Benefits of Carried Interest

1. Incentivizes Fund Managers

One of the key benefits of carried interest is that it incentivizes fund managers to perform well. Since their compensation is tied to the performance of the fund, they have a strong motivation to generate high returns for the investors. This alignment of interests can lead to better decision-making and increased effort on the part of the fund managers.

2. Attracts Top Talent

Carried interest is an attractive feature for top talent in the finance industry. It allows fund managers to potentially earn significant profits if the fund performs well. This can help attract experienced and skilled professionals who have a track record of success. The prospect of earning carried interest can also encourage fund managers to stay with a fund for the long term, which can contribute to stability and continuity in the management of the fund.

Furthermore, carried interest can serve as a powerful recruitment tool, as it offers the potential for substantial financial rewards that are not available in other industries.

3. Tax Advantages

Carried interest is often subject to favorable tax treatment. In many jurisdictions, it is treated as capital gains rather than ordinary income. This means that fund managers may pay a lower tax rate on their carried interest earnings compared to their regular salary or bonus income. This tax advantage can significantly enhance the overall compensation package for fund managers.

However, it is important to note that there has been ongoing debate and scrutiny regarding the tax treatment of carried interest, with some arguing that it should be taxed as ordinary income. The tax treatment of carried interest varies by jurisdiction, and it is important for fund managers to consult with tax professionals to understand the specific rules and regulations that apply to them.

Mechanics of Carried Interest

Here is a breakdown of the mechanics of carried interest:

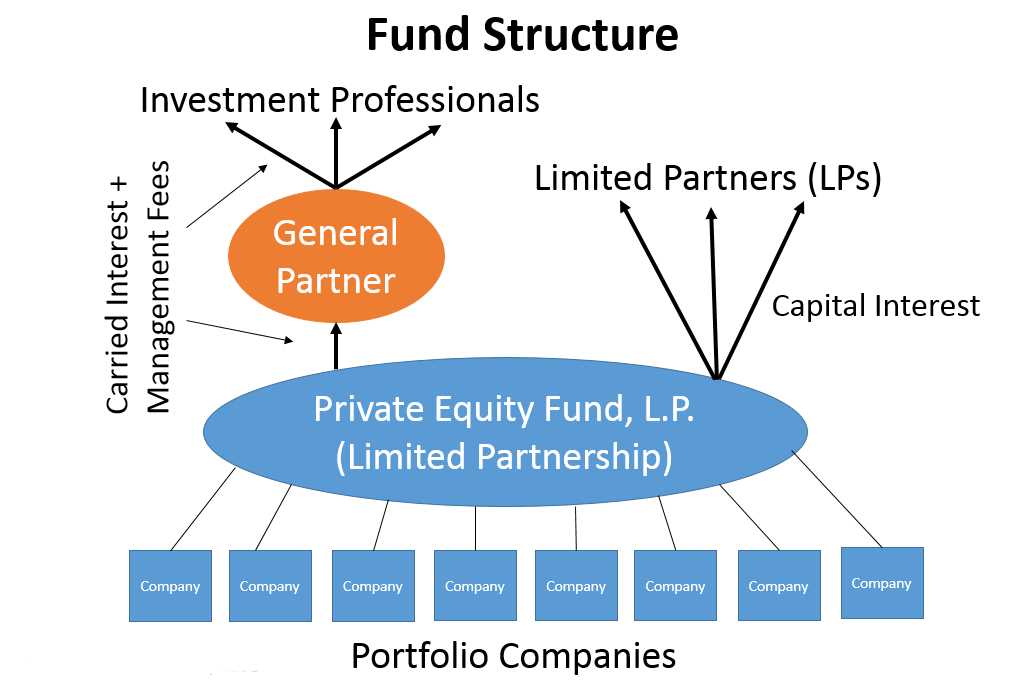

1. Investment Structure

2. Calculation Method

3. Clawback Provision

Many partnership agreements include a clawback provision, which allows the fund to recoup previously paid carried interest in the event of future losses. This provision ensures that the investment managers are not rewarded for short-term gains that are later reversed. It provides an additional layer of alignment between the investment managers and the fund’s investors.

4. Tax Treatment

Carried interest is typically treated as a capital gain for tax purposes, rather than ordinary income. This is because it represents a share of the profits generated by the investment fund. However, there has been ongoing debate and controversy surrounding the tax treatment of carried interest, with some arguing that it should be taxed as ordinary income.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.