Investment Multiplier: Definition, Example, Formula to Calculate

The investment multiplier is a concept in economics that measures the impact of an initial investment on the overall economy. It represents the additional economic activity generated by the initial investment, taking into account the multiplier effect.

The multiplier effect occurs when an initial injection of spending leads to increased consumption, which in turn leads to further rounds of spending and economic activity. This creates a ripple effect throughout the economy, resulting in a larger overall increase in economic output than the initial investment amount.

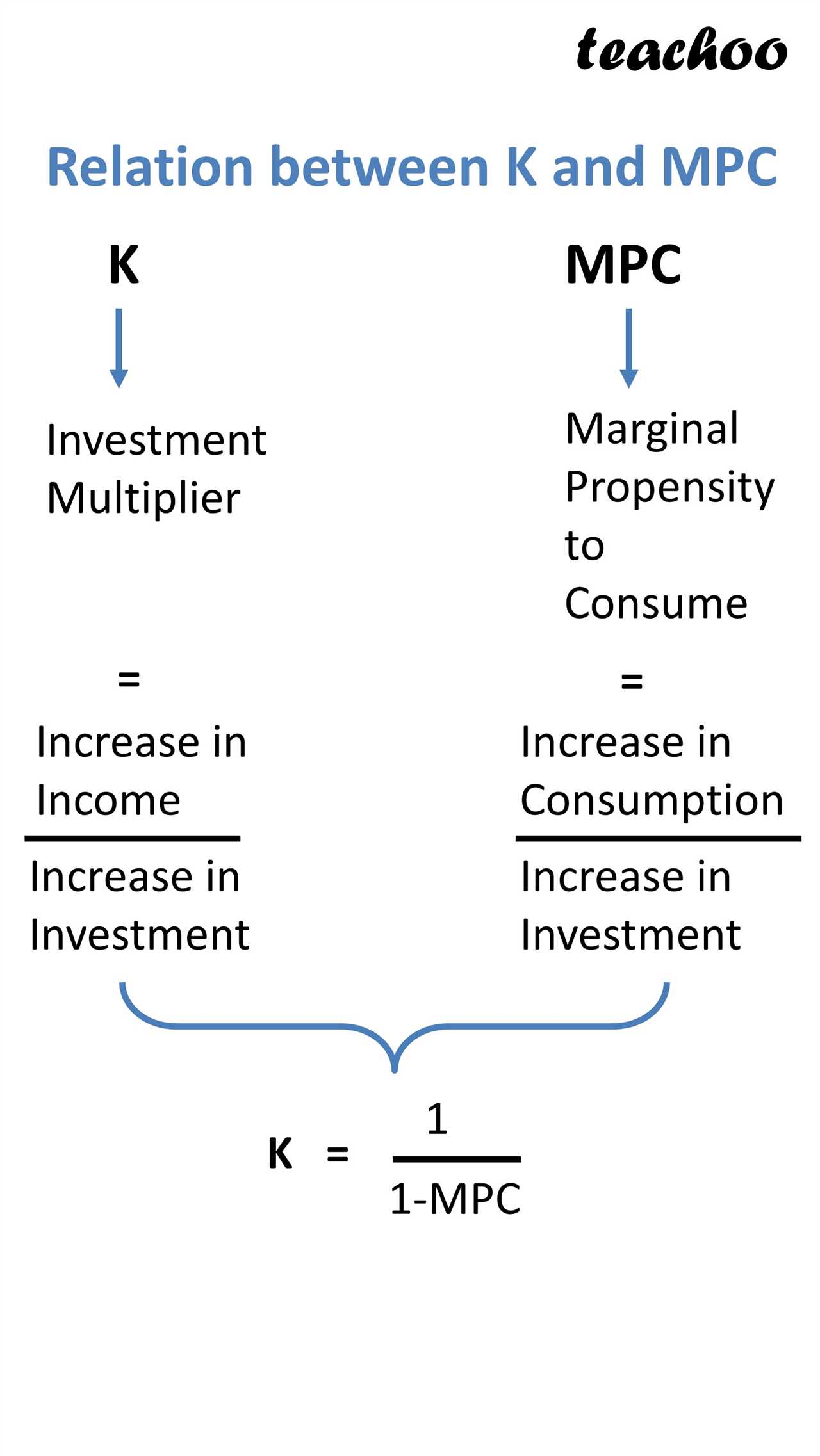

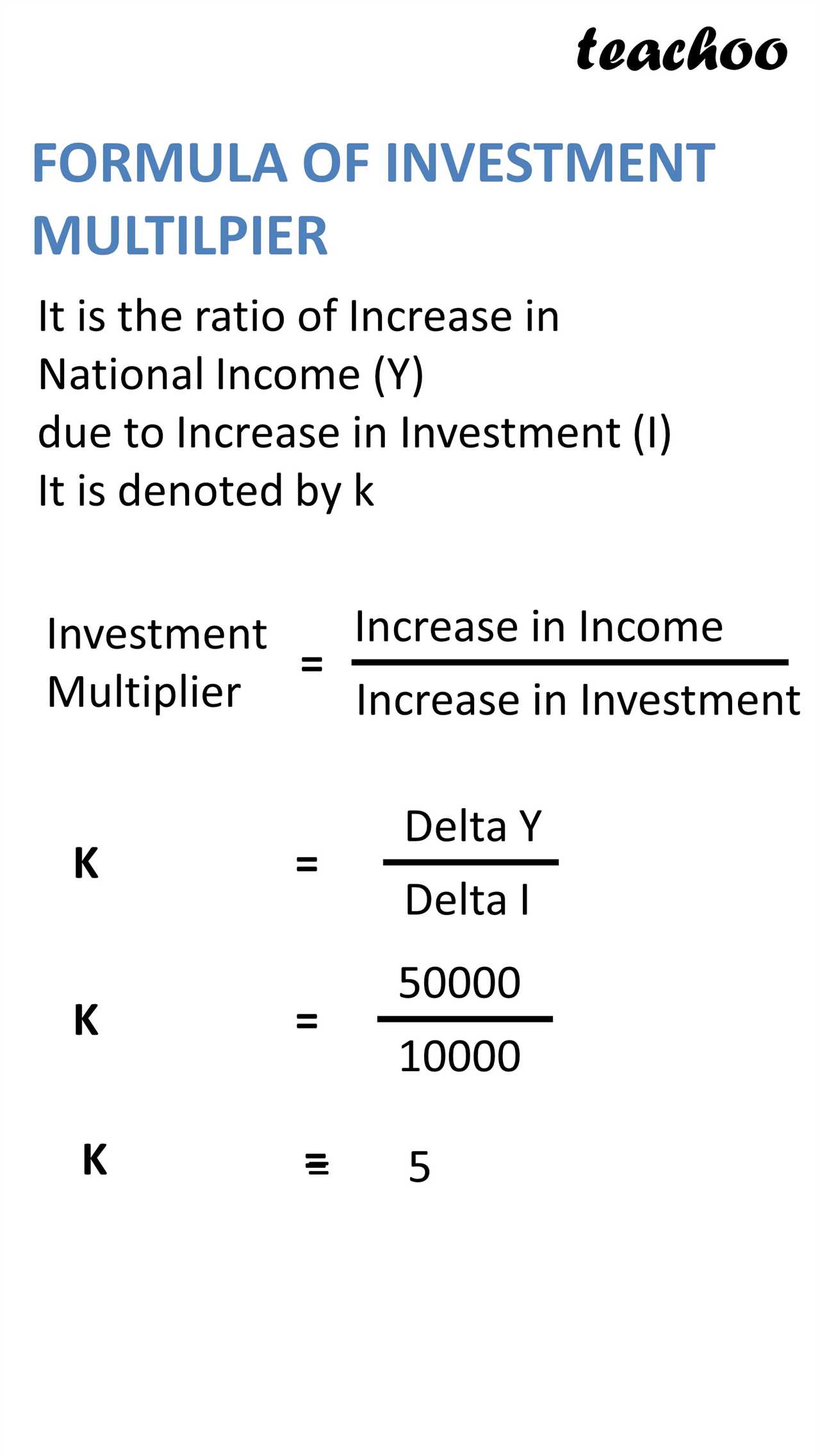

The formula to calculate the investment multiplier is:

The marginal propensity to consume (MPC) represents the proportion of additional income that individuals choose to spend rather than save. It is a key determinant of the investment multiplier, as a higher MPC leads to a larger multiplier effect.

This means that for every dollar of initial investment, the overall increase in economic output would be five dollars. The initial investment has a multiplier effect, resulting in a larger economic impact than the initial amount.

The investment multiplier is an important concept in macroeconomics, as it helps policymakers understand the potential impact of changes in investment on the overall economy. By considering the multiplier effect, policymakers can better assess the effectiveness of fiscal and monetary policies aimed at stimulating economic growth.

The investment multiplier is a concept in economics that measures the impact of an initial investment on the overall economy. It is based on the idea that when a firm or individual makes an investment, it creates a ripple effect that stimulates economic activity and leads to additional spending and investment.

How Does the Investment Multiplier Work?

The investment multiplier works by examining the relationship between an initial investment and the resulting increase in overall economic output. It is calculated by dividing the change in output by the initial investment. The formula for calculating the investment multiplier is as follows:

| Investment Multiplier Formula |

|---|

| Investment Multiplier = Change in Output / Initial Investment |

For example, let’s say a company invests $1 million in a new manufacturing facility. As a result of this investment, the company is able to produce an additional $2 million worth of goods and services. Using the investment multiplier formula, we can calculate the investment multiplier as follows:

| Change in Output | Initial Investment | Investment Multiplier |

|---|---|---|

| $2,000,000 | $1,000,000 | 2 |

Implications of the Investment Multiplier

The investment multiplier has important implications for economic policy and decision-making. It suggests that increasing investment can have a significant positive impact on economic growth and output. By stimulating investment, governments and policymakers can encourage economic activity and create a multiplier effect that leads to increased employment, income, and consumption.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.