Marginal Propensity to Consume (MPC) Formula and Its Significance in Economics

The Marginal Propensity to Consume (MPC) is a concept in economics that measures the change in consumption as a result of a change in income. It represents the proportion of additional income that individuals or households choose to spend on consumption rather than saving or investing.

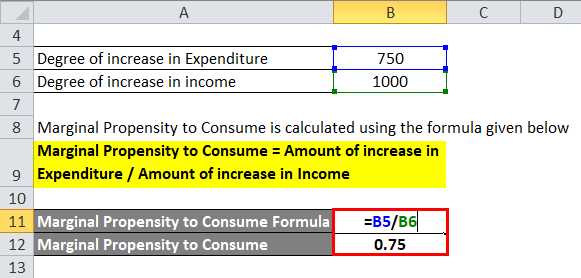

The MPC formula is calculated by dividing the change in consumption by the change in income. Mathematically, it can be expressed as:

| MPC = ΔC / ΔY |

|---|

Where:

- MPC is the Marginal Propensity to Consume

- ΔC is the change in consumption

- ΔY is the change in income

The MPC is an important concept in macroeconomics as it helps to understand the relationship between income and consumption. It indicates how much of an increase in income will be spent on consumption, which in turn affects the overall level of economic activity and aggregate demand.

A high MPC suggests that individuals or households are more likely to spend a larger proportion of their income on consumption, leading to a higher multiplier effect and stimulating economic growth. On the other hand, a low MPC indicates that individuals or households are more likely to save or invest a larger proportion of their income, which can dampen economic growth.

Factors influencing the MPC include income levels, interest rates, consumer confidence, and government policies. Higher income levels generally lead to a lower MPC as individuals tend to save or invest more of their additional income. Lower interest rates can encourage borrowing and spending, increasing the MPC. Consumer confidence plays a role in determining whether individuals are more inclined to spend or save. Government policies, such as tax cuts or stimulus programs, can also influence the MPC by providing individuals with more disposable income to spend.

The Marginal Propensity to Consume (MPC) is a fundamental concept in economics that measures the change in consumption resulting from a change in income. It represents the proportion of an additional dollar of income that is spent on consumption rather than saved.

Importance of MPC:

Calculation of MPC:

The MPC can be calculated by dividing the change in consumption by the change in income. Mathematically, it can be expressed as:

MPC = ΔC / ΔY

Where:

- MPC represents the Marginal Propensity to Consume

- ΔC represents the change in consumption

- ΔY represents the change in income

For example, if a household’s income increases by $100 and their consumption increases by $80, the MPC would be calculated as:

MPC = $80 / $100 = 0.8

This means that for every additional dollar of income, the household spends 80 cents on consumption.

Implications of MPC:

The MPC has several important implications for the economy:

- Multiplier Effect: The MPC is a key component of the multiplier effect, which refers to the magnification of changes in spending throughout the economy. A higher MPC leads to a larger multiplier effect, as more of the additional income is spent on consumption, leading to increased demand and economic growth.

- Savings and Investment: The MPC also affects savings and investment. A higher MPC means a lower propensity to save, which can lead to higher levels of consumption and lower levels of savings. This can have implications for investment and capital accumulation in the economy.

- Fiscal Policy: The MPC is used in fiscal policy analysis to understand the impact of changes in government spending or taxation on aggregate demand. By knowing the MPC, policymakers can estimate the impact of their policy decisions on consumption and overall economic activity.

The Importance of MPC in Macroeconomics

One of the key reasons why MPC is important is its influence on aggregate demand. As consumers spend a higher proportion of their income, it leads to an increase in aggregate demand, which in turn stimulates economic growth. This is especially significant during periods of economic downturn, as higher MPC can help to boost spending and stimulate the economy.

Moreover, the MPC also plays a role in determining the effectiveness of monetary policy. Central banks use monetary policy tools, such as interest rate adjustments, to influence consumer spending and investment. A higher MPC implies that changes in interest rates are more likely to have an impact on consumer spending, as consumers are more responsive to changes in their disposable income.

Overall, the Marginal Propensity to Consume (MPC) is a key concept in macroeconomics that helps to understand the behavior of consumers and its impact on the overall economy. It influences aggregate demand, fiscal policy, and monetary policy, making it an important factor in economic analysis and decision-making.

Factors Influencing MPC and Its Implications

The Marginal Propensity to Consume (MPC) is a crucial concept in macroeconomics that measures the change in consumer spending resulting from a change in income. It represents the proportion of additional income that individuals choose to spend on goods and services rather than saving.

1. Disposable Income: The level of disposable income plays a significant role in determining the MPC. As disposable income increases, individuals tend to have more money available for consumption, leading to a higher MPC. Conversely, a decrease in disposable income may result in a lower MPC.

2. Interest Rates: Interest rates also impact the MPC. When interest rates are low, individuals are more likely to borrow money to finance consumption, resulting in a higher MPC. On the other hand, high interest rates may discourage borrowing and lead to a lower MPC.

3. Consumer Confidence: Consumer confidence, which reflects individuals’ expectations about the future state of the economy, can influence the MPC. When consumers are optimistic about the economy, they are more likely to increase their spending, resulting in a higher MPC. Conversely, during periods of economic uncertainty, consumers may choose to save more, leading to a lower MPC.

4. Wealth and Assets: The level of wealth and assets individuals possess can also affect the MPC. When individuals have a higher level of wealth, they may feel more comfortable spending a larger proportion of their income, resulting in a higher MPC. Conversely, individuals with lower levels of wealth may choose to save a larger proportion of their income, leading to a lower MPC.

5. Government Policies: Government policies, such as tax cuts or stimulus packages, can have a significant impact on the MPC. For example, a tax cut that puts more money in consumers’ pockets can lead to an increase in the MPC as individuals have more disposable income to spend.

The implications of the MPC are far-reaching. A higher MPC indicates that changes in income will have a more significant impact on consumer spending, which can stimulate economic growth. It suggests that policies aimed at increasing disposable income or consumer confidence can be effective in boosting aggregate demand and overall economic activity.

On the other hand, a lower MPC implies that changes in income will have a relatively smaller effect on consumer spending. In such cases, policymakers may need to explore other avenues, such as investment or government spending, to stimulate economic growth.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.