Kijun Line: A Key Indicator for Technical Analysis

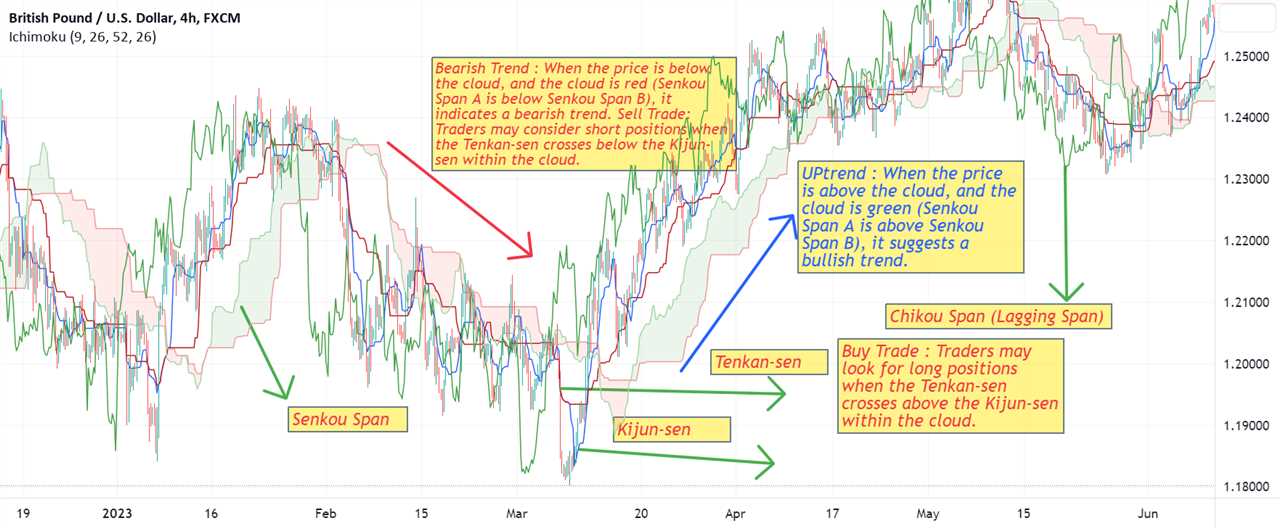

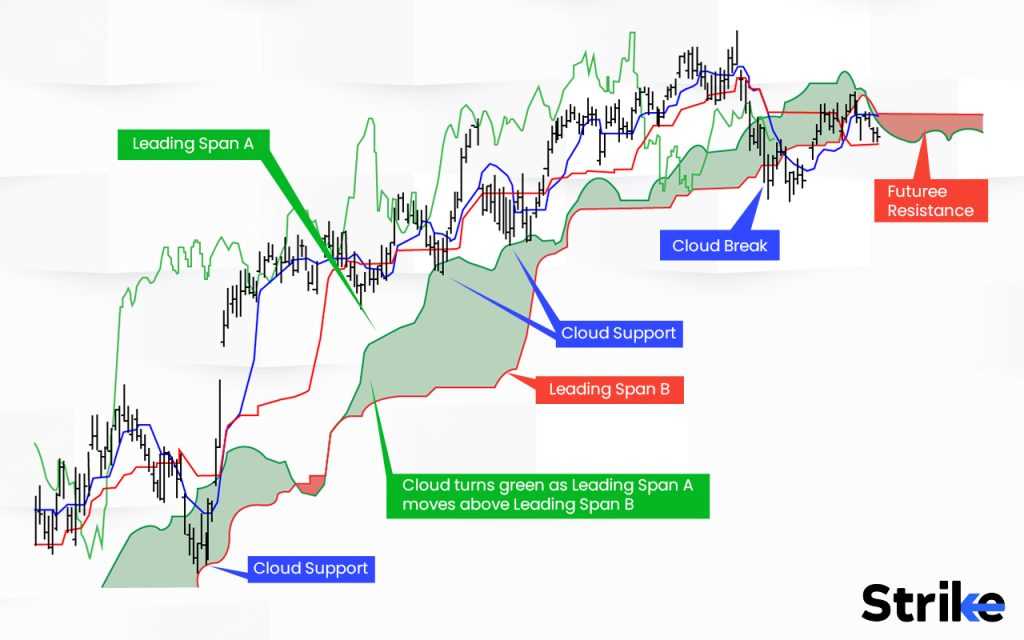

The Kijun Line is a key indicator used in technical analysis to assess market trends and make trading decisions. It is part of the Ichimoku Kinko Hyo system, a popular Japanese charting technique developed by Goichi Hosoda in the late 1930s.

The Kijun Line is used to identify potential support and resistance levels, as well as to determine the overall trend of the market. When the price is above the Kijun Line, it is considered bullish, indicating a potential uptrend. Conversely, when the price is below the Kijun Line, it is considered bearish, indicating a potential downtrend.

Base Line: Another Important Indicator

The relationship between the Kijun Line and the Base Line is crucial in determining market trends. When the Kijun Line is above the Base Line, it confirms a bullish trend, while when the Kijun Line is below the Base Line, it confirms a bearish trend.

Trading Strategies Using the Kijun Line

Traders use the Kijun Line in various ways to make trading decisions. One common strategy is to look for price crossovers with the Kijun Line. When the price crosses above the Kijun Line, it is seen as a bullish signal, suggesting a potential buying opportunity. Conversely, when the price crosses below the Kijun Line, it is seen as a bearish signal, suggesting a potential selling opportunity.

Another strategy is to use the Kijun Line as a trailing stop-loss level. Traders can set their stop-loss orders just below the Kijun Line to protect their profits in case the market reverses.

It is important to note that the Kijun Line should not be used in isolation but in conjunction with other technical indicators and analysis tools to confirm trading signals and improve accuracy.

Conclusion

The Kijun Line is calculated by taking the average of the highest high and the lowest low over a specific period, typically 26 periods. This average is then plotted on the chart, creating a line that represents the midpoint of the price action.

Traders and analysts use the Kijun Line to identify support and resistance levels, as well as to determine the overall trend of the market. When the price is above the Kijun Line, it is considered bullish, indicating a potential uptrend. Conversely, when the price is below the Kijun Line, it is considered bearish, suggesting a potential downtrend.

In addition to trend identification, the Kijun Line can also be used to generate trading signals. For example, when the price crosses above the Kijun Line, it may signal a buy opportunity, while a cross below the Kijun Line may suggest a sell opportunity.

It is important to note that the Kijun Line should not be used in isolation but rather in conjunction with other technical indicators and analysis techniques. It is most effective when used as part of a comprehensive trading strategy.

Base Line: Another Important Indicator

The Base Line is calculated by taking the average of the highest high and the lowest low over a specific period of time. It is typically calculated using a 26-period time frame, but this can be adjusted based on the trader’s preferences and the market being analyzed.

The Base Line is used to identify the overall trend of a market. When the price is above the Base Line, it is considered bullish, indicating an upward trend. Conversely, when the price is below the Base Line, it is considered bearish, indicating a downward trend.

In addition to identifying the trend, the Base Line can also be used as a support or resistance level. When the price approaches the Base Line from below, it may act as a support level, preventing further downward movement. Conversely, when the price approaches the Base Line from above, it may act as a resistance level, preventing further upward movement.

Traders can use the Base Line in conjunction with other indicators and chart patterns to make more informed trading decisions. For example, if the price is above the Base Line and there is a bullish chart pattern, such as a bullish engulfing pattern, it may be a signal to enter a long position. On the other hand, if the price is below the Base Line and there is a bearish chart pattern, such as a bearish engulfing pattern, it may be a signal to enter a short position.

It is important to note that the Base Line is not a standalone indicator and should be used in conjunction with other technical analysis tools. It is also important to consider other factors, such as market conditions and fundamental analysis, when making trading decisions.

Definition and Calculation of the Kijun Line

The Kijun Line is a key indicator used in technical analysis to identify potential support and resistance levels in the financial markets. It is a component of the Ichimoku Kinko Hyo, a popular Japanese charting technique.

What is the Kijun Line?

How is the Kijun Line Calculated?

To calculate the Kijun Line, follow these steps:

- Find the highest high and the lowest low over the past 26 periods.

- Add the highest high and the lowest low together.

- Divide the sum by 2.

The resulting value is the Kijun Line for the given period.

Interpreting the Kijun Line

The Kijun Line is often used as a support or resistance level. When the price is above the Kijun Line, it indicates a bullish trend, and the Kijun Line acts as a support level. Conversely, when the price is below the Kijun Line, it suggests a bearish trend, and the Kijun Line acts as a resistance level.

Traders also look for crossovers between the Kijun Line and other moving averages to identify potential trading opportunities. For example, a bullish crossover, where the price crosses above the Kijun Line, may signal a buy signal, while a bearish crossover, where the price crosses below the Kijun Line, may indicate a sell signal.

Conclusion

| Advantages | Disadvantages |

|---|---|

| – Helps identify support and resistance levels | – Can generate false signals in ranging markets |

| – Provides confirmation for trend reversals | – Lagging indicator, may not capture rapid price movements |

| – Can be used in conjunction with other indicators |

Trading Strategies Using the Kijun Line

One popular trading strategy using the Kijun Line is the “Kijun Cross” strategy. This strategy involves identifying when the price crosses above or below the Kijun Line, which can signal a potential trend reversal or continuation.

When the price crosses above the Kijun Line, it is considered a bullish signal, indicating that the market may be entering an uptrend. Traders can use this signal to enter long positions or add to existing ones, expecting the price to continue rising.

Conversely, when the price crosses below the Kijun Line, it is seen as a bearish signal, suggesting that the market may be entering a downtrend. Traders can use this signal to enter short positions or close out existing long positions, anticipating the price to decline further.

When the price approaches the Kijun Line and bounces off it, it can indicate a strong support or resistance level. Traders can use this bounce as a signal to enter or exit positions, depending on the direction of the bounce and other confirming indicators.

Technical Analysis Basic Education: Mastering the Kijun Line and Base Line

To master the Kijun Line and Base Line, it is important to understand their definitions and calculations. The Kijun Line is calculated by adding the highest high and the lowest low over a specific period of time and dividing it by two. The Base Line is calculated in the same way, but over a different period of time. These calculations can be easily performed using charting software or online trading platforms.

It is important to note that the Kijun Line and Base Line should not be used in isolation. They should be used in conjunction with other technical indicators and analysis tools to make informed trading decisions. Additionally, it is always recommended to practice proper risk management and to thoroughly backtest any trading strategies before applying them in live trading.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.