What is Both-To-Blame Collision Clause?

The Both-To-Blame Collision Clause is a provision commonly found in marine insurance policies. It is designed to protect shipowners and charterers in the event of a collision between two vessels where both parties are partially at fault.

This clause is particularly relevant in cases where the collision is caused by the negligence or fault of both vessels involved. It helps to allocate the financial responsibility for the damages incurred as a result of the collision.

Under the Both-To-Blame Collision Clause, if both vessels are found to be at fault, the damages are divided between the shipowners and charterers based on their respective degrees of fault. This means that each party will be responsible for a portion of the damages, depending on the extent to which they contributed to the collision.

By including this clause in their insurance policies, shipowners and charterers can limit their liability and protect themselves from bearing the full financial burden of a collision that was not entirely their fault. It provides a fair and equitable way of apportioning liability in cases where both parties share some responsibility for the accident.

It is important to note that the Both-To-Blame Collision Clause is not automatically included in all marine insurance policies. It is typically negotiated and agreed upon between the insured party and the insurer, and its specific terms and conditions may vary depending on the policy.

Definition and Explanation

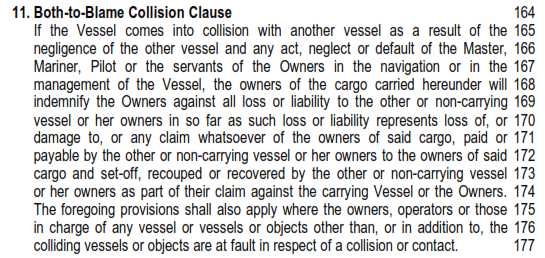

The Both-To-Blame Collision Clause is a provision commonly found in marine insurance policies. It is designed to protect the insured party in the event of a collision between two vessels where both parties share some degree of fault.

When a collision occurs at sea, it can be challenging to determine which party is solely responsible for the accident. The Both-To-Blame Collision Clause addresses this issue by providing coverage to the insured party even if they are partially at fault.

Under this clause, the insurance company agrees to cover the insured party’s damages and losses resulting from the collision, even if they are partially responsible. This means that the insured party can still receive compensation for their losses, regardless of their degree of fault.

This clause is particularly beneficial in situations where it is difficult to determine the exact cause of a collision or when both parties share some responsibility. It provides a level of financial protection for the insured party and helps to avoid lengthy legal disputes over liability.

It’s worth mentioning that the Both-To-Blame Collision Clause may not be included in all marine insurance policies. It is essential for shipowners and operators to carefully review their policy terms and conditions to understand the extent of their coverage.

How Does Both-To-Blame Collision Clause Work?

The Both-To-Blame Collision Clause is a provision commonly found in marine insurance policies. It is designed to protect the insured party in cases where a collision occurs between two vessels and both parties are partially at fault.

When a collision happens at sea, it can often be difficult to determine who is solely responsible for the accident. In some cases, both vessels may have contributed to the collision through negligence or other factors. The Both-To-Blame Collision Clause helps to address this issue by providing coverage to the insured party even if they are partially at fault.

Under this clause, if both vessels are found to be at fault for the collision, the insurance company will still provide coverage for the insured party’s damages. This means that even if the insured vessel is found to be partially responsible for the accident, they can still receive compensation for their losses.

This clause is particularly beneficial for shipowners and operators who may be involved in collisions where fault is shared. It helps to ensure that they are not left solely responsible for the financial burden of the accident, even if they are partially to blame.

In addition, the Both-To-Blame Collision Clause can also help to expedite the claims process. Since fault can be difficult to determine in maritime accidents, disputes can often arise between the parties involved. By including this clause in the insurance policy, it provides a clear framework for determining coverage and can help to resolve claims more efficiently.

Example of Both-To-Blame Collision Clause

To better understand how the Both-To-Blame Collision Clause works, let’s consider an example:

Imagine two ships, Ship A and Ship B, are involved in a collision at sea. Ship A is traveling at a high speed and fails to maintain a proper lookout, while Ship B is navigating in a restricted area without proper authorization. The collision occurs due to the negligence of both ships.

Let’s say the clause determines that Ship A is 70% at fault and Ship B is 30% at fault. Ship A’s insurance policy would then cover 70% of the damages, and Ship B would be responsible for the remaining 30%. This clause helps prevent one party from bearing the full financial burden of the collision, even if they were partially at fault.

Without the Both-To-Blame Collision Clause, Ship A may be held fully liable for the damages, regardless of Ship B’s negligence. This could result in significant financial losses for Ship A.

Overall, the Both-To-Blame Collision Clause provides a fair and balanced approach to allocating liability in cases where both parties share some degree of fault in a collision at sea.

Benefits of Both-To-Blame Collision Clause

The Both-To-Blame Collision Clause is an important provision in corporate insurance policies that offers several benefits to policyholders. These benefits include:

1. Protection against financial losses

One of the main advantages of the Both-To-Blame Collision Clause is that it provides protection against financial losses resulting from collisions at sea. In the event of a collision where both vessels are found to be at fault, the clause ensures that the policyholder is not solely responsible for bearing the costs of the damages.

2. Shared liability

The clause promotes shared liability between the involved parties. Instead of one party being solely responsible for the damages, the Both-To-Blame Collision Clause ensures that both parties contribute to the costs based on their degree of fault. This shared liability helps to prevent unfair financial burdens on a single party and encourages a more equitable distribution of costs.

3. Avoidance of lengthy legal disputes

By including the Both-To-Blame Collision Clause in their insurance policies, companies can avoid lengthy and costly legal disputes. The clause provides a clear framework for determining liability and ensures that disputes can be resolved more efficiently. This not only saves time and money but also allows the involved parties to focus on recovering from the incident and getting back to business as usual.

4. Protection of business reputation

Being involved in a collision at sea can have a negative impact on a company’s reputation. However, with the Both-To-Blame Collision Clause, policyholders can mitigate the damage to their reputation by demonstrating that they are not solely responsible for the incident. This can help maintain the trust and confidence of clients, partners, and stakeholders.

5. Peace of mind

Having the Both-To-Blame Collision Clause in place provides policyholders with peace of mind. They can rest assured knowing that their insurance policy will protect them in the event of a collision where both parties are at fault. This peace of mind allows companies to focus on their core operations without worrying about the potential financial consequences of such incidents.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.