What are Grantor Trust Rules?

Grantor trust rules are a set of regulations that determine the tax treatment of certain types of trusts. These rules are designed to ensure that the income and assets of the trust are properly attributed to the grantor for tax purposes.

Types of Grantor Trusts

There are several types of trusts that can be classified as grantor trusts, including revocable trusts, intentionally defective grantor trusts (IDGTs), and grantor retained annuity trusts (GRATs). Each type of trust has its own specific rules and requirements that must be met in order to qualify as a grantor trust.

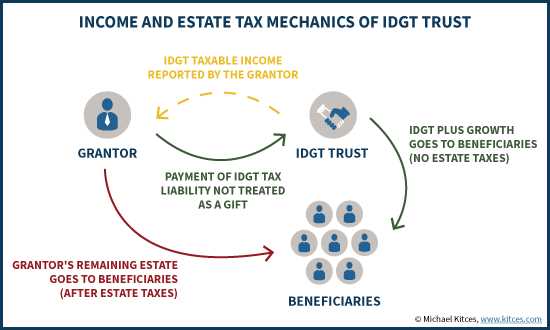

An intentionally defective grantor trust (IDGT) is a trust that is intentionally structured to be a grantor trust for income tax purposes, but not for estate tax purposes. This allows the grantor to transfer assets to the trust without incurring gift or estate taxes, while still being responsible for the income generated by the trust.

Benefits of Grantor Trusts

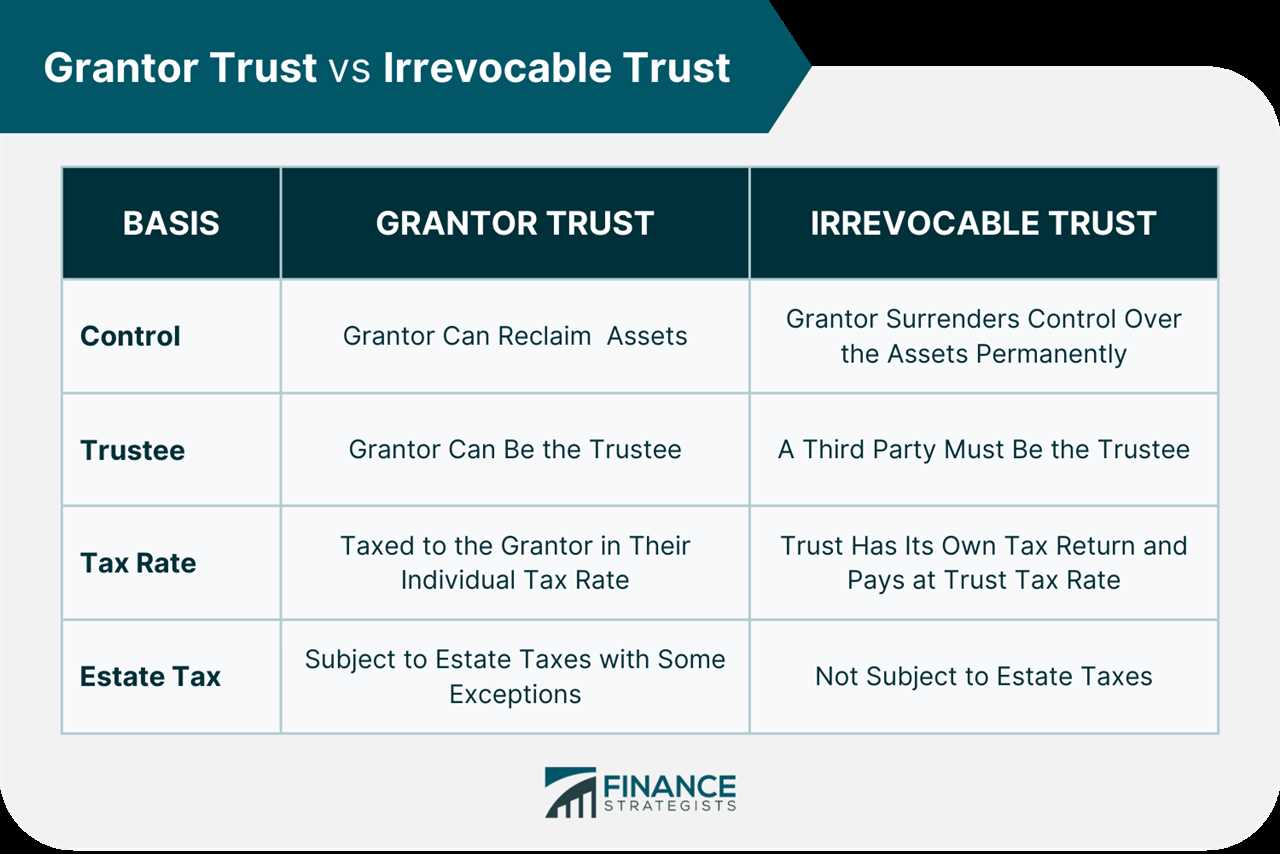

There are several benefits to using grantor trusts in trust and estate planning. First, grantor trusts allow the grantor to maintain control over the trust and its assets, while still receiving favorable tax treatment. This can be particularly useful for individuals who want to transfer assets to their heirs while minimizing their tax liability.

Second, grantor trusts can be used to remove assets from the grantor’s taxable estate, reducing the amount of estate tax that will be owed upon their death. This can help to preserve more of the grantor’s assets for their heirs.

How Do Grantor Trust Rules Work in Trust and Estate Planning?

Grantor trust rules play a crucial role in trust and estate planning. These rules determine how a trust is treated for tax purposes and can have significant implications for both the grantor and the beneficiaries.

Grantor trust rules are a set of tax laws that determine whether a trust is considered a grantor trust or a non-grantor trust. A grantor trust is one where the grantor retains certain control or benefits over the trust assets, while a non-grantor trust is one where the grantor has no control or benefits.

When a trust is classified as a grantor trust, the grantor is responsible for reporting and paying taxes on the income generated by the trust. This means that any income earned by the trust is treated as if it were earned directly by the grantor.

Implications for the Grantor

For the grantor, the grantor trust rules can provide certain tax advantages. By retaining control or benefits over the trust assets, the grantor can continue to benefit from the income generated by the trust without incurring additional tax liabilities. This can be particularly beneficial for estate planning purposes, as it allows the grantor to transfer assets to future generations while minimizing tax consequences.

Implications for the Beneficiaries

However, the beneficiaries should be aware that if they receive assets from a grantor trust as part of their inheritance, they may be subject to capital gains tax if they sell the assets. This is because the assets in a grantor trust receive a step-up in basis upon the grantor’s death, which can result in a higher tax basis for the beneficiaries.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.