Leverage Ratio Explained

Importance of the Leverage Ratio

The leverage ratio is important for several reasons:

- Financial Stability: The leverage ratio is a measure of a company’s financial stability. A lower leverage ratio indicates that the company has a stronger financial position and is less reliant on debt financing. This provides reassurance to investors and lenders that the company is less likely to face financial distress.

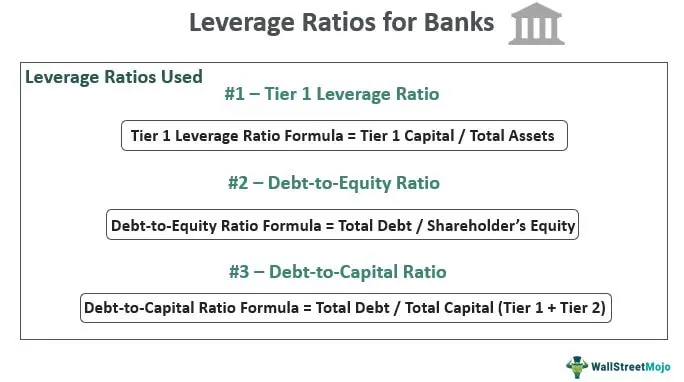

Calculation of the Leverage Ratio

The leverage ratio is calculated by dividing a company’s total debt by its total equity. The formula for the leverage ratio is as follows:

Leverage Ratio = Total Debt / Total Equity

The total debt includes both short-term and long-term debt, while the total equity represents the shareholders’ equity in the company. The resulting ratio indicates how much debt the company has for every unit of equity.

It is important to note that different industries may have different leverage ratio benchmarks, so it is essential to compare a company’s leverage ratio with its industry peers to get a more accurate assessment of its financial health.

One of the key reasons why leverage ratio is important is because it indicates the degree of financial leverage a company is using. A high leverage ratio suggests that a company has a significant amount of debt relative to its equity, which can increase the financial risk. On the other hand, a low leverage ratio indicates a lower level of debt and a more conservative financial structure.

Investors often use leverage ratio to assess a company’s ability to meet its financial obligations, such as interest payments and debt repayments. A high leverage ratio may indicate that a company is at a higher risk of defaulting on its debt, which can be a red flag for investors. On the contrary, a low leverage ratio can provide reassurance to investors that a company has a strong financial position and is less likely to face financial distress.

Creditors also consider leverage ratio when evaluating a company’s creditworthiness. A high leverage ratio may make it more difficult for a company to obtain additional financing or secure favorable lending terms. Creditors prefer companies with a lower leverage ratio as it indicates a lower risk of default, making them more likely to extend credit or offer better borrowing terms.

Furthermore, leverage ratio is an important metric for comparing companies within the same industry. It allows for a standardized assessment of financial risk and helps investors and analysts benchmark a company’s financial performance against its peers. By comparing leverage ratios, stakeholders can gain insights into a company’s relative financial strength and risk profile.

Calculation of Leverage Ratio

The leverage ratio is a financial metric that measures the level of debt a company has relative to its assets or equity. It is an important indicator of a company’s financial health and risk profile. Calculating the leverage ratio involves comparing a company’s total debt to its total assets or equity.

Step 1: Determine Total Debt

To calculate the leverage ratio, you first need to determine the total debt of the company. This includes both short-term and long-term debt obligations. Total debt can be found on the company’s balance sheet or financial statements.

Step 2: Determine Total Assets or Equity

The next step is to determine the total assets or equity of the company. Total assets include all the resources owned by the company, such as cash, inventory, property, and equipment. Total equity represents the ownership interest in the company and can be calculated by subtracting total liabilities from total assets.

Step 3: Calculate the Leverage Ratio

Once you have determined the total debt and total assets or equity, you can calculate the leverage ratio by dividing the total debt by the total assets or equity. The formula for the leverage ratio is as follows:

Leverage Ratio = Total Debt / Total Assets or Equity

For example, if a company has a total debt of $1 million and total assets of $5 million, the leverage ratio would be 0.2 or 20%. This means that for every dollar of assets, the company has 20 cents of debt.

Note: It is important to note that different industries may have different acceptable levels of leverage. A high leverage ratio may indicate a higher risk of financial distress, while a low leverage ratio may suggest a conservative financial position.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.