Overview of Estate Tax Rates

Estate tax rates refer to the percentage of tax that is imposed on the value of an individual’s estate upon their death. These rates can vary depending on the total value of the estate and the applicable tax laws in the jurisdiction.

Additionally, many jurisdictions may have their own estate tax rates, which can differ from the federal rates. These state-level estate taxes can also vary in terms of rates and exemptions, so it is crucial to understand the specific laws in the relevant jurisdiction.

Exclusions and Deductions for Estate Taxes

Exclusions

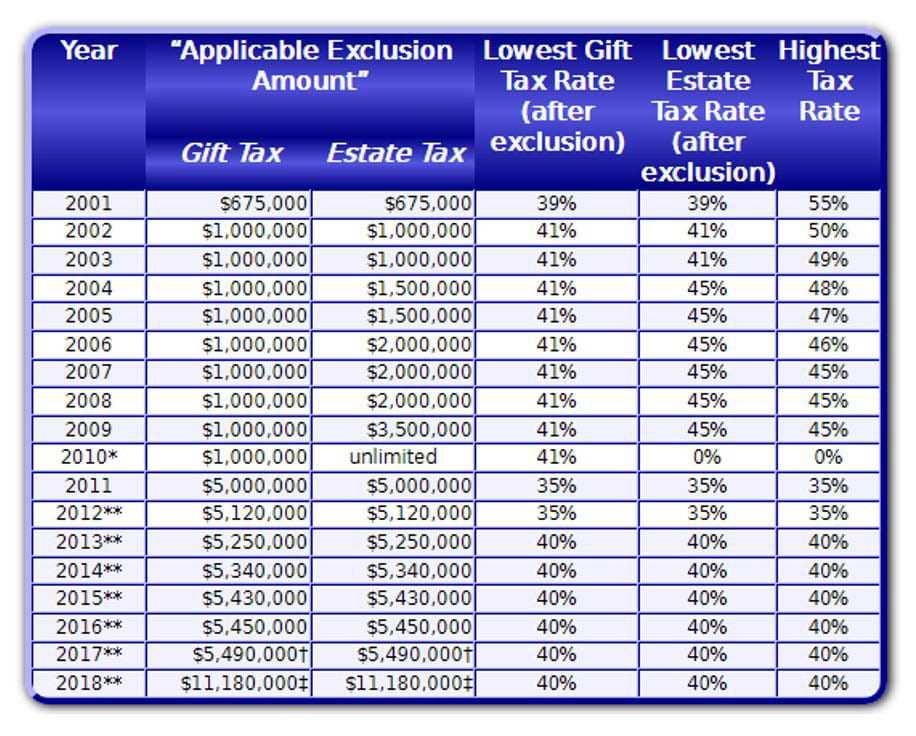

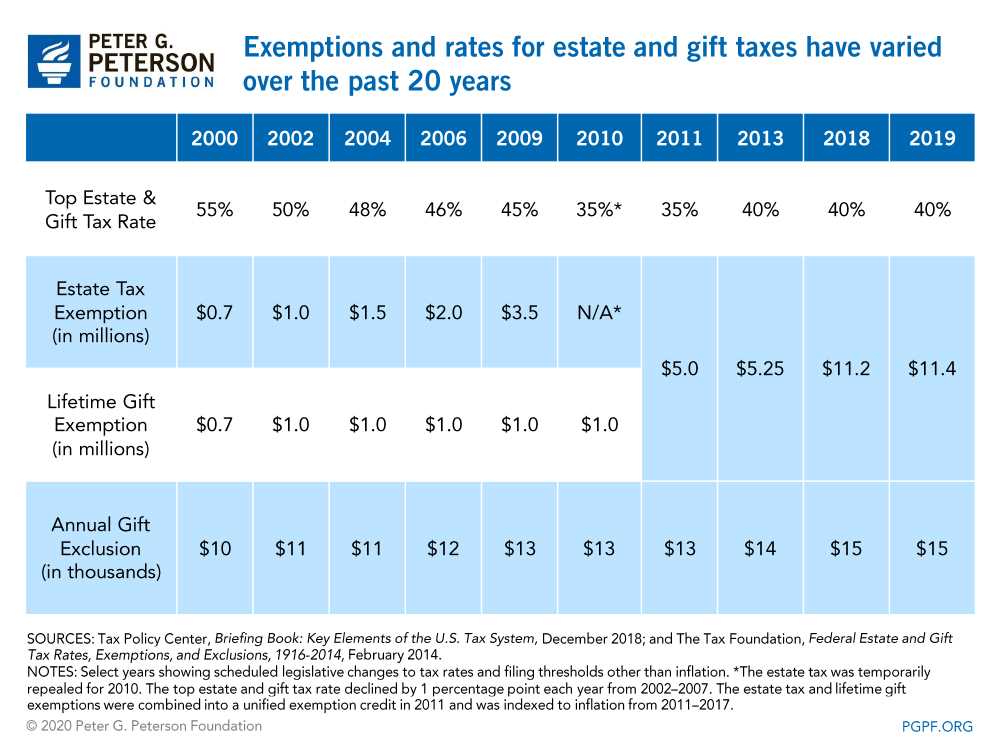

One of the main exclusions for estate taxes is the estate tax exemption. This is the amount of money that can be passed on to heirs without incurring any estate tax liability. The estate tax exemption is adjusted annually for inflation and is currently set at $11.7 million per individual for the year 2021. This means that an individual can pass on up to $11.7 million to their heirs without any estate tax implications.

In addition to the estate tax exemption, there are also certain assets that are excluded from the taxable estate. These include assets such as life insurance proceeds, qualified retirement accounts, and property transferred to a surviving spouse. By excluding these assets from the taxable estate, individuals can further reduce their estate tax liability.

Deductions

There are also several deductions available to reduce the taxable estate. One common deduction is the marital deduction, which allows for an unlimited amount of assets to be transferred to a surviving spouse without incurring any estate tax liability. This deduction helps ensure that spouses are not burdened with estate taxes when inheriting assets from their deceased spouse.

Another deduction is the charitable deduction, which allows individuals to reduce their taxable estate by making charitable donations. By donating a portion of their estate to qualified charitable organizations, individuals can not only support causes they care about but also reduce their estate tax liability.

How Estate Tax Rates Affect Gift Taxes

When an individual gives a gift to someone, the value of that gift may be subject to gift tax. However, there are certain exclusions and deductions that can reduce or eliminate the gift tax liability. The annual exclusion allows individuals to give a certain amount of money or property to another person without incurring gift tax. In 2021, the annual exclusion is $15,000 per recipient.

Gifts that exceed the annual exclusion are considered taxable gifts and may be subject to gift tax. The gift tax rate is tied to the estate tax rate, which means that changes in estate tax rates can also affect gift tax rates. Currently, the gift tax rate ranges from 18% to 40%, depending on the value of the gift.

Therefore, if an individual makes taxable gifts during their lifetime, it will reduce their available estate tax exemption. This can have significant implications for estate planning, as it may result in a higher estate tax liability for the individual’s heirs.

The Impact of Estate Tax Rates on Inheritance Taxes

When considering estate planning and the potential impact of estate tax rates, it is important to also understand how these rates can affect inheritance taxes. Inheritance taxes are taxes imposed on the transfer of assets from a deceased person to their heirs or beneficiaries.

The estate tax rates can have a direct impact on the amount of inheritance taxes that may be owed. In some cases, the estate tax rates may be high enough to significantly reduce the value of the estate, resulting in a smaller inheritance for the beneficiaries.

It is important to note that not all states impose inheritance taxes. Currently, only a few states in the United States have an inheritance tax, and the rates and exemptions vary from state to state. However, for those states that do have an inheritance tax, the estate tax rates can still play a role in determining the amount of tax owed.

For example, if the estate tax rates are high, it may result in a smaller estate value, which in turn could reduce the amount of inheritance taxes owed. On the other hand, if the estate tax rates are low, it may result in a larger estate value and potentially higher inheritance taxes.

Additionally, the exemptions and deductions available for estate taxes can also impact the amount of inheritance taxes owed. These exemptions and deductions can help reduce the taxable value of the estate, which in turn can lower the amount of inheritance taxes owed by the beneficiaries.

It is important for individuals to carefully consider the potential impact of estate tax rates on inheritance taxes when creating an estate plan. Consulting with a qualified estate planning attorney can help ensure that the estate plan takes into account the potential tax implications and maximizes the value of the estate for the beneficiaries.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.