Delinquent Account Credit Card: Definition, Example, Impact

A delinquent account credit card refers to a credit card account that has fallen behind on payments and is considered past due. When a credit card holder fails to make the minimum payment by the due date, the account becomes delinquent. This can happen for various reasons, such as financial difficulties, forgetfulness, or lack of awareness.

Definition

A delinquent account credit card is a credit card account that is in a state of delinquency. Delinquency occurs when a cardholder fails to make the required minimum payment by the due date. The account is then considered past due and subject to late fees and penalties.

Example

For example, let’s say John has a credit card with a monthly minimum payment of $50. If John fails to make the payment by the due date, his account becomes delinquent. The credit card issuer may charge him a late fee and increase his interest rate. If John continues to miss payments, his account may be sent to collections, which can have a negative impact on his credit score.

Impact

A delinquent account credit card can have several negative impacts. First, late fees and penalties can accumulate, making it harder for the cardholder to catch up on payments. Second, the credit card issuer may increase the interest rate, making the debt more expensive to repay. Third, the delinquency will be reported to credit bureaus, resulting in a negative mark on the cardholder’s credit report. This can lower the credit score and make it difficult to obtain credit in the future.

It is important for credit card holders to stay on top of their payments and avoid delinquency. If they are facing financial difficulties, they should reach out to their credit card issuer to discuss possible solutions, such as a payment plan or temporary hardship program.

What is a Delinquent Account Credit Card?

A delinquent account credit card refers to a credit card account that is past due or overdue on its payments. When a credit card holder fails to make the minimum payment by the due date, the account becomes delinquent. This can happen for various reasons, such as financial difficulties, forgetfulness, or simply negligence.

Once an account becomes delinquent, the credit card issuer may charge late fees and increase the interest rate on the outstanding balance. Additionally, the credit card holder’s credit score may be negatively affected, making it more difficult to obtain credit in the future.

It is important for credit card holders to stay on top of their payments and ensure that they are made in a timely manner to avoid delinquency. If a delinquent account is not resolved, it may eventually be sent to collections, resulting in further damage to the individual’s credit history.

In order to avoid delinquency, it is recommended to set up automatic payments or reminders to ensure that credit card payments are made on time. It is also important to regularly review credit card statements and address any discrepancies or fraudulent charges promptly.

Example of a Delinquent Account Credit Card

A delinquent account credit card refers to a credit card account that is past due on payments and has not been brought up to date. When a credit card holder fails to make the minimum required payment by the due date, the account becomes delinquent. This can happen due to various reasons, such as financial difficulties, forgetfulness, or simply neglecting to pay.

For example, let’s say John has a credit card with a $5,000 credit limit. He has been making regular payments on time for the past few months. However, due to an unexpected medical emergency, he was unable to make the minimum payment of $100 by the due date. As a result, his credit card account becomes delinquent.

Impact on Credit Score

A delinquent account credit card has a negative impact on the cardholder’s credit score. The credit card issuer will report the delinquency to the credit bureaus, which will then update the cardholder’s credit report accordingly. This can significantly lower the cardholder’s credit score, making it harder for them to obtain credit in the future.

Furthermore, a delinquent account credit card may also lead to additional fees and penalties. The credit card issuer may charge late payment fees, increase the cardholder’s interest rate, or even close the account altogether. These consequences can further worsen the cardholder’s financial situation.

It is important for credit card holders to stay on top of their payments and avoid delinquency. Making timely payments not only helps maintain a good credit score but also saves the cardholder from unnecessary fees and penalties.

Impact of a Delinquent Account Credit Card

A delinquent account credit card can have significant negative impacts on an individual’s financial situation. When a credit card account becomes delinquent, it means that the cardholder has failed to make the required minimum payments for a certain period of time, usually 30 days or more.

One of the immediate impacts of a delinquent account credit card is the imposition of late fees and penalty interest rates. These additional charges can quickly accumulate and make it even more difficult for the cardholder to catch up on their payments. The higher interest rates can also make it harder to pay off the balance, as more of the monthly payment goes towards interest rather than reducing the principal amount owed.

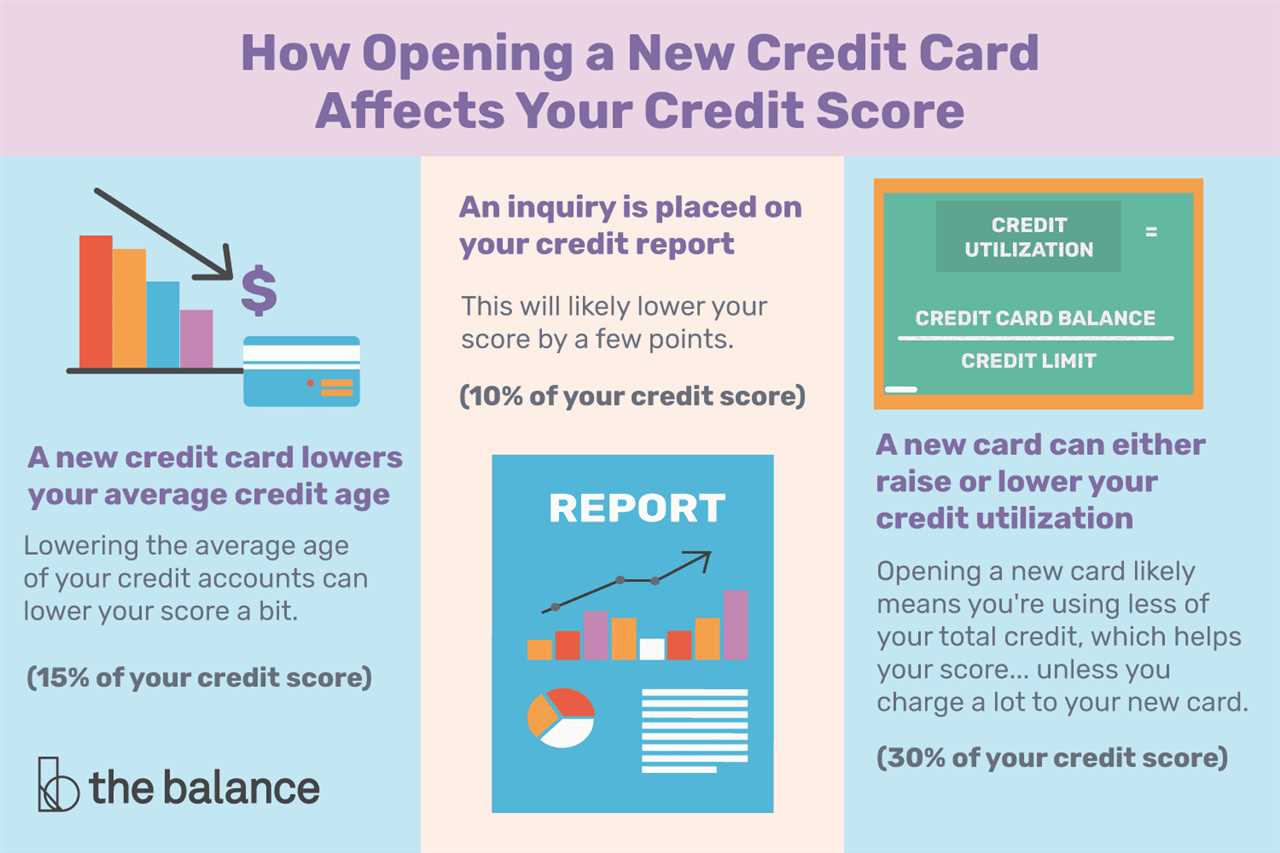

Another consequence of a delinquent account credit card is the negative effect it has on the cardholder’s credit score. Payment history is one of the most important factors in determining a credit score, and a delinquent account can significantly lower it. A lower credit score can make it more difficult to obtain future credit, such as loans or mortgages, and may result in higher interest rates when credit is extended.

In addition to the financial impacts, a delinquent account credit card can also have emotional and psychological effects on the cardholder. The stress and worry associated with being unable to meet financial obligations can take a toll on mental well-being and overall quality of life.

Steps to mitigate the impact

If you find yourself with a delinquent account credit card, there are steps you can take to mitigate the impact:

- Contact the credit card issuer: Reach out to the credit card issuer as soon as possible to explain your situation and explore potential options for repayment or debt management. They may be willing to work with you to develop a plan that fits your financial circumstances.

- Create a budget: Evaluate your income and expenses to create a realistic budget that allows you to allocate funds towards paying off your delinquent credit card account. Cut back on unnecessary expenses and prioritize debt repayment.

- Consider credit counseling: Credit counseling agencies can provide guidance and assistance in managing your debts. They can help negotiate with creditors and develop a debt management plan to get your finances back on track.

- Make consistent payments: Once you have a plan in place, make consistent payments towards your delinquent account credit card. Even small payments can help demonstrate your commitment to repaying the debt and can prevent further damage to your credit score.

- Monitor your credit report: Regularly check your credit report to ensure that your delinquent account credit card is being reported accurately. Dispute any errors or inaccuracies that may be negatively impacting your credit score.

By taking proactive steps and addressing the delinquent account credit card, you can minimize the impact on your financial well-being and work towards improving your credit standing.

Impact of a Delinquent Account Credit Card

A delinquent account credit card can have a significant impact on your financial situation. When you fail to make payments on your credit card, your account becomes delinquent. This can result in a variety of negative consequences.

Firstly, a delinquent account can lead to late fees and increased interest rates. Credit card companies often charge late fees for missed or late payments. Additionally, your credit card issuer may increase your interest rate as a penalty for not paying on time. These additional charges can quickly add up and make it even more difficult to pay off your debt.

Secondly, a delinquent account can have a negative impact on your credit score. Payment history is one of the most important factors in determining your credit score, and a delinquent account can significantly lower your score. A lower credit score can make it more difficult to obtain future credit, such as loans or mortgages, and may result in higher interest rates if you are approved.

Furthermore, a delinquent account can also lead to collection efforts and potential legal action. If you continue to neglect your credit card payments, your account may be sent to a collections agency. These agencies will attempt to collect the debt on behalf of the credit card issuer, often through phone calls, letters, or even legal action. This can be a stressful and time-consuming process, and may result in additional fees and damage to your credit.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.