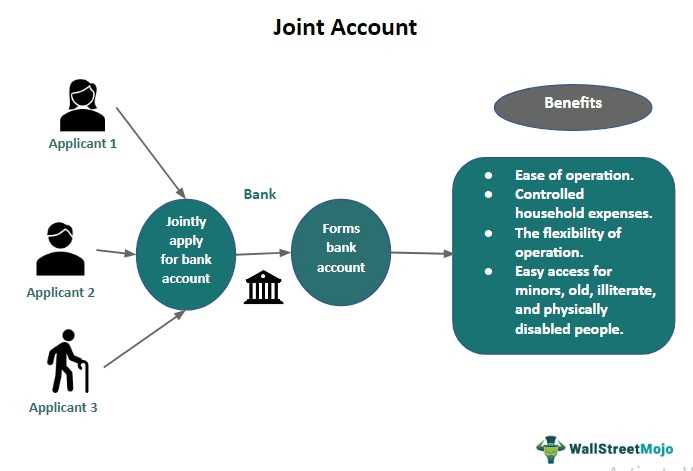

Benefits of Joint Accounts

Joint accounts can offer several benefits for individuals who choose to share their finances with a partner or family member. Here are some of the key advantages:

- Convenience: One of the main benefits of a joint account is the convenience it provides. With a joint account, both account holders have equal access to funds, which can make managing household expenses and bills much easier. It eliminates the need for constant transfers or sharing of cash between individuals.

- Shared Financial Responsibility: Joint accounts allow for shared financial responsibility. This can be particularly beneficial for couples or families who have common financial goals, such as saving for a vacation or a down payment on a house. By pooling their resources in a joint account, individuals can work together towards these goals more effectively.

- Transparency: Another advantage of joint accounts is the transparency they offer. Both account holders have full visibility into the account’s transactions and balance, which can help promote trust and open communication about financial matters. This transparency can also be useful in identifying and addressing any potential issues or discrepancies.

- Emergency Preparedness: Joint accounts can provide a sense of security and preparedness in case of emergencies. If one account holder becomes incapacitated or unable to manage their finances, the other account holder can step in and handle the necessary transactions and expenses without any disruptions.

- Building Credit: For individuals who are looking to build or improve their credit, a joint account can be beneficial. By sharing a joint account with someone who has a strong credit history, individuals can potentially benefit from their partner’s positive credit behavior and improve their own credit score over time.

Shared Financial Responsibility

One of the main benefits of having a joint account is the shared financial responsibility it brings. When you open a joint account with someone, whether it’s a spouse, a family member, or a business partner, you both have equal access to the funds and are equally responsible for managing them.

Additionally, having a joint account can simplify the process of managing shared expenses. For example, if you and your spouse have a joint account, you can use it to pay for household bills, groceries, and other shared expenses. This eliminates the need for constant transfers between individual accounts and reduces the chances of one person being burdened with all the financial responsibilities.

Equal Decision-making

Another advantage of shared financial responsibility is that it promotes equal decision-making. Since both account holders have an equal stake in the account, they have an equal say in how the funds are used. This can be particularly important in situations where both parties contribute to the account but have different financial priorities or goals.

By having joint access to the funds, both individuals can actively participate in financial decision-making, ensuring that their needs and goals are taken into consideration. This can lead to more balanced and fair financial management, as both parties have a voice in determining how the funds are allocated.

Conclusion

Easy Access to Funds

One of the main benefits of having a joint account is the easy access to funds. With a joint account, both account holders have equal rights and access to the money in the account. This can be especially useful in situations where one person may need immediate access to funds, such as in emergencies or unexpected expenses.

Having easy access to funds can also be convenient for day-to-day expenses. For example, if one person is out shopping and realizes they forgot their wallet, they can simply use the joint account to make the purchase. This eliminates the need to transfer money between individual accounts or rely on credit cards.

Furthermore, joint accounts can be beneficial for couples or families who share financial responsibilities. For instance, if one person is responsible for paying the bills, they can easily access the funds in the joint account to cover the expenses. This can help streamline the financial management process and ensure that all necessary payments are made on time.

However, it is important to note that easy access to funds can also be a potential pitfall of joint accounts. Both account holders have equal rights to withdraw money, which means that one person can potentially drain the account without the knowledge or consent of the other. Therefore, it is crucial to establish clear communication and trust when managing a joint account to avoid any potential conflicts or misuse of funds.

Pitfalls of Joint Accounts

1. Lack of Control

One of the main pitfalls of joint accounts is the potential lack of control. When you open a joint account, you are giving the other account holder equal access and control over the funds. This means that they have the ability to withdraw money or make financial decisions without your knowledge or consent. If you are not on the same page financially or have different spending habits, this lack of control can lead to conflicts and disagreements.

2. Financial Liability

Another potential pitfall of joint accounts is the financial liability that comes with it. When you open a joint account, you are not only sharing access to the funds, but you are also sharing the responsibility for any debts or liabilities associated with the account. This means that if the other account holder incurs debt or overdrafts the account, you could be held responsible for repaying those debts, even if you were not the one who incurred them.

3. Relationship Strain

4. Legal Implications

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.