Overview of Form 1040-A U.S. Individual Tax Return

Form 1040-A is a simplified version of the Form 1040 U.S. Individual Tax Return. It is designed for taxpayers who have relatively simple tax situations and do not need to itemize deductions. This form allows taxpayers to report their income, claim certain deductions and credits, and calculate their tax liability.

What is Form 1040-A?

Form 1040-A is a two-page form that taxpayers can use to report their income and claim certain deductions and credits. It is shorter and less complex than the standard Form 1040, making it easier for individuals with simpler tax situations to file their taxes.

Who can use Form 1040-A?

Not everyone is eligible to use Form 1040-A. Taxpayers must meet certain criteria to qualify for this simplified form. Generally, individuals who have taxable income below $100,000, do not itemize deductions, and have only certain types of income can use Form 1040-A.

For example, taxpayers who have income from self-employment, rental properties, or foreign sources cannot use Form 1040-A. Additionally, individuals who want to claim itemized deductions or have more complex tax situations must use the standard Form 1040.

Benefits of using Form 1040-A

Using Form 1040-A offers several benefits for eligible taxpayers. First, it simplifies the tax filing process by providing a shorter and less complex form. This can save time and reduce the chances of making errors.

Second, Form 1040-A allows taxpayers to claim certain deductions and credits that can reduce their tax liability. By taking advantage of these tax breaks, individuals may be able to lower the amount of taxes they owe or increase their refund.

Lastly, using Form 1040-A can help taxpayers avoid the need to itemize deductions. This can be beneficial for individuals who do not have significant deductible expenses, as it eliminates the need to gather and report detailed information about these expenses.

Form 1040-A is a simplified version of the Form 1040, which is the standard individual tax return form used by taxpayers in the United States. The 1040-A form is designed for individuals who have less complex tax situations and who do not qualify for certain deductions or credits available on the more detailed Form 1040.

One of the main advantages of using Form 1040-A is its simplicity. The form is shorter and easier to understand compared to the longer and more complex Form 1040. It eliminates the need to itemize deductions, which can be time-consuming and require additional documentation.

However, there are limitations to using Form 1040-A. Taxpayers who have more complex tax situations, such as self-employment income, rental income, or extensive itemized deductions, may not be eligible to use Form 1040-A and will need to use Form 1040 instead. Additionally, certain credits and deductions are not available on Form 1040-A, so taxpayers who qualify for these may need to use Form 1040 to claim them.

It is important for taxpayers to carefully review the eligibility requirements and limitations of Form 1040-A before deciding to use this form. If unsure, it may be beneficial to consult a tax professional or use tax software to determine the most appropriate form to use.

Eligibility and Requirements for Form 1040-A

Eligibility Criteria

To be eligible to file Form 1040-A, you must meet the following criteria:

- You must be a U.S. citizen or resident alien for the entire tax year.

- Your taxable income must be less than $100,000.

- You must have income only from wages, salaries, tips, interest, dividends, capital gains, IRA distributions, pensions, and annuities.

- You cannot itemize deductions. Instead, you must claim the standard deduction or certain adjustments to income.

- You cannot have any income from self-employment, farm income, or rental income.

- You cannot have any income from partnerships, S corporations, estates, or trusts.

- You cannot claim any dependents.

Benefits of Form 1040-A

Form 1040-A offers several benefits for eligible taxpayers:

- It is simpler and less time-consuming to complete compared to the standard Form 1040.

- It provides a straightforward method for calculating your tax liability based on your taxable income and filing status.

- It allows you to claim the standard deduction, which can reduce your taxable income and potentially lower your tax liability.

However, it is important to note that Form 1040-A also has some limitations:

- It does not allow you to itemize deductions, which means you may not be able to take advantage of certain deductions that could lower your tax liability further.

- It does not accommodate complex tax situations, such as self-employment income, rental income, or income from partnerships or trusts.

- It does not allow you to claim any dependents, which may limit your ability to qualify for certain tax credits.

Before deciding to file Form 1040-A, it is important to carefully review the eligibility criteria and consider whether it is the most appropriate form for your specific tax situation. If you are unsure, it may be beneficial to consult a tax professional or use tax software to determine the best filing option for you.

Filing Process for Form 1040-A

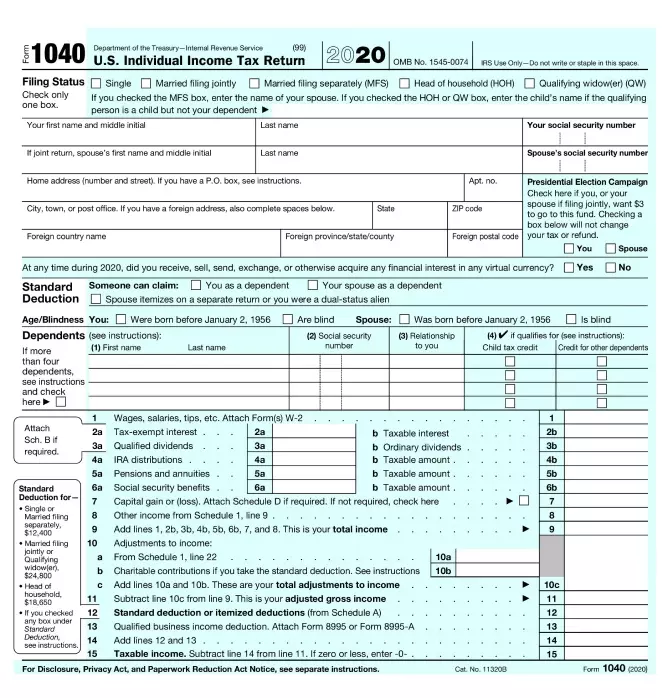

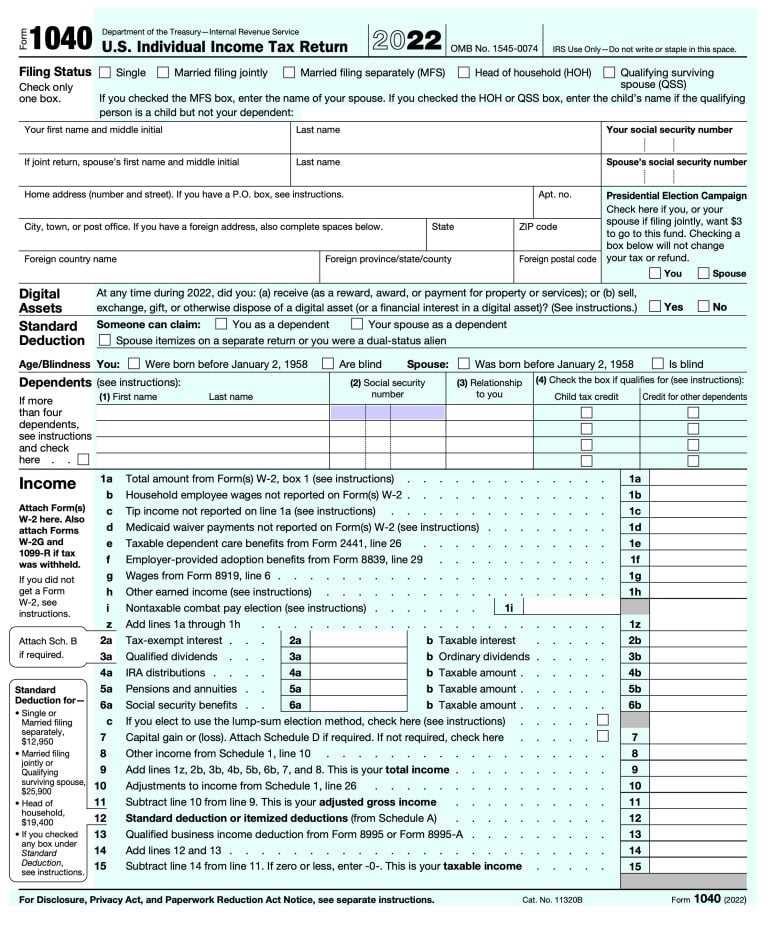

Filing your taxes can be a daunting task, but with the Form 1040-A, the process becomes much simpler. Here is a step-by-step guide on how to file your taxes using Form 1040-A:

- Gather all necessary documents: Before you start filling out the form, make sure you have all the required documents handy. This includes your W-2 forms, 1099 forms, and any other relevant income and deduction records.

- Download and print Form 1040-A: You can find the form on the official website of the Internal Revenue Service (IRS). Download and print the form, making sure to select the correct year.

- Fill out your personal information: Start by entering your name, address, and Social Security number at the top of the form. Double-check this information to ensure accuracy.

- Report your income: The next step is to report your income. This includes wages, salaries, tips, and any other taxable income you received during the year. Use the appropriate lines on the form to enter this information.

- Claim deductions and credits: If you are eligible for any deductions or credits, make sure to claim them on the form. This can help reduce your taxable income and potentially lower your tax liability.

- Calculate your tax liability: Once you have reported all your income and claimed any deductions or credits, use the tax tables provided by the IRS to calculate your tax liability. This will determine how much you owe in taxes.

- Sign and date the form: Before submitting your form, make sure to sign and date it. Failure to do so may result in delays or penalties.

- Submit your form: Once you have completed the form and double-checked all the information, you can submit it to the IRS. You can either mail it or file electronically, depending on your preference.

Remember to keep a copy of your completed Form 1040-A for your records. It is also recommended to keep all supporting documents in case of an audit or any future inquiries from the IRS.

Filing your taxes using Form 1040-A can be a straightforward process if you follow these steps. However, if you have a more complex tax situation or are unsure about certain aspects, it is always advisable to seek professional assistance or consult the IRS website for further guidance.

Benefits and Limitations of Form 1040-A

Benefits:

1. Simplified Form: Form 1040-A is a simplified version of the standard Form 1040, making it easier for taxpayers to complete. It is shorter and less complex, requiring less time and effort to fill out.

3. Income Limitations: Form 1040-A allows individuals with certain types of income to file their taxes without needing to use the more complex Form 1040. This includes individuals with taxable income of $100,000 or less, income from wages, salaries, tips, interest, dividends, and unemployment compensation.

Limitations:

1. Income and Deduction Restrictions: Form 1040-A has limitations on the types of income and deductions that can be reported. Taxpayers with more complex financial situations, such as self-employment income, rental income, or itemized deductions, may not be eligible to use this form.

2. Limited Additional Schedules: Unlike Form 1040, Form 1040-A does not allow for the attachment of additional schedules. This means that taxpayers with certain types of income or deductions may need to use Form 1040 instead, which can be more time-consuming and require additional documentation.

3. Restricted Tax Planning Opportunities: Using Form 1040-A may limit the ability to engage in certain tax planning strategies. Taxpayers with more complex financial situations may benefit from the flexibility and options provided by Form 1040, allowing for greater control over their tax liability.

4. State Tax Considerations: While Form 1040-A is accepted for federal tax purposes, it may not be accepted by all state tax authorities. Taxpayers should check with their state tax agency to ensure that Form 1040-A is accepted for their state tax filings.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.