Structural Factors

The current account deficit is influenced by various structural factors that affect a country’s trade balance. These factors include:

2. Exchange Rates: Exchange rates can have a significant impact on a country’s current account balance. A depreciating currency makes exports more competitive and imports more expensive, which can help reduce the trade deficit. Conversely, an appreciating currency can make exports more expensive and imports cheaper, leading to a wider trade deficit.

3. Demographics: Demographic factors, such as population growth and age distribution, can also influence the current account balance. Countries with a young and growing population tend to have higher consumption levels, leading to increased imports and a wider trade deficit. Conversely, countries with an aging population may have lower consumption levels and a smaller trade deficit.

4. Government Policies: Government policies, such as trade barriers and subsidies, can impact a country’s current account balance. Protectionist measures, such as tariffs and quotas, can reduce imports and improve the trade balance. Conversely, government subsidies can promote exports and widen the trade deficit.

1. Economic Growth: One of the main cyclical factors affecting the current account deficit is the level of economic growth. During periods of high economic growth, there is usually an increase in domestic consumption and investment, leading to higher imports. At the same time, exports may not grow at the same pace, resulting in a trade imbalance and a current account deficit.

2. Exchange Rates: Fluctuations in exchange rates can also contribute to a current account deficit. If a country’s currency appreciates, its exports become more expensive for foreign buyers, leading to a decrease in exports. On the other hand, imports become cheaper, which can lead to an increase in imports. This imbalance in trade can result in a current account deficit.

3. Interest Rates: Changes in interest rates can affect a country’s current account balance. Higher interest rates attract foreign investors, leading to an inflow of capital and an appreciation of the currency. This can make exports more expensive and imports cheaper, contributing to a current account deficit.

4. Business Cycle: The stage of the business cycle can also impact the current account deficit. During economic downturns, there is usually a decrease in domestic consumption and investment, leading to a decrease in imports. At the same time, exports may not decline at the same rate, resulting in a trade surplus and a reduction in the current account deficit. Conversely, during economic booms, imports tend to increase, leading to a current account deficit.

5. Government Policies: Government policies can also influence the cyclical factors of a current account deficit. For example, expansionary fiscal policies, such as increased government spending, can stimulate domestic demand and lead to higher imports. Similarly, contractionary monetary policies, such as higher interest rates, can attract foreign capital and appreciate the currency, affecting the trade balance.

Impact on Financial Statements

The current account deficit has a significant impact on a country’s financial statements. It reflects the imbalance between a country’s imports and exports, and therefore affects various components of the financial statements, including the balance of payments, income statement, and national income accounts.

Firstly, the current account deficit affects the balance of payments, which is a record of all economic transactions between a country and the rest of the world. The deficit is reflected as a negative value in the current account section of the balance of payments, indicating that the country is spending more on imports than it is earning from exports. This deficit can lead to a decrease in the country’s foreign exchange reserves, which can have implications for its currency stability and overall economic health.

Secondly, the current account deficit affects the income statement of a country. It represents a net outflow of income from the country to foreign entities. This outflow includes payments for imports, interest payments on foreign debt, and dividends and profits repatriated by foreign investors. These outflows reduce the country’s net income and can have a negative impact on its overall economic performance.

Lastly, the current account deficit affects the national income accounts of a country. It reduces the country’s gross domestic product (GDP) by the amount of the deficit. This reduction in GDP can indicate a decrease in economic activity and can have implications for employment levels, investment, and overall economic growth.

Analyzing the Current Account Deficit

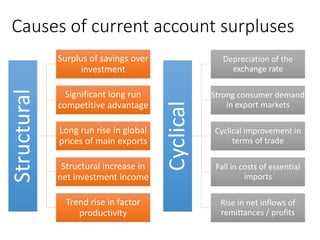

When analyzing the current account deficit, it is important to consider both the structural and cyclical factors that contribute to its formation. The current account deficit is a measure of a country’s net trade balance, including both goods and services, as well as income and transfer payments with the rest of the world.

One way to analyze the current account deficit is by examining the composition of its components. For example, a large deficit in the trade balance, which measures the difference between a country’s exports and imports of goods, can indicate a lack of competitiveness in the domestic economy. This could be due to factors such as high production costs, lack of innovation, or an overvalued currency.

Another factor to consider when analyzing the current account deficit is the balance of payments. This includes not only the trade balance, but also the balance of services, income, and transfers. A deficit in any of these components can contribute to an overall current account deficit. For example, a deficit in the balance of services could indicate a lack of competitiveness in the service sector, while a deficit in the balance of income could indicate a high level of foreign ownership of domestic assets.

In addition to the composition of the current account deficit, it is also important to consider the underlying structural and cyclical factors that contribute to its formation. Structural factors refer to long-term trends and characteristics of the economy, such as demographics, technological advancements, and institutional factors. Cyclical factors, on the other hand, refer to short-term fluctuations in economic activity, such as business cycles and exchange rate movements.

Strategies for Managing the Current Account Deficit

Managing a current account deficit requires a comprehensive approach that addresses both structural and cyclical factors. Here are some strategies that can be implemented to effectively manage the current account deficit:

1. Promoting Export-Led Growth:

One of the most effective ways to reduce a current account deficit is to promote export-led growth. This can be achieved by implementing policies that support domestic industries and encourage them to increase their exports. Governments can provide incentives, such as tax breaks or subsidies, to exporters, and also focus on improving the competitiveness of domestic industries in the global market.

2. Encouraging Foreign Direct Investment (FDI):

Foreign direct investment can play a crucial role in managing the current account deficit. Governments can attract FDI by creating a favorable investment climate, implementing investor-friendly policies, and providing incentives to foreign investors. FDI not only brings in capital but also contributes to job creation and technology transfer, which can help boost exports and reduce the trade deficit.

3. Enhancing Competitiveness:

A current account deficit can be partially attributed to a lack of competitiveness in the domestic economy. To address this, governments should focus on improving the overall business environment, including infrastructure development, reducing bureaucratic hurdles, and promoting innovation and research and development. By enhancing competitiveness, domestic industries can become more efficient and cost-effective, which can lead to increased exports and a reduction in the trade deficit.

4. Implementing Import Substitution Policies:

Import substitution policies aim to reduce imports by promoting domestic production of goods that are currently being imported. This can be achieved by imposing tariffs or quotas on imported goods, providing subsidies to domestic producers, and implementing regulations that favor domestic industries. By reducing imports, countries can decrease their reliance on foreign goods and narrow the current account deficit.

5. Managing Capital Flows:

Managing capital flows is another important strategy for managing the current account deficit. Governments can implement measures to regulate and control capital inflows and outflows, such as imposing capital controls or implementing monetary policies that influence exchange rates. By managing capital flows, countries can prevent excessive currency appreciation or depreciation, which can have a significant impact on the current account balance.

6. Strengthening Domestic Savings:

A current account deficit can also be addressed by increasing domestic savings. Governments can implement policies that encourage individuals and businesses to save more, such as providing tax incentives for savings or implementing mandatory savings schemes. By increasing domestic savings, countries can reduce their reliance on foreign borrowing and decrease the current account deficit.

Overall, managing a current account deficit requires a combination of structural reforms, policy interventions, and strategic measures. By implementing these strategies, countries can effectively manage their current account deficits and promote sustainable economic growth.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.