Liquidation Value Definition

Liquidation value is a financial term that refers to the estimated value of an asset or a company if it were to be sold or liquidated. It is an important concept in accounting and finance, as it helps determine the worth of an asset or a company in a worst-case scenario.

Importance of Liquidation Value

The liquidation value is particularly important for investors and creditors, as it provides an indication of the minimum value they can expect to receive in the event of liquidation. It helps them assess the risk associated with their investment or lending, and make informed decisions.

For example, if a company is facing financial distress and is unable to meet its obligations, the liquidation value can help creditors determine whether it is worth pursuing legal action to recover their funds or assets. Similarly, investors can use the liquidation value to assess the potential return on their investment in case of liquidation.

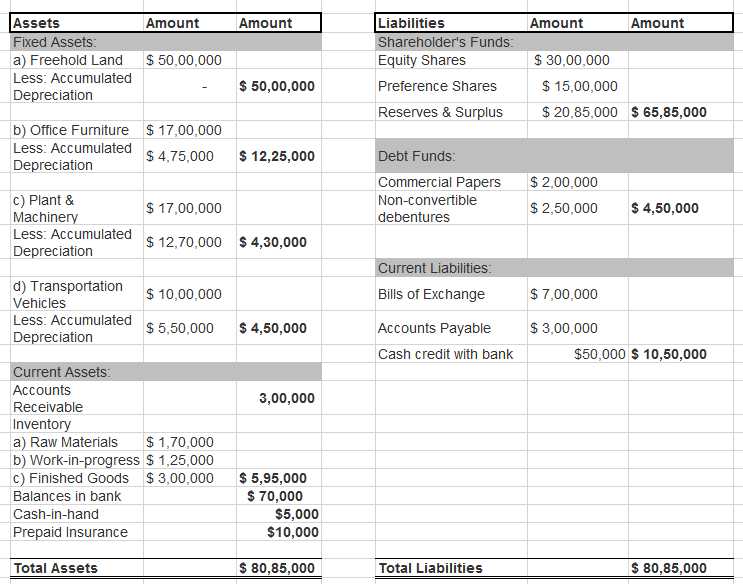

Calculation of Liquidation Value

Assets that are included in the calculation of liquidation value can vary depending on the type of asset or company. Generally, tangible assets such as property, inventory, and equipment are considered, while intangible assets such as patents or trademarks may be excluded.

Liabilities that are excluded from the calculation of liquidation value may include long-term debt, future lease payments, or other obligations that would not be relevant in a liquidation scenario.

What’s Excluded from Liquidation Value

When determining the liquidation value of an asset or a company, certain items are excluded from the calculation. These exclusions help to provide a more accurate representation of the value that could be realized in a forced sale or liquidation scenario.

1. Intangible Assets

Intangible assets, such as patents, trademarks, copyrights, and goodwill, are typically excluded from the liquidation value. This is because these assets do not have a physical presence and may not be easily sold or converted into cash in a short period of time. Additionally, the value of intangible assets can be subjective and difficult to determine.

2. Future Earnings Potential

3. Non-essential Assets

The exclusion of non-essential assets helps to provide a more realistic valuation of the assets or company in a forced sale situation, where the focus is on maximizing the value of the core business operations.

Example of Liquidation Value Calculation

| Assets | Value |

|---|---|

| Cash | $100,000 |

| Inventory | $200,000 |

| Land and Buildings | $500,000 |

| Equipment | $300,000 |

| Total Assets | $1,100,000 |

| Liabilities | Value |

|---|---|

| Accounts Payable | $150,000 |

| Loans Payable | $400,000 |

| Total Liabilities | $550,000 |

To calculate the liquidation value, we need to subtract the total liabilities from the total assets:

Liquidation Value = $550,000

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.