Examples of Optimum Currency Area (OCA) Theory in Economics

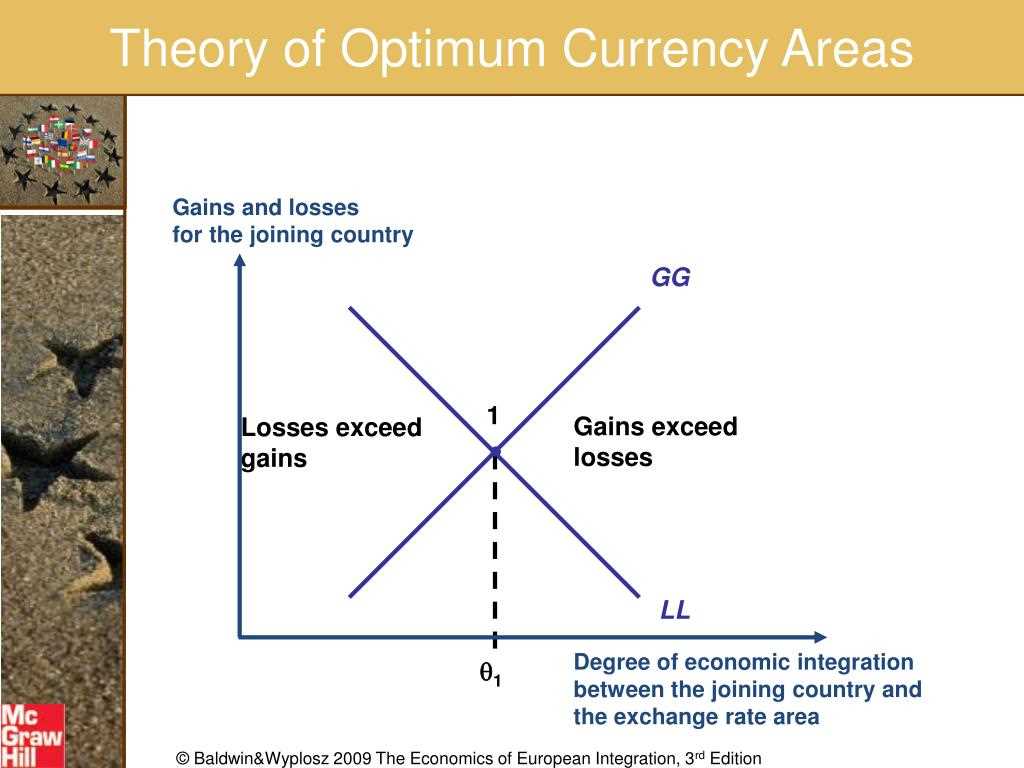

The Optimum Currency Area (OCA) theory is a concept in economics that explores the conditions under which it is beneficial for countries to share a common currency. The theory suggests that a currency union can lead to increased economic efficiency and stability if certain criteria are met.

1. Eurozone

By sharing a common currency, the Eurozone countries benefit from reduced transaction costs and exchange rate fluctuations, which facilitate trade and investment within the region. The euro also provides a sense of stability and credibility to the participating countries, making them more attractive to foreign investors.

2. Caribbean Currency Union

By using a common currency, the Caribbean countries eliminate the need for exchange rate adjustments and reduce transaction costs, which can stimulate trade and investment within the region. The currency union also provides a sense of stability and credibility to the participating countries, making them more attractive to foreign investors.

3. West African Monetary Zone

The West African Monetary Zone (WAMZ) is another example of the OCA theory in action. It consists of five West African countries that have agreed to adopt a common currency, the Eco, in the future. The establishment of the WAMZ aims to promote economic integration and stability in the region.

By sharing a common currency, the WAMZ countries hope to eliminate exchange rate fluctuations and reduce transaction costs, which can enhance trade and investment within the region. The common currency also symbolizes the commitment of the participating countries to economic cooperation and integration.

Benefits of Currency Union

- Elimination of exchange rate fluctuations: By adopting a common currency, countries within a currency union no longer need to worry about exchange rate fluctuations between their currencies. This stability can promote trade and investment within the union.

- Increased price transparency: With a common currency, prices for goods and services can be easily compared across countries within the union. This transparency can lead to increased competition and efficiency in the market.

- Reduced transaction costs: Using a common currency eliminates the need for currency exchange when conducting business or traveling within the currency union. This can result in lower transaction costs and increased convenience.

- Enhanced economic integration: A currency union can foster closer economic integration among participating countries. It can encourage the free movement of goods, services, and capital, leading to increased trade and investment opportunities.

- Greater monetary policy coordination: In a currency union, participating countries share a common monetary policy. This coordination allows for a more unified approach to managing inflation, interest rates, and other economic factors, which can promote stability and growth.

- Improved credibility and access to capital markets: Being part of a currency union can enhance a country’s credibility in the eyes of investors and financial markets. This can lead to increased access to capital at more favorable terms.

While there are clear benefits to currency unions, it is important to note that they also come with challenges and potential drawbacks. These challenges will be discussed in the next section.

Challenges of Currency Union

While currency unions can bring various benefits, they also come with their fair share of challenges. These challenges can arise due to differences in economic structures, fiscal policies, and political factors among member countries. Here are some of the main challenges faced by currency unions:

1. Loss of Monetary Policy Autonomy: When countries join a currency union, they give up their ability to independently set monetary policy. This means that they cannot adjust interest rates or use other monetary tools to stabilize their economies in response to domestic shocks. Instead, monetary policy decisions are made by a central authority, such as a central bank, which may not always align with the needs of individual member countries.

2. Lack of Fiscal Transfers: In a currency union, member countries share a common currency but maintain separate fiscal policies. This can create challenges when one country experiences an economic downturn or faces a fiscal crisis. Without the ability to devalue their currency or receive fiscal transfers from other member countries, the affected country may struggle to address its economic challenges effectively.

3. Divergent Economic Cycles: Member countries of a currency union may experience different economic cycles due to variations in their economic structures and exposure to external shocks. This can create imbalances within the union, with some countries experiencing rapid growth while others face stagnation or recession. These divergent economic cycles can strain the cohesion and stability of the currency union.

4. Loss of Exchange Rate Flexibility: When countries join a currency union, they give up their ability to adjust their exchange rates. This can be problematic when member countries have different levels of competitiveness or face external shocks that require exchange rate adjustments. Without the option to devalue or appreciate their currency, countries may struggle to restore competitiveness or address imbalances in their economies.

5. Political Challenges: Currency unions require a high degree of political cooperation and coordination among member countries. Differences in political systems, ideologies, and priorities can create challenges in making collective decisions and implementing necessary reforms. Political tensions and disagreements can undermine the stability and effectiveness of the currency union.

Overall, while currency unions offer benefits such as increased trade and price stability, they also present significant challenges that need to be carefully considered and managed. Addressing these challenges requires strong institutional frameworks, effective coordination mechanisms, and a willingness to make collective decisions for the common good of all member countries.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.