What is Degree of Operating Leverage?

The Degree of Operating Leverage (DOL) is a financial ratio that measures the sensitivity of a company’s operating income to changes in its sales revenue. It helps businesses understand the impact of changes in sales on their profitability.

The DOL is calculated by dividing the percentage change in operating income by the percentage change in sales revenue. It provides insights into the fixed and variable costs of a company’s operations and helps in evaluating the risk associated with changes in sales volume.

By analyzing the DOL, businesses can determine the level of risk and leverage in their operations. A high DOL indicates that a company has a higher proportion of fixed costs, which can magnify the impact of changes in sales on its profitability. On the other hand, a low DOL suggests that a company has a higher proportion of variable costs, resulting in less sensitivity to changes in sales.

Benefits of Degree of Operating Leverage

The Degree of Operating Leverage (DOL) is an important financial ratio that measures the sensitivity of a company’s operating income to changes in its sales revenue. It helps businesses understand the impact of changes in sales on their profitability and resource allocation.

Increased Profitability

Efficient Resource Allocation

Another advantage of the Degree of Operating Leverage is that it enables businesses to allocate their resources more efficiently. By determining the level of fixed costs and their impact on operating income, companies can make informed decisions about how to allocate their resources effectively. This can help businesses optimize their cost structure and improve their overall operational efficiency.

Risk Management

For example, companies with a high DOL may consider diversifying their product offerings or expanding into new markets to reduce their reliance on a single source of revenue. They may also explore hedging strategies or insurance options to mitigate the impact of unexpected changes in sales. On the other hand, companies with a low DOL may focus on building a strong customer base and maintaining stable sales to minimize their exposure to market fluctuations.

Increased Profitability

One of the key benefits of the Degree of Operating Leverage (DOL) is its ability to increase profitability for a company. DOL is a financial ratio that measures the sensitivity of a company’s operating income to changes in its sales revenue.

On the other hand, a company with a low DOL may have a more stable operating income, but it will also have less potential for significant profit growth. This is because a small change in sales revenue will have a smaller impact on its operating income.

By analyzing the DOL, companies can make informed decisions about their fixed costs and pricing strategies. They can determine the level of fixed costs that will allow them to maximize their profitability and adjust their pricing accordingly.

| Benefits of Increased Profitability: |

|---|

| 1. Maximizes profit growth |

| 2. Allows for strategic pricing decisions |

| 3. Identifies potential risks and vulnerabilities |

Efficient Resource Allocation

Efficient resource allocation is a key benefit of the Degree of Operating Leverage (DOL). By calculating the DOL, businesses can determine the optimal allocation of their resources, such as labor, capital, and materials, to maximize their profitability.

Maximizing Profitability

Optimizing Costs

By analyzing the DOL, businesses can identify areas where costs can be reduced without significantly impacting sales. This could involve streamlining operations, renegotiating supplier contracts, or implementing more efficient production processes.

Improving Decision Making

For example, a company with a high DOL may decide to increase prices for its products or focus on higher-margin products to maximize profits. On the other hand, a company with a low DOL may choose to focus on increasing sales volume to drive profitability.

Overall, efficient resource allocation is essential for businesses to optimize their profitability. By calculating and analyzing the Degree of Operating Leverage, businesses can make informed decisions about how to allocate their resources effectively and maximize their profits.

Risk Management

What is Risk Management?

Risk management refers to the process of identifying, assessing, and prioritizing risks in order to minimize their impact on a business. It involves implementing strategies and measures to mitigate potential risks and ensure the smooth operation of the company.

The Role of DOL in Risk Management

The Degree of Operating Leverage (DOL) provides businesses with a valuable tool for risk management. It helps them understand the relationship between fixed costs, variable costs, and profits, allowing them to make informed decisions and manage risks effectively.

Benefits of Using DOL for Risk Management

There are several benefits to using the Degree of Operating Leverage (DOL) for risk management:

1. Enhanced Risk Assessment: By calculating the DOL, businesses can assess the impact of changes in sales volume on their profitability, allowing them to identify potential risks more accurately.

2. Informed Decision Making: The DOL provides businesses with valuable insights into the relationship between costs and profits. This information helps them make informed decisions and develop effective risk management strategies.

How to Calculate Degree of Operating Leverage

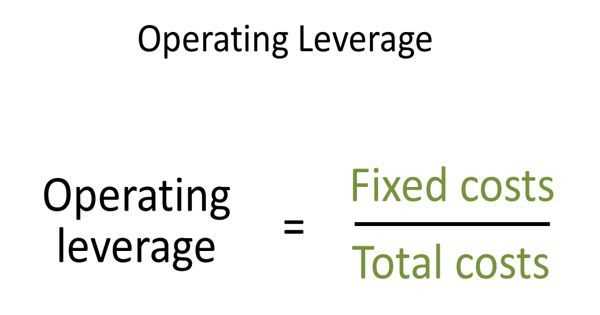

Calculating the Degree of Operating Leverage (DOL) is a straightforward process that involves using a simple formula. The DOL formula is:

DOL = % Change in Operating Income / % Change in Sales

Here’s a step-by-step guide on how to calculate the Degree of Operating Leverage:

- Determine the initial operating income and sales figures. These figures can be obtained from the company’s financial statements.

- Determine the final operating income and sales figures. These figures should represent the desired period for analysis, such as a month, quarter, or year.

- Calculate the percentage change in operating income by subtracting the initial operating income from the final operating income and dividing the result by the initial operating income. Multiply the result by 100 to express it as a percentage.

- Calculate the percentage change in sales by subtracting the initial sales figure from the final sales figure and dividing the result by the initial sales figure. Multiply the result by 100 to express it as a percentage.

- Divide the percentage change in operating income by the percentage change in sales to calculate the Degree of Operating Leverage.

For example, let’s say a company’s initial operating income is $100,000, and its final operating income is $150,000. The initial sales figure is $500,000, and the final sales figure is $600,000.

Using the formula, we can calculate the percentage change in operating income as follows:

Similarly, we can calculate the percentage change in sales:

Finally, we divide the percentage change in operating income by the percentage change in sales:

50% / 20% = 2.5

The Degree of Operating Leverage for this example is 2.5.

By calculating the Degree of Operating Leverage, businesses can gain valuable insights into their financial performance and make informed decisions regarding resource allocation, risk management, and profitability.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.