What is Decreasing Term Insurance?

Decreasing term insurance is a type of life insurance policy that provides coverage for a specific period of time, but with a decreasing death benefit over time. Unlike other types of life insurance, such as whole life or universal life, the death benefit of a decreasing term insurance policy decreases over the term of the policy.

Definition and Explanation

With decreasing term insurance, the death benefit is designed to decrease at a predetermined rate over the life of the policy. This means that if the insured passes away during the early years of the policy, the death benefit will be higher compared to the later years of the policy.

Example of Decreasing Term Insurance

Let’s say a person takes out a 20-year decreasing term insurance policy to cover their mortgage. The initial death benefit might be equal to the amount of the mortgage. Over the 20-year term, the death benefit will decrease each year, reflecting the decreasing amount of the mortgage as it is paid off. By the end of the term, the death benefit would be zero.

If the insured were to pass away during the early years of the policy, the full death benefit would be paid out to the beneficiary. However, if the insured were to pass away towards the end of the term, the death benefit would be significantly lower.

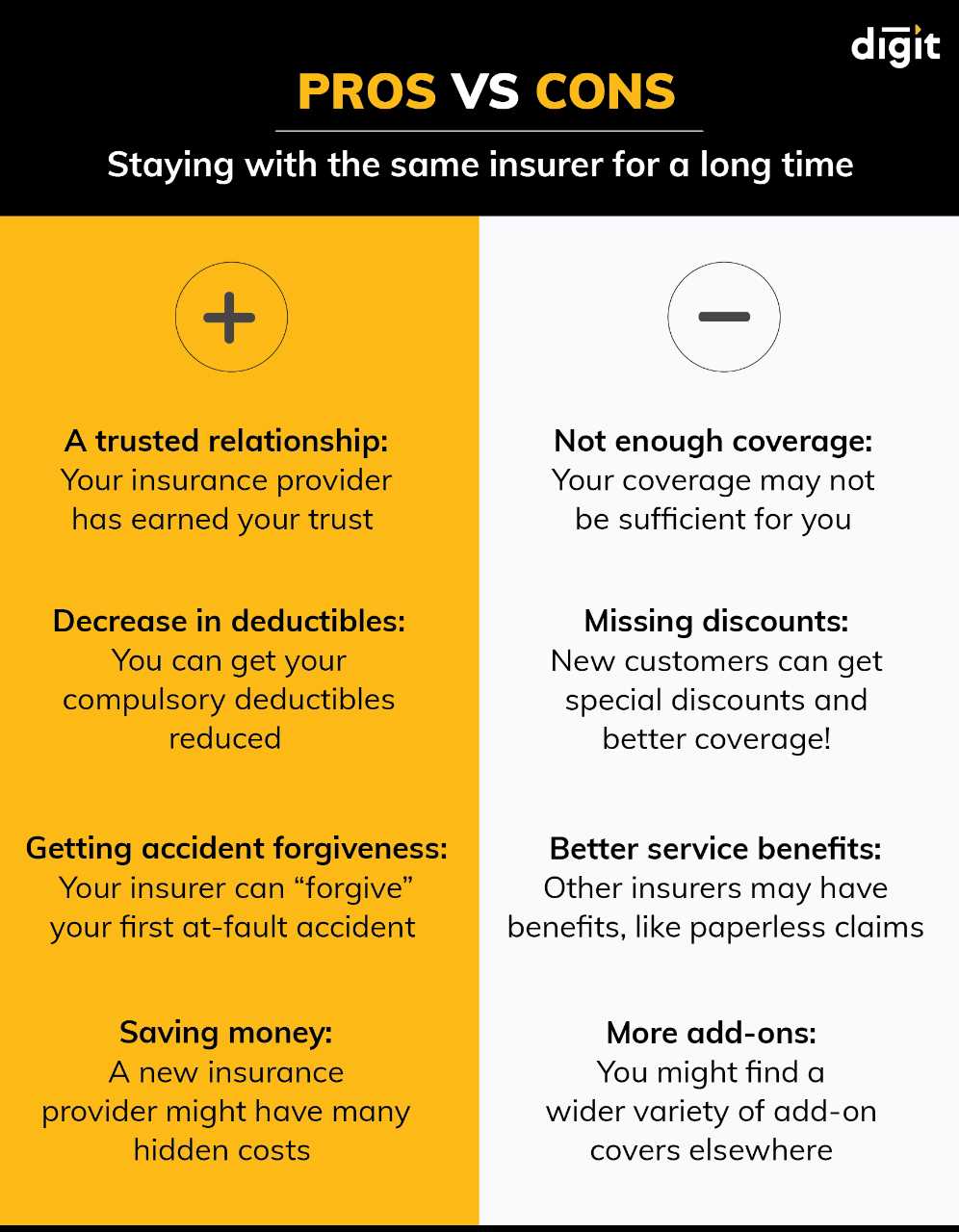

Pros and Cons of Decreasing Term Insurance

Like any insurance product, decreasing term insurance has its pros and cons.

Pros:

- Cost-effective: Decreasing term insurance is generally more affordable compared to other types of life insurance policies.

- Customizable: The policy term and the rate at which the death benefit decreases can be tailored to fit specific needs.

- Specific coverage: It is ideal for covering specific financial obligations that decrease over time, such as a mortgage or loan.

Cons:

- Decreasing coverage: The death benefit decreases over time, which means the coverage may not be sufficient for long-term needs.

- No cash value: Unlike whole life or universal life insurance, decreasing term insurance does not accumulate cash value.

- Limited flexibility: Once the policy is in place, it may be difficult to change or modify the coverage.

Definition and Explanation

With decreasing term insurance, the premium remains the same throughout the policy term, but the coverage amount decreases. This is in contrast to level term insurance, where the death benefit remains the same over the entire policy term.

This type of insurance is often used by individuals who have specific financial obligations that will decrease over time. For example, if a person has a mortgage that will be paid off in 20 years, they may choose a decreasing term insurance policy with a 20-year term to ensure that their beneficiary will have enough funds to pay off the remaining mortgage balance in the event of their death.

Decreasing term insurance is typically less expensive than level term insurance because the coverage amount decreases over time. This makes it an attractive option for individuals who want to ensure that their specific financial obligations will be covered in the event of their death, but do not want to pay the higher premiums associated with level term insurance.

It is important to note that decreasing term insurance only provides coverage for a specific period of time. Once the policy term ends, the coverage ceases and there is no payout to the beneficiary if the policyholder passes away after the term has expired.

In summary, decreasing term insurance is a type of life insurance policy where the death benefit decreases over time. It is designed to provide coverage for specific financial obligations that decrease over time, such as a mortgage or other loans. This type of insurance is often less expensive than level term insurance and is a popular choice for individuals who want to ensure that their specific financial obligations will be covered in the event of their death.

Example of Decreasing Term Insurance

Let’s consider an example to understand how decreasing term insurance works. Suppose John is a 35-year-old individual who wants to ensure that his mortgage is paid off in case of his untimely death. He has a mortgage of $200,000 with a term of 30 years. John decides to purchase a decreasing term insurance policy to cover the outstanding balance of his mortgage.

John opts for a decreasing term insurance policy with a coverage term of 30 years. The coverage amount decreases each year, aligning with the outstanding balance of his mortgage. The premium for the policy remains constant throughout the term.

In the first year, the coverage amount is equal to the outstanding mortgage balance of $200,000. If John passes away during this year, the insurance company will pay out the full coverage amount to his beneficiaries. However, if John survives the year, the coverage amount for the second year will decrease to match the reduced mortgage balance.

This example illustrates how decreasing term insurance provides coverage that aligns with the decreasing financial obligations of the insured individual, such as a mortgage or other long-term loans.

Pros and Cons of Decreasing Term Insurance

Decreasing term insurance is a type of life insurance that provides coverage for a specific period of time, with the death benefit decreasing over time. While this type of insurance can be beneficial for certain individuals, it also has its pros and cons to consider.

Pros of Decreasing Term Insurance

1. Affordability: Decreasing term insurance is generally more affordable compared to other types of life insurance policies. This is because the death benefit decreases over time, reducing the risk for the insurance company.

3. Flexibility: Decreasing term insurance policies can be tailored to meet specific needs. Policyholders can choose the duration of coverage and the amount of the death benefit, allowing them to customize the policy based on their financial situation and goals.

4. Simplified Underwriting: Compared to other types of life insurance, decreasing term insurance often has simplified underwriting processes. This means that individuals with certain health conditions or higher-risk occupations may still be able to obtain coverage at affordable rates.

Cons of Decreasing Term Insurance

1. Decreasing Death Benefit: The main disadvantage of decreasing term insurance is that the death benefit decreases over time. This means that if the policyholder passes away later in the policy term, the payout may not be sufficient to cover the financial needs of their loved ones.

2. Limited Coverage Period: Decreasing term insurance provides coverage for a specific period of time, typically ranging from 10 to 30 years. Once the policy term ends, the coverage terminates, and the policyholder will no longer have life insurance protection.

3. No Cash Value: Unlike some other types of life insurance, decreasing term insurance does not accumulate cash value over time. This means that policyholders cannot borrow against the policy or use it as an investment vehicle.

Overall, decreasing term insurance can be a cost-effective option for individuals looking to protect their mortgage or have coverage for a specific period of time. However, it is important to carefully consider the pros and cons before making a decision to ensure it aligns with your financial goals and needs.

Advantages of Decreasing Term Insurance

Decreasing term insurance offers several advantages for policyholders. Here are some of the key benefits:

1. Cost-effective:

2. Mortgage protection:

3. Flexibility:

Decreasing term insurance offers flexibility in terms of policy duration. Policyholders can choose the length of the policy based on their specific needs. For example, if someone has a 20-year mortgage, they can opt for a 20-year decreasing term insurance policy to align with the duration of their mortgage. This flexibility allows policyholders to customize their coverage to suit their individual circumstances.

4. Simple and straightforward:

Another advantage of decreasing term insurance is its simplicity. The policy structure is easy to understand, with a clear payout structure that decreases over time. This simplicity makes it easier for policyholders to make informed decisions about their coverage and ensures that their loved ones will receive the intended benefits without any confusion or complications.

5. No investment component:

Unlike some other types of life insurance, decreasing term insurance does not have an investment component. This means that policyholders do not need to worry about managing or monitoring any investment accounts. The focus is solely on providing financial protection for the policyholder’s beneficiaries, without the added complexity of investment decisions.

Disadvantages of Decreasing Term Insurance

While decreasing term insurance can be a suitable option for some individuals, it also has its disadvantages that should be considered before making a decision:

- Decreasing coverage: One of the main drawbacks of decreasing term insurance is that the coverage amount decreases over time. This means that if the policyholder passes away later in the term, the payout may not be sufficient to meet the financial needs of their beneficiaries.

- Limited flexibility: Unlike other types of life insurance, decreasing term insurance does not offer much flexibility. The policyholder cannot adjust the coverage amount or extend the term once the policy is in place. This lack of flexibility can be a disadvantage for individuals whose financial needs change over time.

- No cash value: Unlike whole life insurance or universal life insurance, decreasing term insurance does not accumulate any cash value over time. This means that if the policyholder cancels the policy or outlives the term, they will not receive any return on their premiums.

- Not suitable for long-term needs: Decreasing term insurance is designed to cover specific financial obligations that decrease over time, such as a mortgage or a loan. It may not be suitable for individuals who have long-term financial needs, such as providing for dependents or leaving a legacy.

It is important to carefully consider these disadvantages and evaluate your own financial situation before deciding if decreasing term insurance is the right choice for you. Consulting with a financial advisor can also help you make an informed decision based on your individual needs and goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.