Fiscal Year Advantages: Why It’s Better Than a Calendar Year

1. Financial Planning Flexibility

One of the major advantages of a fiscal year is the flexibility it provides for financial planning. By choosing a fiscal year that aligns with the natural business cycle, companies can better track and analyze their financial performance. This allows for more accurate budgeting, forecasting, and decision-making.

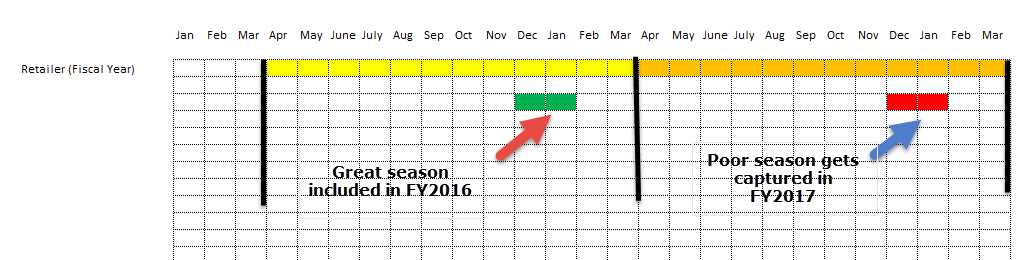

For example, a retail business that experiences peak sales during the holiday season may benefit from having a fiscal year that starts in January and ends in December. This way, they can analyze their sales, inventory levels, and expenses in a way that reflects their busiest period accurately.

2. Tax Benefits and Strategies

Another advantage of a fiscal year is the potential for tax benefits and strategies. By choosing a fiscal year that optimizes tax planning, businesses can take advantage of various tax incentives and deductions.

For instance, some tax credits and deductions are based on annual income. By shifting income and expenses between fiscal years, businesses can potentially reduce their tax liability. This can be particularly beneficial for businesses with seasonal fluctuations in revenue or significant one-time expenses.

In addition, a fiscal year can also provide businesses with more time to prepare and file their taxes. By having a fiscal year-end that is different from the traditional December 31st, businesses can avoid the rush and potential errors that come with the end-of-year tax season.

3. Alignment with Business Operations

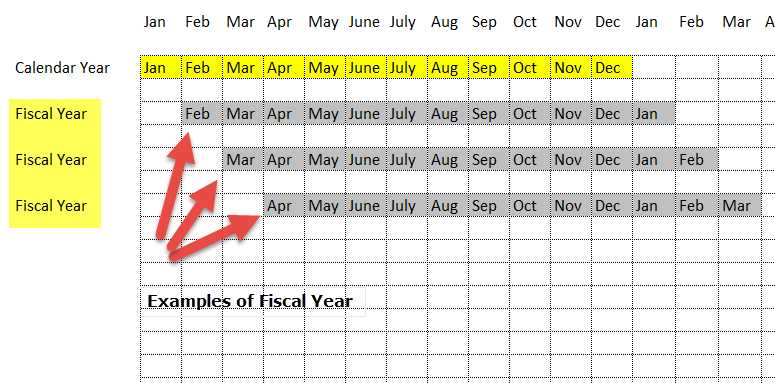

Choosing a fiscal year that aligns with a company’s specific business operations can also be advantageous. For example, a construction company that operates primarily during the summer months may find it more logical to have a fiscal year that starts in April and ends in March.

This alignment allows the company to accurately track and analyze its financial performance during its busiest period. It also simplifies the process of budgeting, forecasting, and evaluating the success of projects that span multiple fiscal years.

Overall, opting for a fiscal year instead of a calendar year can provide businesses with greater financial planning flexibility, potential tax benefits, and alignment with their specific business operations. It is important for businesses to carefully consider their unique circumstances and consult with accounting professionals to determine the most suitable fiscal year for their needs.

Financial Planning Flexibility

One of the key advantages of using a fiscal year instead of a calendar year for financial planning is the increased flexibility it provides. By aligning your financial reporting period with the specific needs and cycles of your business, you can better manage your cash flow, budgeting, and forecasting.

With a fiscal year, you have the ability to choose a start date that makes the most sense for your business. This allows you to align your financial planning with your industry’s seasonal trends or the timing of your major business activities. For example, if you run a retail business, you may want your fiscal year to start in January to capture the holiday shopping season.

Additionally, a fiscal year can provide more accurate financial projections and comparisons. By analyzing financial data within a consistent time frame, you can better identify trends, patterns, and fluctuations in your business performance. This can help you make more informed decisions and adjust your strategies accordingly.

Benefits of Financial Planning Flexibility:

1. Improved cash flow management: By aligning your fiscal year with your business cycles, you can better anticipate and plan for periods of high and low cash flow. This can help you allocate resources more effectively and avoid financial challenges.

2. Enhanced budgeting and forecasting: With a fiscal year, you have the opportunity to create more accurate and realistic budgets and forecasts. By considering the specific needs and trends of your business, you can make more informed projections and set achievable financial goals.

3. Streamlined financial reporting: A fiscal year can simplify your financial reporting process. By consolidating financial information within a consistent time frame, you can streamline the preparation of financial statements and reports, making it easier for stakeholders to understand and analyze your business performance.

Example of Financial Planning Flexibility:

Let’s say you own a construction company that experiences a peak season during the summer months. By aligning your fiscal year to start in April and end in March, you can better plan for and allocate resources during this busy period. You can also analyze your financial data from previous fiscal years to identify trends and make informed decisions about hiring additional staff, purchasing equipment, or securing financing.

| Advantages of Financial Planning Flexibility | Benefits |

|---|---|

| Improved cash flow management | Ability to allocate resources effectively and avoid financial challenges |

| Enhanced budgeting and forecasting | Creation of more accurate and realistic budgets and forecasts |

| Streamlined financial reporting | Simplification of financial statement preparation and analysis |

Overall, having financial planning flexibility through a fiscal year can provide your business with a strategic advantage. It allows you to align your financial activities with your business cycles, make more informed decisions, and effectively manage your resources.

Tax Benefits and Strategies

One of the advantages of using a fiscal year instead of a calendar year for financial reporting is the potential for tax benefits and strategies. By aligning your fiscal year with your business operations and taking advantage of certain tax laws, you can potentially reduce your tax liability and improve your overall financial position.

Here are some tax benefits and strategies that you can consider when using a fiscal year:

| Tax Planning | Tax Deductions | Tax Credits |

|---|---|---|

| By having a fiscal year that aligns with your business operations, you can strategically plan your expenses and income to optimize your tax position. This can include timing the recognition of revenue and expenses to minimize your tax liability. | Certain tax deductions may be available to businesses that use a fiscal year. For example, you may be able to deduct expenses related to inventory, depreciation, and research and development. | There are also tax credits that may be available to businesses that use a fiscal year. These credits can help offset your tax liability and provide additional financial benefits. |

In addition to tax planning, using a fiscal year can also provide other financial advantages. For example, it can help with cash flow management, budgeting, and financial forecasting. By aligning your financial reporting period with your business operations, you can gain a clearer picture of your financial performance and make more informed decisions.

Alignment with Business Operations

Choosing a fiscal year that aligns with your business operations can provide several advantages. By selecting a fiscal year that corresponds with your company’s busiest or slowest periods, you can better manage your finances and make more informed decisions.

One of the key benefits of aligning your fiscal year with your business operations is improved financial reporting. When your fiscal year matches the natural cycles of your business, it becomes easier to track and analyze financial data. This can help you identify trends, evaluate performance, and make strategic decisions based on accurate and timely information.

Additionally, aligning your fiscal year with your business operations can simplify budgeting and forecasting. By basing your financial plans on the actual cycles of your business, you can more accurately predict revenue and expenses. This can lead to more realistic budgeting, better resource allocation, and improved financial stability.

Lastly, aligning your fiscal year with your business operations can improve tax planning and compliance. By choosing a fiscal year that optimizes tax benefits and strategies, you can potentially reduce your tax liability and maximize deductions. This can result in significant savings for your business and help you stay in compliance with tax laws and regulations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.