The Basics of Fixed Income Investments

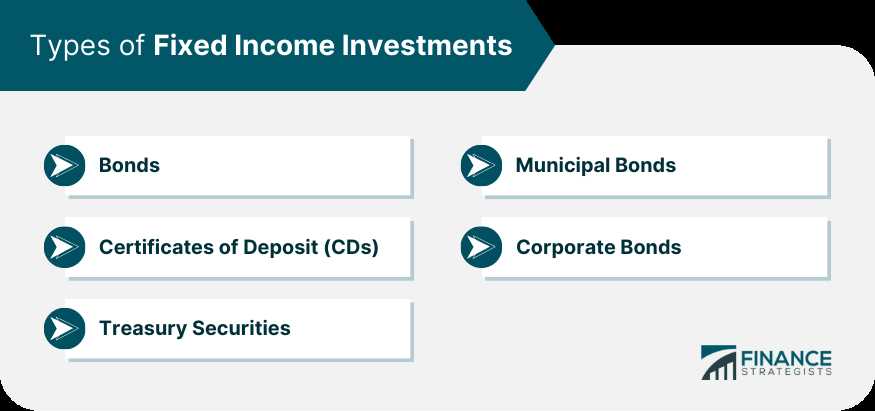

There are several types of fixed income investments, including bonds, certificates of deposit (CDs), and Treasury bills. Bonds are debt securities issued by governments, municipalities, and corporations to raise capital. They pay interest to investors at a fixed rate and return the principal amount at maturity. CDs are time deposits offered by banks that pay a fixed interest rate over a specified period of time. Treasury bills are short-term debt securities issued by the government with a maturity of less than one year.

One of the key benefits of fixed income investments is their relatively low volatility compared to other types of investments. This means that the value of the investment is less likely to fluctuate significantly over time. This stability can be particularly attractive to conservative investors who are seeking a steady income stream and are less willing to take on higher levels of risk.

Another advantage of fixed income investments is their potential for regular income. Unlike stocks, which may or may not pay dividends, fixed income investments typically provide a regular stream of interest payments. This can be especially beneficial for retirees or individuals who rely on their investments for income.

How to Invest in Fixed Income

Investing in fixed income securities can be a smart way to diversify your investment portfolio and generate a steady stream of income. Here are some steps to help you get started:

1. Determine Your Investment Goals

2. Understand Different Types of Fixed Income Securities

There are various types of fixed income securities, including government bonds, corporate bonds, municipal bonds, and Treasury bills. Each type has its own risk and return characteristics. Take the time to understand the differences between these securities and choose the ones that align with your investment goals and risk tolerance.

3. Do Your Research

4. Diversify Your Portfolio

One of the key principles of investing is diversification. By investing in a variety of fixed income securities, you can spread your risk and potentially increase your returns. Consider investing in different types of fixed income securities, as well as securities with different maturities and credit ratings.

5. Consider Working with a Financial Advisor

If you are new to fixed income investing or feel overwhelmed by the options, consider working with a financial advisor. They can help you navigate the complexities of the fixed income market and develop a strategy that aligns with your investment goals and risk tolerance.

6. Monitor and Rebalance Your Portfolio

Investing in fixed income securities requires careful consideration and research. By following these steps, you can make informed decisions and build a diversified fixed income portfolio that suits your investment needs.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.