Global Macro Strategy: Definition and Functioning

Global macro funds, which employ the global macro strategy, aim to generate returns by taking positions in various asset classes, including stocks, bonds, currencies, and commodities. These funds typically have a flexible investment mandate, allowing them to go long or short on different assets based on their analysis of macroeconomic trends.

The main goal of the global macro strategy is to identify and capitalize on opportunities that arise from macroeconomic imbalances and market inefficiencies. This can involve taking advantage of currency fluctuations, interest rate differentials, and changes in government policies.

To implement the global macro strategy, fund managers use a variety of tools and techniques, including fundamental analysis, technical analysis, and quantitative models. They closely monitor economic indicators, such as GDP growth, inflation rates, and employment data, to assess the health of different economies and make investment decisions accordingly.

One of the key advantages of the global macro strategy is its ability to generate positive returns in both bull and bear markets. By taking positions in different asset classes and markets, global macro funds can profit from both rising and falling prices.

However, the global macro strategy also carries risks. The success of the strategy depends on the accuracy of the fund manager’s analysis and predictions. If their assessments of macroeconomic trends and market conditions are incorrect, it can lead to losses for the fund.

Investors who employ the global macro strategy aim to profit from large-scale economic trends and events by taking positions in various asset classes, such as stocks, bonds, currencies, and commodities. They use a top-down approach, starting with the analysis of global economic indicators, such as GDP growth, inflation rates, interest rates, and employment data, to identify potential investment opportunities.

One of the key aspects of the global macro strategy is the ability to identify and anticipate market trends and turning points. Macro traders use a combination of fundamental analysis, technical analysis, and market sentiment analysis to identify potential market movements and make informed investment decisions.

However, the global macro strategy is not without risks. The global economy is complex and constantly changing, and predicting its future direction can be challenging. Macro traders must be prepared to adapt their investment strategies and positions as new information becomes available and market conditions evolve.

How the Global Macro Strategy Works

The global macro strategy is a type of investment approach that focuses on making investment decisions based on macroeconomic factors and trends. It involves analyzing and predicting the overall economic conditions of different countries or regions and using this information to make investment decisions.

Here is a step-by-step breakdown of how the global macro strategy works:

1. Research and Analysis

The first step in the global macro strategy is conducting extensive research and analysis of various macroeconomic factors. This includes studying economic indicators, such as GDP growth, inflation rates, interest rates, employment data, and fiscal policies of different countries or regions.

Investors also analyze geopolitical events, global trade patterns, and other factors that can impact the overall economic conditions. This research helps investors identify potential investment opportunities and risks.

2. Formulating Investment Thesis

Based on the research and analysis, investors formulate an investment thesis. This is a hypothesis or a view on how the global economy will perform in the future and which investment opportunities are likely to be profitable.

The investment thesis can be based on various scenarios, such as economic growth, recession, inflation, or deflation. Investors use their expertise and knowledge to develop a thesis that they believe will generate positive returns.

3. Portfolio Construction

Once the investment thesis is formulated, investors construct a portfolio of investments that align with their views. This can include a combination of different asset classes, such as stocks, bonds, currencies, commodities, and derivatives.

The portfolio is diversified to spread the risk and capture potential opportunities in different markets. Investors may also use leverage or derivatives to enhance their returns or hedge against potential risks.

4. Monitoring and Adjusting

After constructing the portfolio, investors closely monitor the macroeconomic factors and trends to assess the performance of their investments. They continuously analyze economic data, news, and market developments to identify any changes or potential risks.

If the actual economic conditions deviate from their initial thesis, investors may adjust their portfolio accordingly. This can involve reallocating investments, changing positions, or hedging against potential losses.

5. Risk Management

Risk management is a crucial aspect of the global macro strategy. Investors carefully manage the risks associated with their investments by diversifying their portfolio, setting stop-loss orders, and using risk management techniques.

They also closely monitor their exposure to various risks, such as currency risk, interest rate risk, and geopolitical risk. By actively managing risks, investors aim to protect their capital and generate consistent returns.

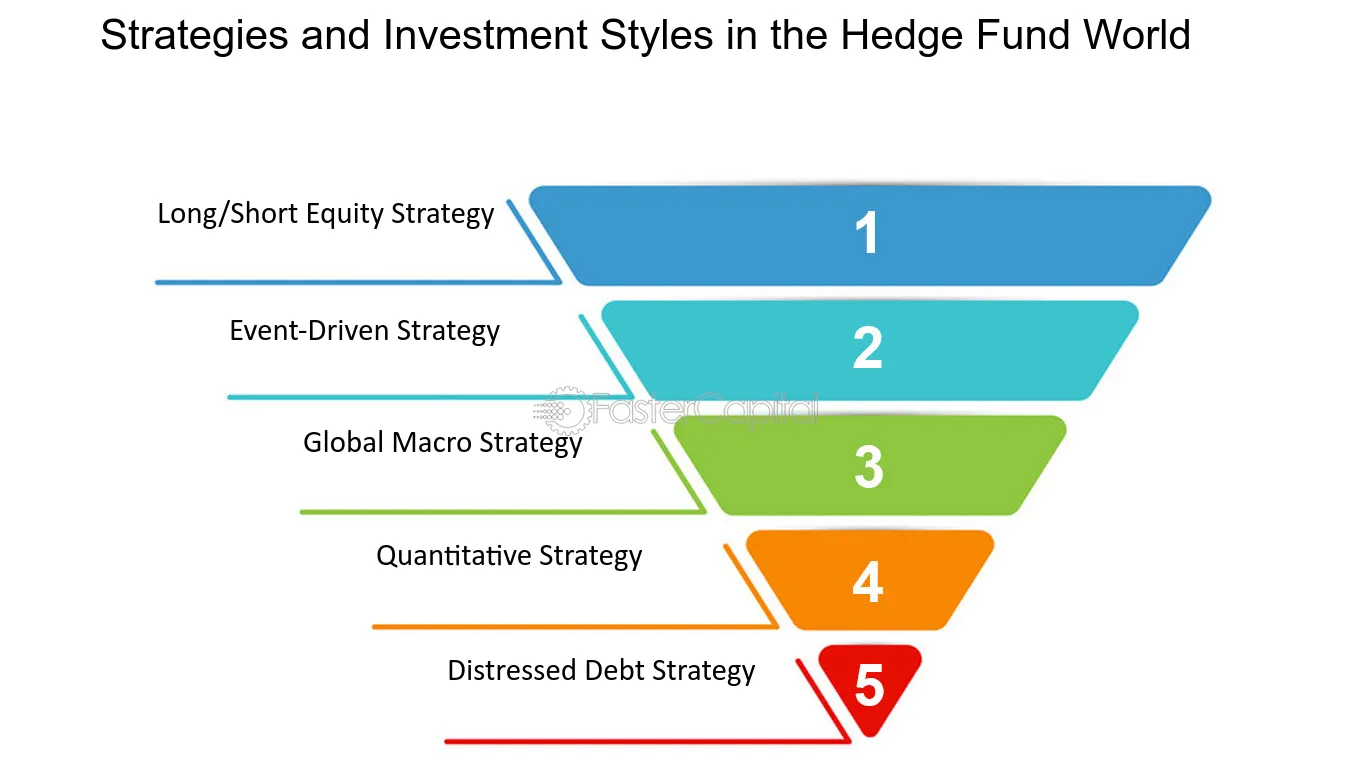

Types of Hedge Funds

Hedge funds are a popular investment vehicle that utilizes various strategies to generate returns for investors. Within the hedge fund industry, there are different types of funds, each with its own unique characteristics and investment strategies. Here are some of the most common types of hedge funds:

1. Long/Short Equity Funds

Long/short equity funds are one of the most prevalent types of hedge funds. These funds aim to generate returns by taking both long and short positions in equities. The fund manager will buy stocks they believe will increase in value (long positions) and sell stocks they believe will decrease in value (short positions). This strategy allows the fund to profit from both rising and falling markets.

2. Event-Driven Funds

Event-driven funds focus on investing in companies that are undergoing significant corporate events, such as mergers, acquisitions, bankruptcies, or restructurings. The fund manager will analyze these events and take positions in the affected companies, aiming to profit from the price movements resulting from the events.

3. Global Macro Funds

Global macro funds take a broad approach to investing, focusing on macroeconomic trends and events that can impact financial markets. The fund manager will analyze global economic data, political developments, and other factors to identify investment opportunities. These funds can invest in various asset classes, including stocks, bonds, currencies, and commodities.

4. Distressed Debt Funds

Distressed debt funds specialize in investing in the debt of companies that are experiencing financial distress or facing bankruptcy. The fund manager will analyze the distressed debt market and identify opportunities to purchase debt securities at a discount. If the company successfully restructures or recovers, the fund can generate significant returns.

5. Quantitative Funds

These are just a few examples of the types of hedge funds available in the market. Each type has its own unique investment strategy and risk profile. Investors should carefully consider their investment objectives and risk tolerance before investing in hedge funds.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.