Annuity Table Overview

An annuity table is a tool used in finance to calculate the present value or future value of an annuity. An annuity is a series of equal payments made at regular intervals over a specified period of time.

The annuity table provides a convenient way to determine the value of an annuity based on different interest rates and time periods. It is often used by financial professionals, such as actuaries and investment analysts, to assess the worth of annuities and make informed decisions.

The table typically consists of rows and columns, with each row representing a specific interest rate and each column representing a specific time period. The intersection of a row and column provides the factor or multiplier that is used to calculate the present value or future value of the annuity.

For example, if you have an annuity with a 5% interest rate and a duration of 10 years, you would find the corresponding factor in the annuity table. This factor can then be multiplied by the amount of each annuity payment to determine the present value or future value of the annuity.

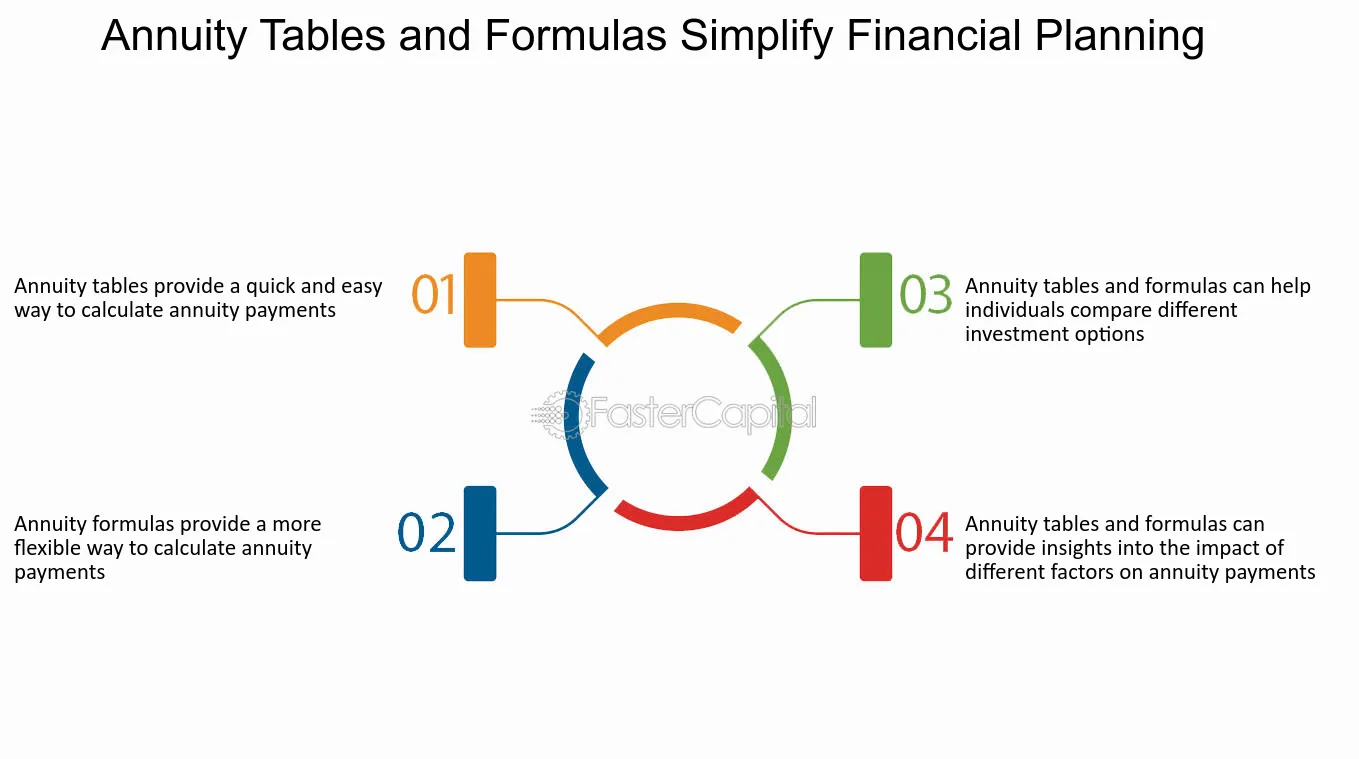

Annuity tables are widely used in various financial calculations, including retirement planning, loan amortization, and investment analysis. They provide a quick and reliable way to evaluate the value of annuities under different scenarios and help individuals and businesses make informed financial decisions.

What is an Annuity Table?

An annuity table is a financial tool used to calculate the present value or future value of an annuity. An annuity is a series of equal cash flows received or paid at regular intervals over a specified period of time. The annuity table provides a convenient way to determine the value of these cash flows based on different interest rates and time periods.

How does an Annuity Table work?

An annuity table typically consists of rows and columns that represent different interest rates and time periods. The rows represent the interest rates, while the columns represent the time periods. Each cell in the table contains a factor that is used to calculate the present value or future value of the annuity.

To use an annuity table, you need to know the interest rate, the time period, and the cash flow amount. You locate the intersection of the interest rate row and the time period column to find the corresponding factor. You then multiply the factor by the cash flow amount to calculate the present value or future value of the annuity.

Why are Annuity Tables useful?

Annuity tables provide a quick and easy way to calculate the present value or future value of an annuity without having to perform complex mathematical calculations. They are especially useful for financial professionals, such as actuaries and investment analysts, who deal with annuities on a regular basis.

By using an annuity table, you can save time and reduce the risk of errors in your calculations. It allows you to compare the values of different annuities based on different interest rates and time periods, helping you make informed financial decisions.

Overall, annuity tables are a valuable tool for anyone involved in financial planning or investment management. They provide a standardized method for calculating annuity values and can help simplify complex financial calculations.

Examples of Annuity Tables

Annuity tables are used to calculate the present value or future value of annuities based on different interest rates and time periods. These tables provide a quick reference for determining the value of annuities without having to perform complex calculations.

Here are a few examples of annuity tables:

1. Present Value of an Ordinary Annuity: This table shows the present value of an ordinary annuity, which is a series of equal cash flows received or paid at the end of each period. The table lists different interest rates and time periods, allowing you to find the present value factor for a specific combination of rate and time.

2. Future Value of an Ordinary Annuity: This table shows the future value of an ordinary annuity, which is the accumulated value of a series of equal cash flows received or paid at the end of each period. Similar to the present value table, it provides factors for different interest rates and time periods to calculate the future value of an annuity.

3. Present Value of an Annuity Due: An annuity due is a series of equal cash flows received or paid at the beginning of each period. This table helps determine the present value of an annuity due by providing factors for different interest rates and time periods.

4. Future Value of an Annuity Due: This table calculates the future value of an annuity due, which is the accumulated value of a series of equal cash flows received or paid at the beginning of each period. It provides factors for different interest rates and time periods to determine the future value of an annuity due.

These examples illustrate the usefulness of annuity tables in quickly determining the value of annuities based on different interest rates and time periods. By referring to these tables, individuals and businesses can make informed financial decisions regarding annuity investments or payments.

Formulas for Calculating Annuity Tables

Annuity tables are used to calculate the present value or future value of an annuity. These tables provide a quick and easy way to determine the value of an annuity based on different interest rates and time periods. Here are some of the formulas commonly used to calculate annuity tables:

- Present Value of an Ordinary Annuity: The present value of an ordinary annuity can be calculated using the formula:

- PV: Present value of the annuity

- P: Payment amount per period

- r: Interest rate per period

- n: Number of periods

- Future Value of an Ordinary Annuity: The future value of an ordinary annuity can be calculated using the formula:

- FV: Future value of the annuity

- P: Payment amount per period

- r: Interest rate per period

- n: Number of periods

- Present Value of an Annuity Due: The present value of an annuity due can be calculated using the formula:

- PV: Present value of the annuity

- P: Payment amount per period

- r: Interest rate per period

- n: Number of periods

- Future Value of an Annuity Due: The future value of an annuity due can be calculated using the formula:

- FV: Future value of the annuity

- P: Payment amount per period

- r: Interest rate per period

- n: Number of periods

These formulas can be used to create annuity tables that provide a comprehensive overview of the present value and future value of annuities at different interest rates and time periods. By using these tables, individuals and businesses can make informed financial decisions and plan for the future.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.