Cash Flow From Investing Activities: Types and Examples

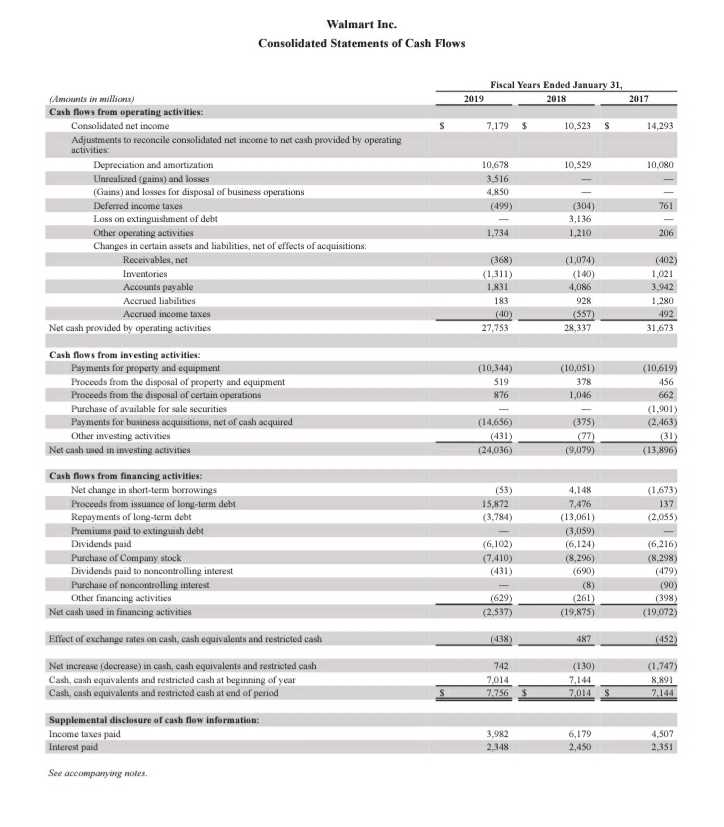

Cash flow from investing activities is a section of the statement of cash flows that provides information about the cash flows related to the purchase and sale of long-term assets, investments, and other non-current assets. It shows how a company invests its cash in different activities to generate future returns.

Types of Cash Flow From Investing Activities

There are several types of cash flow from investing activities that companies may report in their financial statements:

- Capital Expenditures: This refers to the cash outflows for the purchase of property, plant, and equipment (PP&E) or other long-term assets that are used in the business operations. Examples include the purchase of machinery, buildings, or vehicles.

- Sale of Assets: This represents the cash inflows from the sale of long-term assets, such as land, buildings, or equipment, that are no longer needed or are replaced by newer assets.

- Investment in Marketable Securities: Companies may invest their excess cash in marketable securities, such as stocks or bonds, to earn a return. The purchase of these securities is considered a cash outflow, while the sale of them is a cash inflow.

Examples of Cash Flow From Investing Activities

Here are some examples that illustrate the cash flow from investing activities:

- A company purchases a new manufacturing plant for $1 million. This is reported as a cash outflow in the capital expenditures category.

- A company sells an old delivery truck for $20,000. This is reported as a cash inflow in the sale of assets category.

- A company buys $500,000 worth of stocks in another company. This is reported as a cash outflow in the investment in marketable securities category.

- A company acquires a competitor for $10 million. This is reported as a cash outflow in the acquisition or sale of subsidiaries category.

- A company provides a loan of $100,000 to a customer. This is reported as a cash outflow in the loans to other entities category.

Overall, the cash flow from investing activities section provides valuable insights into how a company deploys its cash for long-term investments and strategic initiatives. It helps investors and analysts assess the company’s capital allocation decisions and evaluate its ability to generate future cash flows.

What is Cash Flow From Investing Activities?

Cash flow from investing activities is a section of the statement of cash flows that reports the cash inflows and outflows related to a company’s investments in long-term assets. These investments can include the purchase or sale of property, plant, and equipment, investments in other companies, and the purchase or sale of marketable securities.

This section of the statement of cash flows provides insights into how a company is deploying its capital and whether it is investing in assets that will generate future cash flows. Positive cash flow from investing activities indicates that a company is making investments that are expected to generate returns in the future, while negative cash flow from investing activities suggests that a company is divesting assets or making investments that are not expected to generate positive returns.

Examples of Cash Flow From Investing Activities

There are several types of transactions that can be classified as cash flow from investing activities. Some common examples include:

- Purchase of property, plant, and equipment: When a company buys new equipment or invests in expanding its facilities, it will record a cash outflow in the cash flow from investing activities section.

- Sale of property, plant, and equipment: If a company sells its assets, such as equipment or real estate, it will record a cash inflow in the cash flow from investing activities section.

- Investments in other companies: When a company acquires shares or makes investments in other companies, it will record a cash outflow in the cash flow from investing activities section.

- Proceeds from the sale of investments: If a company sells its investments, such as stocks or bonds, it will record a cash inflow in the cash flow from investing activities section.

These are just a few examples, and the specific transactions included in the cash flow from investing activities section can vary depending on the nature of the company’s business and its investment activities.

Importance of Cash Flow From Investing Activities

By analyzing the cash flow from investing activities, investors can assess the long-term sustainability and growth potential of a company. They can also evaluate whether a company is using its capital efficiently and effectively to generate value for its shareholders.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.