Definition and Eligibility

An in-service withdrawal refers to the ability to withdraw funds from a retirement plan while still actively employed. This option allows individuals to access their retirement savings before reaching the age of retirement, which is typically 59 ½ years old. In order to be eligible for an in-service withdrawal, certain criteria must be met.

Firstly, the retirement plan must offer an in-service withdrawal option. Not all plans provide this feature, so it is important to check with your plan administrator or human resources department to determine if this option is available to you.

Secondly, there may be specific eligibility requirements set by the retirement plan. These requirements can vary depending on the plan and may include factors such as years of service, age, or employment status. It is crucial to review the plan documents or consult with the plan administrator to understand the eligibility criteria for an in-service withdrawal.

Additionally, it is important to note that even if you meet the eligibility requirements, there may still be restrictions on the amount of funds that can be withdrawn. Some plans may limit the percentage or dollar amount that can be withdrawn, while others may allow for full withdrawal.

Furthermore, it is essential to consider the potential impact on your retirement savings. Withdrawing funds early can reduce the amount of money available for your retirement years. It is important to carefully evaluate your financial situation and future retirement needs before making a decision to withdraw funds in-service.

Rules and Regulations

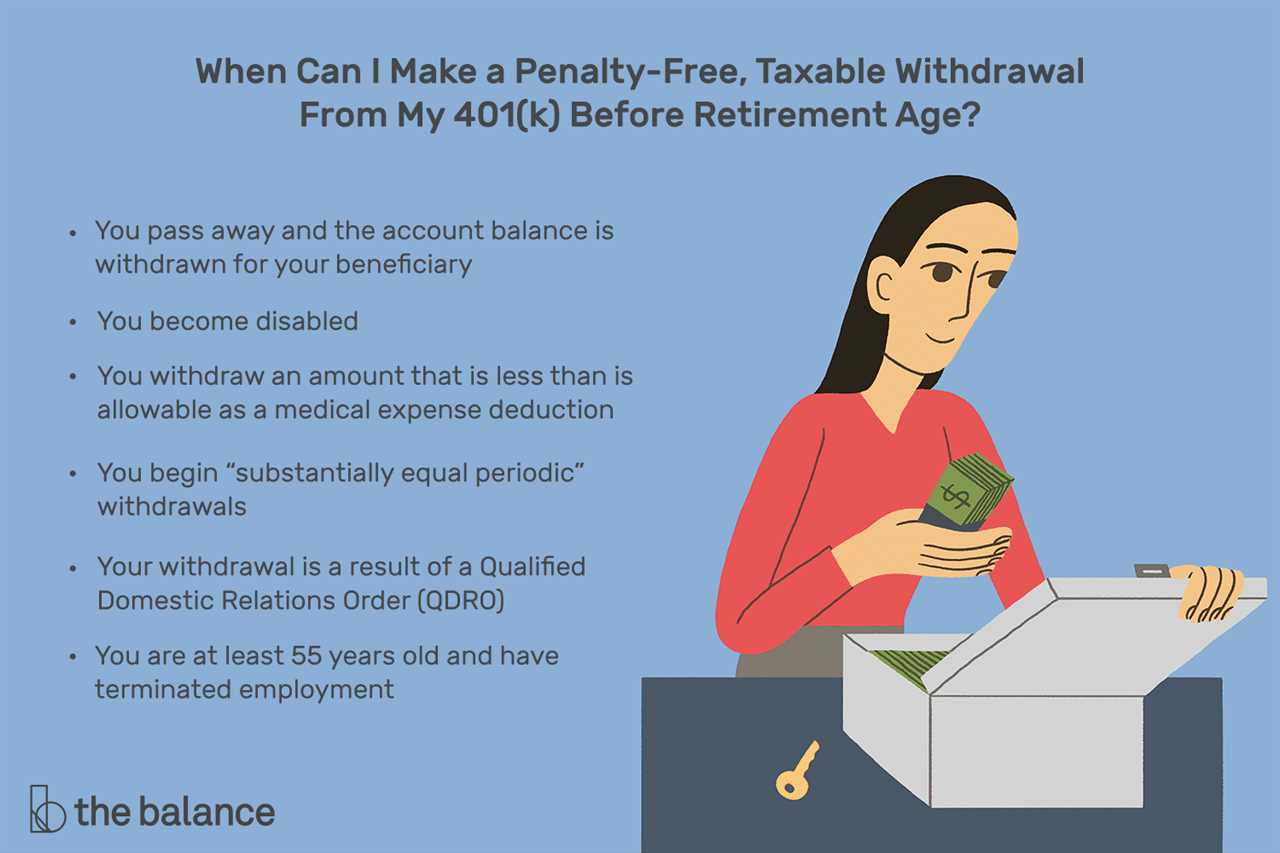

Secondly, there are restrictions on when you can make an in-service withdrawal. In most cases, you must meet certain age or service requirements to be eligible for an in-service withdrawal. For example, you may need to be at least 59 ½ years old or have completed a certain number of years of service with your employer.

Additionally, there may be limitations on what you can do with the funds from an in-service withdrawal. Some retirement plans only allow for a lump sum distribution, meaning you must take the entire amount out at once. Other plans may offer the option to take partial distributions or roll the funds over into another retirement account.

| Withdrawal Type | Tax Implications |

|---|---|

| Lump Sum Distribution | Subject to income tax and potential early withdrawal penalty |

| Partial Distribution | Subject to income tax on the amount withdrawn |

| Rollover | No immediate tax implications if funds are rolled over into another retirement account |

Taxes and Penalties

| Tax Treatment | Description |

|---|---|

| Taxable | If you withdraw funds from your retirement account through an in-service withdrawal, the amount you withdraw will be subject to income tax. This means that you will need to report the withdrawal as taxable income on your annual tax return. |

| Penalties | In addition to income tax, there may also be penalties associated with in-service withdrawals. If you withdraw funds before reaching the age of 59½, you may be subject to an early withdrawal penalty of 10% of the amount withdrawn. However, there are some exceptions to this rule, such as if you become disabled or if you use the funds for certain qualified expenses. |

| Withholding | When you request an in-service withdrawal, you may have the option to have taxes withheld from the distribution. This can help you avoid a large tax bill when you file your annual return. Be sure to carefully consider your withholding options and consult with a tax professional if needed. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.