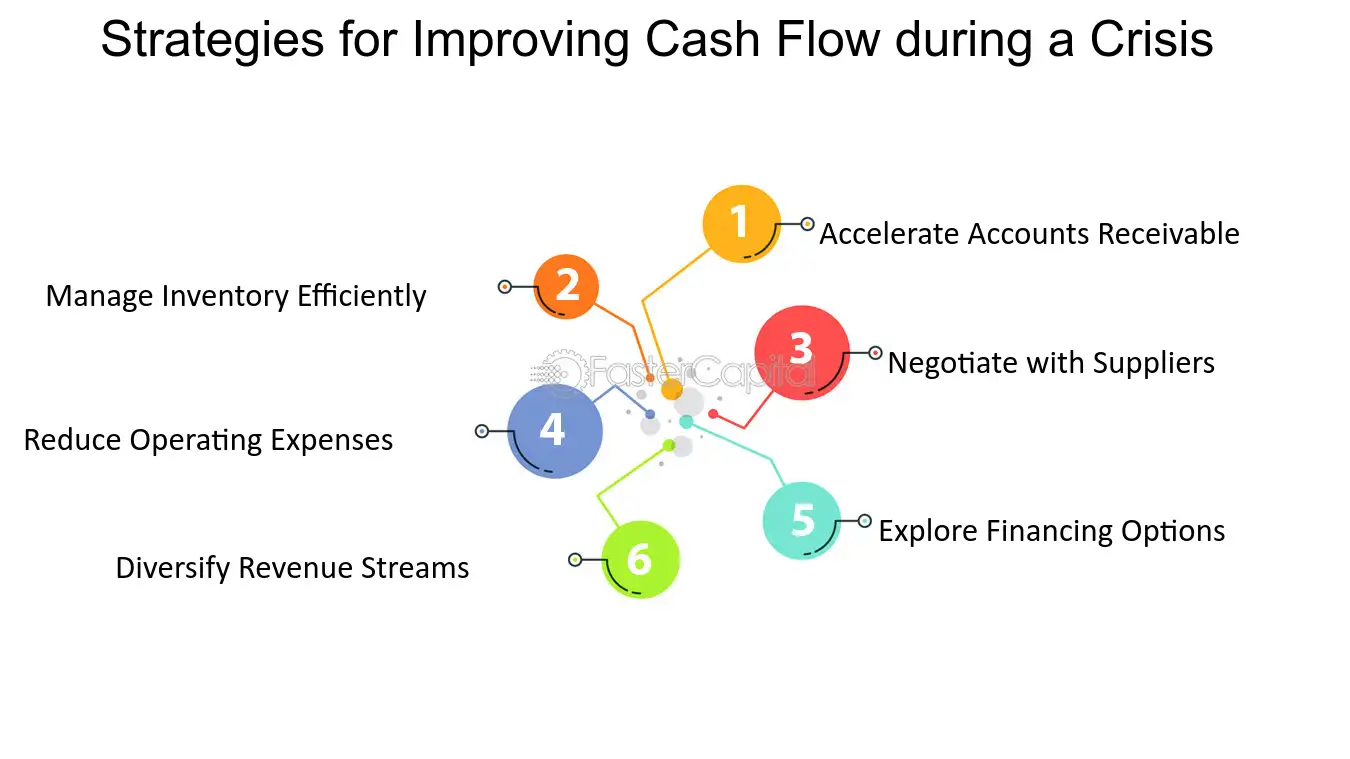

Addressing a liquidity crisis requires a proactive approach and careful financial management. Some strategies that businesses can employ include:

- Reducing expenses: Cutting costs can help free up cash and improve the company’s liquidity position.

- Improving cash flow: Implementing measures to accelerate cash inflows, such as offering discounts for early payment or tightening credit terms for customers.

- Seeking external financing: In some cases, businesses may need to explore options for obtaining additional funding, such as loans or lines of credit, to address their immediate cash flow needs.

A liquidity crisis occurs when a company or an individual experiences a shortage of cash or liquid assets to meet their short-term financial obligations. This can lead to severe financial distress and potentially bankruptcy if not managed properly.

Causes of Liquidity Crisis

There are several factors that can contribute to a liquidity crisis:

- Insufficient cash reserves: If a company does not have enough cash reserves to cover its short-term expenses, it can quickly run into a liquidity crisis. This can happen due to poor financial management or unexpected events such as a sudden decrease in sales.

- High levels of debt: Companies with high levels of debt may struggle to generate enough cash flow to meet their debt obligations. If they are unable to repay their loans or interest payments, it can lead to a liquidity crisis.

- Declining sales or revenue: A decrease in sales or revenue can significantly impact a company’s ability to generate cash flow. If the decline is sudden or unexpected, it can lead to a liquidity crisis.

- Unforeseen expenses: Unexpected expenses, such as legal fees or equipment repairs, can put a strain on a company’s cash flow. If these expenses are not accounted for in the budget, it can lead to a liquidity crisis.

Managing a Liquidity Crisis

When faced with a liquidity crisis, it is crucial to take immediate action to address the issue and prevent further financial damage. Here are some steps that can be taken:

- Assess the situation: Identify the root causes of the liquidity crisis and evaluate the severity of the situation. This will help determine the appropriate course of action.

- Reduce expenses: Cut unnecessary costs and expenses to free up cash flow. This may involve reducing staff, renegotiating contracts, or selling assets.

- Improve cash flow: Implement strategies to increase cash flow, such as offering discounts for early payment, negotiating better payment terms with suppliers, or diversifying revenue streams.

- Seek additional funding: Explore options for obtaining additional funding, such as securing a loan, seeking investment from shareholders, or applying for government assistance programs.

- Communicate with stakeholders: Keep stakeholders informed about the situation and the steps being taken to address the liquidity crisis. This includes employees, suppliers, lenders, and investors.

The Importance of Liquidity Management

Proper liquidity management is essential for any business or individual to maintain financial stability and avoid liquidity crises. It involves monitoring cash flow, maintaining adequate cash reserves, and implementing strategies to mitigate potential risks.

By effectively managing liquidity, companies and individuals can ensure they have enough cash on hand to meet their short-term obligations, withstand unexpected financial challenges, and seize opportunities for growth.

| Key Takeaways |

|---|

| A liquidity crisis occurs when there is a shortage of cash or liquid assets to meet short-term financial obligations. |

| Causes of a liquidity crisis can include insufficient cash reserves, high levels of debt, declining sales or revenue, and unforeseen expenses. |

| Managing a liquidity crisis involves assessing the situation, reducing expenses, improving cash flow, seeking additional funding, and communicating with stakeholders. |

| Proper liquidity management is crucial for maintaining financial stability and avoiding liquidity crises. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.