What is Key Rate Duration?

Key Rate Duration is a financial metric that measures the sensitivity of a bond’s price to changes in specific interest rates along the yield curve. It helps investors and analysts understand how the price of a bond will change in response to fluctuations in interest rates at different maturities.

Key Rate Duration is calculated by dividing the change in the bond’s price by the change in the specific interest rate. It is expressed as a percentage or a decimal value. A higher key rate duration indicates that the bond’s price is more sensitive to changes in the specific interest rate.

Key Rate Duration is an important tool for bond portfolio management as it allows investors to assess the risk associated with changes in interest rates. By analyzing the key rate duration of different bonds in a portfolio, investors can determine the overall interest rate risk and make informed decisions about their investments.

To calculate the key rate duration, a bond’s cash flows are discounted using different interest rates along the yield curve. The present value of the cash flows is then calculated for each interest rate. The key rate duration is the weighted average of the durations calculated for each interest rate.

Key Rate Duration is particularly useful in scenarios where interest rates are expected to change at different maturities. It helps investors identify which bonds in their portfolio are most sensitive to changes in specific interest rates and adjust their investment strategy accordingly.

Calculation of Key Rate Duration

Key Rate Duration is a measure used in finance to assess the sensitivity of a bond’s price to changes in interest rates at specific key points along the yield curve. It helps investors and analysts understand how a bond’s price will react to changes in interest rates at different maturities.

To calculate the Key Rate Duration, you need to follow these steps:

- First, determine the key points along the yield curve that you want to analyze. These key points are usually selected based on the maturity of the bond and the specific interest rate scenarios you want to evaluate.

- Next, calculate the present value of the bond’s cash flows at each key point along the yield curve. This involves discounting the future cash flows of the bond using the corresponding interest rates at each key point.

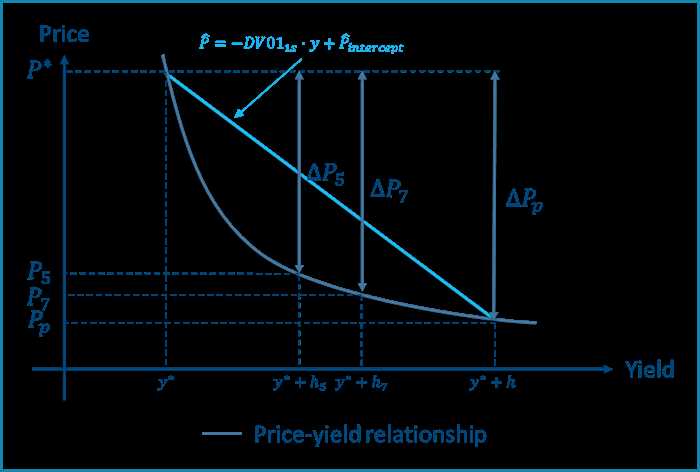

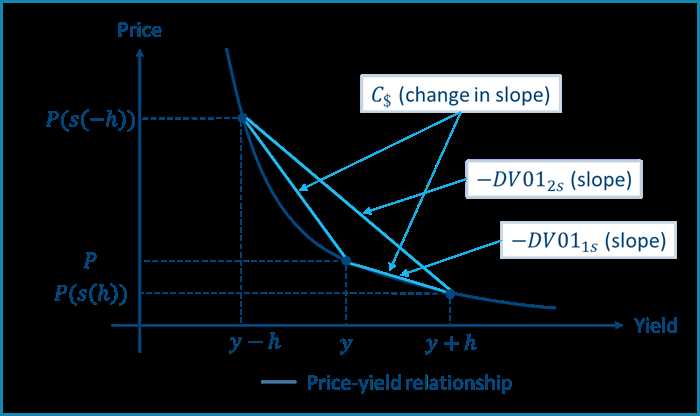

- After calculating the present value of the cash flows, determine the change in the bond’s price for each key point by calculating the difference between the present value of the cash flows at the current interest rate and the present value of the cash flows at a slightly higher interest rate.

- Finally, divide the change in the bond’s price for each key point by the change in the interest rate to calculate the Key Rate Duration for that specific key point. This will give you a measure of the bond’s sensitivity to changes in interest rates at that particular maturity.

Formula for Key Rate Duration

Key rate duration is a measure that quantifies the sensitivity of a bond’s price to changes in interest rates at specific key rate points along the yield curve. It helps investors understand how the price of a bond will change in response to changes in interest rates at different maturities.

The formula for calculating key rate duration is as follows:

Key Rate Duration = (ΔP / P) / ΔY

Where:

- ΔP is the change in the price of the bond

- P is the initial price of the bond

- ΔY is the change in the yield of the key rate point

To calculate the key rate duration, you need to determine the change in the price of the bond when there is a change in the yield of a specific key rate point. This can be done by calculating the present value of the bond’s cash flows using the new yield and comparing it to the present value of the cash flows using the initial yield.

The key rate duration can be calculated for multiple key rate points along the yield curve, allowing investors to assess the bond’s sensitivity to changes in interest rates at different maturities. By analyzing the key rate duration, investors can make more informed decisions about their bond investments and manage their interest rate risk effectively.

Importance of Key Rate Duration

One of the primary reasons why key rate duration is important is its ability to assess the interest rate risk associated with a bond or a bond portfolio. By calculating the key rate duration, investors can determine how the price of a bond will change in response to interest rate fluctuations at different points on the yield curve.

Key rate duration helps investors identify which maturities are most sensitive to interest rate changes. This information is crucial for making informed investment decisions and managing risk effectively. It allows investors to adjust their portfolio’s duration and allocation based on their risk tolerance and market expectations.

Additionally, key rate duration is an essential tool for bond portfolio managers. It allows them to assess the risk exposure of their portfolios and make informed decisions regarding asset allocation and duration management. By analyzing the key rate duration of individual bonds within a portfolio, managers can identify potential sources of risk and take appropriate measures to mitigate them.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.